Formulario 480 7 Oe 2017

What is the Formulario 480 7 Oe

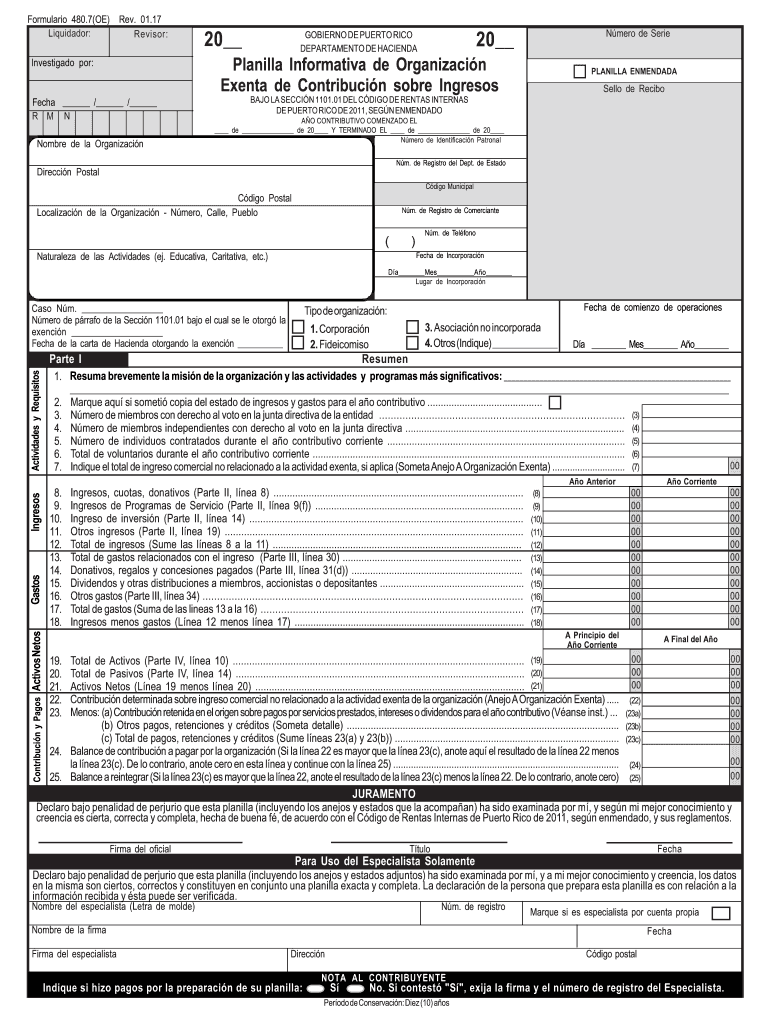

The Formulario 480 7 Oe is a crucial tax document used in the United States for reporting specific types of income and deductions. This form is particularly relevant for organizations that need to declare exempt income, ensuring compliance with federal tax regulations. The 480 7 planilla serves as a tool for organizations to accurately report their financial activities, thereby fulfilling their legal obligations to the IRS.

How to use the Formulario 480 7 Oe

Using the Formulario 480 7 Oe involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and previous tax returns. Next, carefully fill out the form, ensuring all fields are completed accurately. It is essential to review the form for any errors before submission. Once completed, the form can be submitted electronically or via mail, depending on the preference of the organization.

Steps to complete the Formulario 480 7 Oe

Completing the Formulario 480 7 Oe requires attention to detail. Follow these steps:

- Gather all relevant financial documentation.

- Access the form through an authorized platform or download it from the IRS website.

- Fill in the required fields, ensuring accuracy in all entries.

- Double-check for any errors or omissions.

- Submit the form electronically or by mail, as preferred.

Legal use of the Formulario 480 7 Oe

The legal use of the Formulario 480 7 Oe is vital for organizations to maintain compliance with IRS regulations. This form must be filled out in accordance with the guidelines set forth by the IRS, ensuring that all reported income and deductions are legitimate and accurately reflected. Failure to use the form correctly can lead to penalties and legal issues, making it essential for organizations to understand their responsibilities.

Key elements of the Formulario 480 7 Oe

Several key elements are essential when working with the Formulario 480 7 Oe:

- Identification Information: This includes the organization’s name, address, and tax identification number.

- Income Reporting: Accurate reporting of exempt income is crucial.

- Deductions: Organizations must clearly outline any deductions claimed.

- Signature: A valid signature is required to authenticate the form.

Filing Deadlines / Important Dates

Filing deadlines for the Formulario 480 7 Oe are critical for compliance. Organizations must submit the form by the specified due date to avoid penalties. Typically, the deadline aligns with the annual tax filing period, but it is advisable to check for any specific dates that may apply to your situation. Staying informed about these deadlines ensures timely submission and adherence to tax regulations.

Quick guide on how to complete formulario 4807 oe 2017 2019

Your assistance manual on how to prepare your Formulario 480 7 Oe

If you’re interested in discovering how to generate and dispatch your Formulario 480 7 Oe, here are a few concise guidelines on how to simplify tax submission.

To begin, you simply need to create your airSlate SignNow account to revolutionize your document management online. airSlate SignNow is a highly user-friendly and robust document solution that permits you to edit, generate, and finalize your tax paperwork effortlessly. Utilizing its editor, you can alternate between text, checkboxes, and electronic signatures, and return to modify details as necessary. Streamline your tax handling with advanced PDF editing, eSigning, and intuitive sharing.

Adhere to the instructions below to finalize your Formulario 480 7 Oe in just a few minutes:

- Create your account and start processing PDFs within minutes.

- Utilize our library to locate any IRS tax document; navigate through variations and schedules.

- Select Obtain form to access your Formulario 480 7 Oe in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Signature Tool to add your legally-binding electronic signature (if necessary).

- Review your document and correct any errors.

- Preserve changes, print a copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Be aware that submitting on paper may increase return errors and delay refunds. Naturally, before e-filing your taxes, verify the IRS website for filing guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct formulario 4807 oe 2017 2019

FAQs

-

What if your taxes for 2017 was filed last year 2018 when filling out taxes this year 2019 and you didn't file the 2017 taxes, but waiting to do them with your 2019 taxes?

Looks like you want to wait for next year to file for 2018 & 2019 at the same time. In that case, 2018 will have to be mailed and 2019 only can be electronically filed. If you have refund coming to you on the 2018, no problem, refund check will take around 2 months. If you owe instead, late filing penalties will apply. If you have not yet filed for 2018, you can still file electronically till October 15.

-

What should I do if I filled out the FAFSA application for 2018-2019 instead of 2017-2018?

Speak with the financial aid office at the college if your choice to make sure that this is actually a problem.

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

Create this form in 5 minutes!

How to create an eSignature for the formulario 4807 oe 2017 2019

How to generate an electronic signature for the Formulario 4807 Oe 2017 2019 online

How to create an eSignature for your Formulario 4807 Oe 2017 2019 in Chrome

How to make an eSignature for signing the Formulario 4807 Oe 2017 2019 in Gmail

How to generate an eSignature for the Formulario 4807 Oe 2017 2019 right from your smart phone

How to generate an electronic signature for the Formulario 4807 Oe 2017 2019 on iOS

How to create an eSignature for the Formulario 4807 Oe 2017 2019 on Android

People also ask

-

What is 4807 oe and how does it relate to airSlate SignNow?

The term 4807 oe refers to a specific service offered by airSlate SignNow that facilitates easy document signing. This feature helps users streamline their paperwork process, making eSigning quick and efficient.

-

How much does airSlate SignNow cost with the 4807 oe feature?

airSlate SignNow offers competitive pricing for its services, including the 4807 oe feature. Pricing may vary based on the plan selected, but it remains a cost-effective solution for businesses of all sizes.

-

What are the key features of airSlate SignNow's 4807 oe?

The 4807 oe feature provides several essential functions such as customizable templates, team collaboration tools, and real-time tracking of document status. These features empower users to enhance their workflow and get documents signed faster.

-

How does integrating airSlate SignNow's 4807 oe with other software benefit my business?

Integrating airSlate SignNow's 4807 oe with other platforms can streamline your workflow signNowly. It enables seamless data transfer and reduces the risk of errors, thereby enhancing productivity and reducing turnaround times.

-

Can I access airSlate SignNow's 4807 oe on mobile devices?

Yes, airSlate SignNow's 4807 oe is fully accessible on mobile devices, allowing users to send and eSign documents on-the-go. This flexibility ensures that you can manage your documents anytime, anywhere.

-

What benefits does airSlate SignNow's 4807 oe provide for remote teams?

The 4807 oe feature of airSlate SignNow is particularly beneficial for remote teams, as it simplifies document collaboration and approval processes. This results in improved efficiency and helps maintain communication across dispersed team members.

-

Is it easy to migrate my existing documents to airSlate SignNow's 4807 oe?

Absolutely! Migrating your documents to airSlate SignNow's 4807 oe is straightforward and user-friendly. The platform offers guides and support to ensure a smooth transition, minimizing disruption to your operations.

Get more for Formulario 480 7 Oe

- Ladbs inspection card form

- 8288 b fillable form

- Bronx naturalization form italiangen

- 07002255646 form

- Bereavement leave application form application form to be used by employees to apply for bereavement leave complete the form

- Fillable online form f31 rule 10 63 fax email print fill online

- Denuncia di smarrimento o di furto del form

- Sample letter of direction 1 docx form

Find out other Formulario 480 7 Oe

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer