Nevada Probate Form 2015-2026

What is the Nevada Probate Form

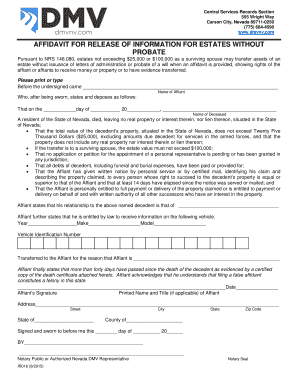

The Nevada probate form is a legal document used in the probate process, which is the procedure for administering a deceased person's estate. This form is essential for validating wills, distributing assets, and settling debts according to Nevada state laws. It ensures that the wishes of the deceased are honored and that all legal requirements are met for the transfer of property. The form may vary based on the specifics of the estate, such as whether there is a will or if the estate qualifies for simplified probate procedures.

How to use the Nevada Probate Form

To utilize the Nevada probate form effectively, individuals must first determine the appropriate type of form needed based on the estate's situation. This may include forms for filing a will, initiating probate proceedings, or declaring heirs. Once the correct form is identified, it should be filled out with accurate information regarding the deceased, the estate, and any beneficiaries. After completing the form, it must be submitted to the appropriate probate court in Nevada for processing.

Steps to complete the Nevada Probate Form

Completing the Nevada probate form involves several key steps:

- Identify the correct form based on the estate's needs.

- Gather necessary information, including details about the deceased, assets, and beneficiaries.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- File the completed form with the appropriate probate court, either online, by mail, or in person.

Legal use of the Nevada Probate Form

The legal use of the Nevada probate form is crucial for ensuring compliance with state laws governing the probate process. This form must be completed and submitted in accordance with the Nevada Revised Statutes, which outline the requirements for probate proceedings. By using the form correctly, individuals can avoid potential legal disputes and ensure that the estate is administered according to the deceased's wishes.

Required Documents

When filing the Nevada probate form, several documents are typically required to support the application. These may include:

- A certified copy of the death certificate.

- The original will, if applicable.

- Inventory of the deceased's assets.

- Identification for the executor or personal representative.

- Any relevant financial documents related to the estate.

Form Submission Methods (Online / Mail / In-Person)

The Nevada probate form can be submitted through various methods, depending on the court's requirements and the individual's preference. Options typically include:

- Online submission through the court's electronic filing system.

- Mailing the completed form and supporting documents to the probate court.

- In-person submission at the designated court office.

Quick guide on how to complete ir 001 application for records account nevada dmv

Streamline Your Life by Filling Out Nevada Probate Form with airSlate SignNow

Whether you need to register a new vehicle, obtain a driver's license, transfer ownership, or perform any other task related to motor vehicles, handling RMV forms like Nevada Probate Form is an unavoidable task.

There are multiple ways to obtain them: via postal service, at the RMV service center, or by downloading from your local RMV website and printing them. Each of these methods consumes time. If you’re seeking a faster way to complete and sign them with a legally-recognized eSignature, airSlate SignNow is the ideal solution.

How to fill out Nevada Probate Form efficiently

- Select Show details to view a brief overview of the document you are interested in.

- Choose Get document to initiate the process and access the document.

- Follow the highlighted labels indicating required fields if applicable.

- Utilize the top toolbar and access our professional features to modify, annotate, and enhance your document.

- Insert text, your initials, shapes, images, and additional components.

- Select Sign in in the same toolbar to create a legally-recognized eSignature.

- Review the document text to ensure it is free of errors and inconsistencies.

- Click on Done to complete the document.

Using our service to fill out your Nevada Probate Form and similar forms will save you signNow time and effort. Enhance your RMV document processing from the very beginning!

Create this form in 5 minutes or less

Find and fill out the correct ir 001 application for records account nevada dmv

FAQs

-

How do I fill out an application form to open a bank account?

I want to believe that most banks nowadays have made the process of opening bank account, which used to be cumbersome, less cumbersome. All you need to do is to approach the bank, collect the form, and fill. However if you have any difficulty in filling it, you can always call on one of the banks rep to help you out.

-

How can I fill out an online application form for a SBI savings account opening, as I have a single name not a surname or last name?

go paperless. open your account at your home using SBI YONO apps.

-

How do I fill out the online application for a tourist visa to Canada for a family, one account and two applications or two accounts for two applications?

One account for all applicants is adequate assuming others are close family members. if they are not related in any way, ask them to create separate account and apply on their own. You can keep yourself as primary applicant and add family members as secondary. Just follow instructions on the website- very simpleApplication for Visitor Visa (Temporary Resident Visa - TRV)

-

How long does it take for Facebook to get back to you after you fill out your account form when you got locked out?

Up to 48 hrs.

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

Why does the IRS not allow accountants to help business owners fill out tax forms? When the IRS isn't available to answer clarification questions, why can't I ask my accountant for clarification instead? What's the reasoning behind this IRS rule?

What! The IRS doesn’t allow CPAs to fill in tax returns for their clients? Where have I been? The IRS allows CPAs to help their clients in any respect necessary. The only thing is , if they materially contribute to the preparation of the return, the IRS wants the CPA to sign the return as a preparer. I get that, it makes sense. If I help you do a tax return, essentially I am a “shadow preparer” and the IRS wants me to sign on the return, to be sure I gave you proper and lawful advice.What I think you are relating is a common issue. A client comes in and asks a bunch of questions about how to complete a return. The CPA gives them all sorts of advice, but the client wants to do it themselves. Now the CPA is in an ethical quandary. The IRS demands that the CPA sign on the return, because they have materially participated in the preparation. The client is going to prepare the return, and so the CPA has lost control of what’s actually in the return, yet is going to have to sign it. Most CPAs simply won’t do that. They are going to demand to prepare the return, because their name ( and their professional status) is on the line. That’s what I do. If a client wants to ask me theoretical questions, fine, but if they are asking a bunch of questions about the preparation of their specific return, then I basically say that the IRS demands I sign the return, and there are so many moving parts in a tax return that I really have to prepare it, or charge them for reviewing it, which will probably cost as much or more.You can ( and should) ask your accountant for clarification on tax issues, that’s what we’re here for. But really, why are you so insistent on preparing your own return? It’s kind of like doing your own appendectomy. You probably could, but isn’t it better to have a professional fiddle with those things? I mean, is this really a special interest of yours, a hobby?In my experience, most clients who are convinced they should do their own returns are deluded by the myth that they can understand the tax law without spending hundreds of hours studying it, or they are afraid of paying for expert assistance. In either case, they are penny wise and pound foolish. If your time is only worth the minimum wage, if you are to keep up to date with the tax law, you have already spent time that’s way in excess of what a return professionally prepared will cost. Additionally, you’ve missed out having the return reviewed by someone who sees hundreds of returns, and knows when things stick out like sore audit flags. And, very importantly, you are flying solo without someone to back up and support the work they did.

Create this form in 5 minutes!

How to create an eSignature for the ir 001 application for records account nevada dmv

How to create an electronic signature for the Ir 001 Application For Records Account Nevada Dmv online

How to create an eSignature for your Ir 001 Application For Records Account Nevada Dmv in Google Chrome

How to generate an electronic signature for putting it on the Ir 001 Application For Records Account Nevada Dmv in Gmail

How to make an eSignature for the Ir 001 Application For Records Account Nevada Dmv straight from your smart phone

How to generate an eSignature for the Ir 001 Application For Records Account Nevada Dmv on iOS

How to make an electronic signature for the Ir 001 Application For Records Account Nevada Dmv on Android devices

People also ask

-

What is a Nevada Probate Form and why is it important?

A Nevada Probate Form is a legal document used in the probate process to manage the distribution of a deceased person's estate in Nevada. It's essential for ensuring that the deceased's wishes are fulfilled and that assets are distributed according to state laws. Properly completing the Nevada Probate Form can streamline the probate process, making it easier for executors and beneficiaries.

-

How can airSlate SignNow help with Nevada Probate Forms?

airSlate SignNow simplifies the process of completing and signing Nevada Probate Forms by providing an easy-to-use platform for electronic signatures and document management. Our solution allows users to fill out forms digitally, making it faster and more efficient to obtain the necessary signatures. With airSlate SignNow, you can ensure your Nevada Probate Form is processed without the hassle of traditional paperwork.

-

Is airSlate SignNow compatible with other document management systems for Nevada Probate Forms?

Yes, airSlate SignNow integrates seamlessly with various document management systems, enhancing your workflow when dealing with Nevada Probate Forms. This integration allows for easy access to your files and ensures that all necessary documents are in one place. You can streamline your probate process by connecting airSlate SignNow with your existing tools.

-

What are the pricing options for using airSlate SignNow for Nevada Probate Forms?

airSlate SignNow offers flexible pricing plans designed to accommodate various needs, including those specifically for managing Nevada Probate Forms. Our plans are cost-effective and provide access to features that simplify document signing and management. You can choose a plan that best fits your budget and requirements.

-

Are there any features specific to handling Nevada Probate Forms in airSlate SignNow?

Absolutely! airSlate SignNow includes features tailored for handling Nevada Probate Forms, such as customizable templates, secure storage, and audit trails. These features help ensure that your documents are compliant with Nevada law and that you have a clear record of all actions taken with the forms.

-

Can I access my Nevada Probate Forms on mobile with airSlate SignNow?

Yes, airSlate SignNow offers a mobile-friendly platform, allowing you to access your Nevada Probate Forms from anywhere, at any time. Our mobile app ensures that you can sign and manage your documents on the go, making it convenient to handle your probate needs. Whether you’re at home or in the office, airSlate SignNow keeps your documents at your fingertips.

-

What is the process for signing a Nevada Probate Form using airSlate SignNow?

The process for signing a Nevada Probate Form with airSlate SignNow is straightforward. Simply upload your form to the platform, add the necessary fields for signatures, and invite signers to review and sign it electronically. It’s efficient and legally binding, ensuring that your Nevada Probate Form is completed correctly.

Get more for Nevada Probate Form

- Swalamban online applications punjab national bank form

- Work at height permit word format

- Military transcript request information sheet page 1 of 1 army

- Wv salesperson license form

- Silent auction rules 243559566 form

- 30 day notice to landlord form

- Cloth brand ambassador contract template form

- Female led relationship contract template form

Find out other Nevada Probate Form

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe