480 7OE Rev 04 21 Inst Rev 04 21 480 7OE Rev 04 21 Inst Rev 04 21 2021-2026

Understanding the 480 7 Planilla

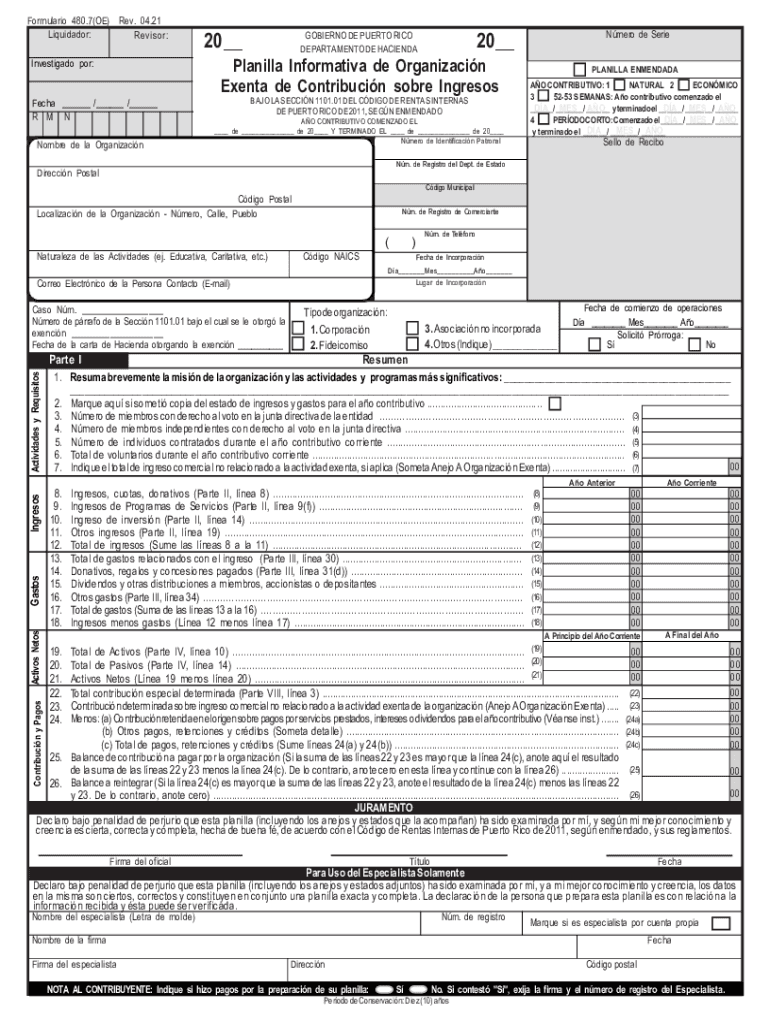

The 480 7 planilla, also known as the 480 7 informativa, is a crucial document for organizations exempt from certain tax obligations in the United States. This form is used to report specific income and expenses, ensuring compliance with federal and state regulations. It is essential for organizations to accurately complete this form to maintain their tax-exempt status and avoid potential penalties.

Steps to Complete the 480 7 Planilla

Filling out the 480 7 planilla requires careful attention to detail. Here are the key steps involved:

- Gather Required Information: Collect all necessary financial documents, including income statements and expense reports.

- Fill Out the Form: Enter the relevant data into the form, ensuring accuracy in all figures.

- Review for Errors: Double-check all entries for mistakes or omissions that could lead to compliance issues.

- Submit the Form: Follow the designated submission method, whether online, by mail, or in person, as per the guidelines.

Legal Use of the 480 7 Planilla

The 480 7 planilla serves a legal purpose in the context of tax compliance for exempt organizations. It must be filled out in accordance with IRS regulations to ensure that the organization maintains its tax-exempt status. Failure to complete the form correctly can result in penalties, including the potential loss of tax-exempt status.

Filing Deadlines for the 480 7 Planilla

Timeliness is crucial when submitting the 480 7 planilla. Organizations must be aware of the specific filing deadlines to avoid late penalties. Typically, the form is due on the fifteenth day of the fourth month following the end of the tax year. It is advisable to check for any updates or changes to the deadlines each year.

Key Elements of the 480 7 Planilla

Understanding the key elements of the 480 7 planilla is vital for accurate completion. Important components include:

- Identification Information: This includes the organization's name, address, and tax identification number.

- Income Reporting: Details of all income received by the organization during the tax year.

- Expense Reporting: A comprehensive list of expenses incurred in the operation of the organization.

- Signature Section: A designated area for authorized representatives to sign and date the form, confirming its accuracy.

Examples of Using the 480 7 Planilla

Organizations may encounter various scenarios where the 480 7 planilla is applicable. For instance, a nonprofit organization receiving grants must report this income using the form. Similarly, educational institutions that qualify for tax exemption must accurately complete the planilla to maintain compliance with IRS requirements.

Quick guide on how to complete 4807oe rev 0421 inst rev 0421 4807oe rev 0421 inst rev 0421

Prepare 480 7OE Rev 04 21 Inst Rev 04 21 480 7OE Rev 04 21 Inst Rev 04 21 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to access the correct form and securely preserve it online. airSlate SignNow equips you with all the resources necessary to create, alter, and electronically sign your documents promptly without holdups. Handle 480 7OE Rev 04 21 Inst Rev 04 21 480 7OE Rev 04 21 Inst Rev 04 21 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign 480 7OE Rev 04 21 Inst Rev 04 21 480 7OE Rev 04 21 Inst Rev 04 21 with ease

- Locate 480 7OE Rev 04 21 Inst Rev 04 21 480 7OE Rev 04 21 Inst Rev 04 21 and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize key sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes moments and holds the same legal validity as a conventional ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and digitally sign 480 7OE Rev 04 21 Inst Rev 04 21 480 7OE Rev 04 21 Inst Rev 04 21 while ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 4807oe rev 0421 inst rev 0421 4807oe rev 0421 inst rev 0421

Create this form in 5 minutes!

People also ask

-

What is the 480 7 planilla and how can airSlate SignNow help with it?

The 480 7 planilla is a required document for certain tax filings in various jurisdictions. airSlate SignNow provides an easy-to-use platform for signing and managing this document, ensuring compliance and efficiency in your filing process. With the ability to eSign and share the 480 7 planilla securely, businesses can save time and reduce paperwork.

-

Is there a cost associated with using airSlate SignNow for the 480 7 planilla?

Yes, airSlate SignNow offers subscription plans that vary in pricing based on features. However, the solution remains cost-effective for businesses, especially when handling documents like the 480 7 planilla. Pricing is competitive, and the benefits of streamlined signing and document management can lead to signNow savings in time and resources.

-

What features does airSlate SignNow offer for managing the 480 7 planilla?

airSlate SignNow offers a variety of features tailored for managing the 480 7 planilla, including eSigning, document templates, and secure storage. Users can easily create and send the 480 7 planilla for signatures, track its status, and ensure that all parties have completed their actions. These features streamline the workflow and enhance organization.

-

Can airSlate SignNow integrate with other software to handle the 480 7 planilla?

Absolutely! airSlate SignNow integrates with various software solutions to enhance the management of documents like the 480 7 planilla. This means you can seamlessly connect your existing tools, improving overall efficiency and productivity when preparing and eSigning the 480 7 planilla.

-

What are the benefits of using airSlate SignNow for the 480 7 planilla?

Using airSlate SignNow for the 480 7 planilla offers numerous benefits, including speed, convenience, and security. The platform allows users to easily eSign and send documents from anywhere, reducing the hassle associated with traditional paperwork. Enhanced tracking features also ensure you stay informed throughout the signing process.

-

Is it safe to eSign the 480 7 planilla using airSlate SignNow?

Yes, safety is a top priority for airSlate SignNow. The platform employs advanced security measures including encryption and secure authentication to protect your documents, including the 480 7 planilla. You can eSign with confidence, knowing that your information is secure throughout the process.

-

How user-friendly is airSlate SignNow for creating the 480 7 planilla?

airSlate SignNow is designed with user-friendliness in mind, making it easy to create and manage the 480 7 planilla. The intuitive interface allows users to quickly navigate through the signing process, ensuring that you can prepare and send your document without hassle. Even those with minimal technical expertise can use the platform effectively.

Get more for 480 7OE Rev 04 21 Inst Rev 04 21 480 7OE Rev 04 21 Inst Rev 04 21

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts where 497323233 form

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts effective 497323234 form

- Marital domestic separation and property settlement agreement no children parties may have joint property or debts where 497323236 form

- Marital domestic separation and property settlement agreement no children parties may have joint property or debts effective 497323237 form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts where 497323238 form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts effective 497323239 form

- Oklahoma dissolve form

- Oklahoma dissolution form

Find out other 480 7OE Rev 04 21 Inst Rev 04 21 480 7OE Rev 04 21 Inst Rev 04 21

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online