IC 002 Form 4T Wisconsin Exempt Organization Business Franchise or Income Tax Return Fillable 2022

What is the IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable

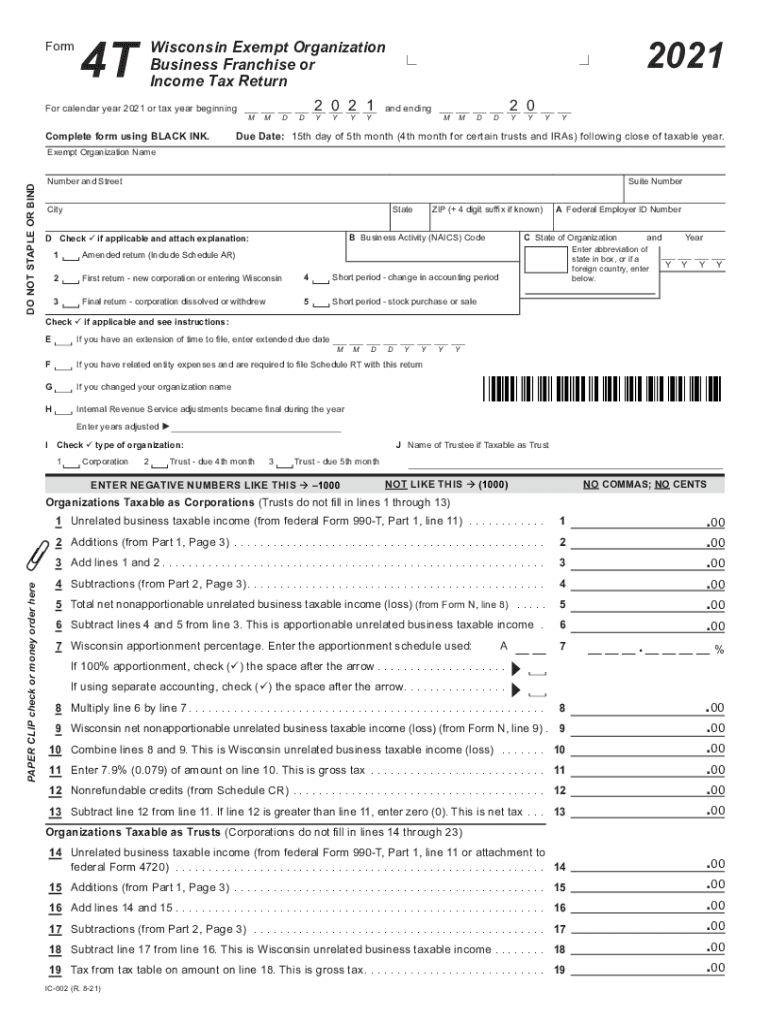

The IC 002 Form 4T is a specific tax return form used by exempt organizations in Wisconsin. This form is designed for entities that are exempt from federal income tax but may still be subject to state business franchise or income taxes. The form allows these organizations to report their income, deductions, and tax liability to the Wisconsin Department of Revenue. It is essential for maintaining compliance with state tax regulations while ensuring that exempt organizations fulfill their reporting obligations accurately.

How to use the IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable

Using the IC 002 Form 4T involves several straightforward steps. First, download the fillable version of the form from the appropriate state website or tax authority. Once downloaded, you can complete the form electronically by entering your organization's information directly into the fields provided. Ensure that all required sections are filled out, including income details and any applicable deductions. After completing the form, review it for accuracy before submitting it to the Wisconsin Department of Revenue, either electronically or via mail.

Steps to complete the IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable

Completing the IC 002 Form 4T requires careful attention to detail. Follow these steps for successful completion:

- Gather necessary documentation, including financial statements and previous tax returns.

- Open the fillable form and enter your organization's name, address, and identification number.

- Report all sources of income, including contributions, grants, and any unrelated business income.

- List all allowable deductions, ensuring you have supporting documentation for each.

- Calculate the total tax liability based on the information provided.

- Review all entries for accuracy and completeness.

- Submit the form by the specified deadline to avoid penalties.

Key elements of the IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable

The IC 002 Form 4T includes several key elements that are crucial for accurate reporting. These elements typically encompass:

- Organization Information: Basic details about the exempt organization, including name and address.

- Income Reporting: Sections for detailing various income sources, including contributions and grants.

- Deductions: Areas to list applicable deductions that can reduce taxable income.

- Tax Calculation: A section for calculating the total tax owed based on reported income and deductions.

- Signature Line: A place for an authorized representative to sign and date the form.

Filing Deadlines / Important Dates

Filing deadlines for the IC 002 Form 4T are critical to ensure compliance and avoid penalties. Typically, exempt organizations must submit their tax return by the 15th day of the fifth month following the end of their fiscal year. For organizations operating on a calendar year, this means the form is due by May 15. It is advisable to check for any updates or changes to deadlines each tax year to ensure timely submission.

Eligibility Criteria

Eligibility to file the IC 002 Form 4T is generally limited to organizations that have been granted tax-exempt status under federal law, such as 501(c)(3) organizations. These entities must also engage in activities that qualify for exemption under Wisconsin state law. Organizations should verify their eligibility status and ensure they meet all criteria before filing to avoid complications with their tax return.

Quick guide on how to complete ic 002 form 4t wisconsin exempt organization business franchise or income tax return fillable

Complete IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable seamlessly on any device

Online document administration has become increasingly favored by organizations and individuals alike. It offers a superb eco-friendly substitute for traditional printed and signed documents, as you can obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable effortlessly

- Locate IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method of submitting your form, either via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable to guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ic 002 form 4t wisconsin exempt organization business franchise or income tax return fillable

Create this form in 5 minutes!

How to create an eSignature for the ic 002 form 4t wisconsin exempt organization business franchise or income tax return fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable?

The IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable is a tax form specifically designed for exempt organizations in Wisconsin. It allows these organizations to report their income and calculate any applicable franchise taxes. Using the fillable version simplifies the process, making it easier to complete and submit.

-

How can I access the IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable?

You can easily access the IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable through the airSlate SignNow platform. Simply navigate to the forms section, and you will find the fillable version available for download or online completion. This ensures you have the most up-to-date form at your fingertips.

-

Is there a cost associated with using the IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable?

Using the IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable through airSlate SignNow is part of our subscription service. We offer various pricing plans that cater to different needs, ensuring you get the best value for your organization. Check our pricing page for more details on the available options.

-

What features does the IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable offer?

The IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable includes features such as easy form filling, electronic signatures, and secure document storage. These features streamline the filing process, making it efficient and user-friendly. Additionally, you can track the status of your submissions directly through the platform.

-

How does using the IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable benefit my organization?

Utilizing the IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable can signNowly reduce the time and effort spent on tax filing. It ensures accuracy and compliance with Wisconsin tax regulations, minimizing the risk of errors. This allows your organization to focus more on its mission rather than administrative tasks.

-

Can I integrate the IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable with other software?

Yes, airSlate SignNow allows for seamless integration with various software applications, enhancing your workflow. You can connect the IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable with accounting software, CRM systems, and more. This integration helps streamline your processes and improve overall efficiency.

-

What support is available for users of the IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable?

We provide comprehensive support for users of the IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable. Our customer service team is available to assist with any questions or issues you may encounter. Additionally, we offer a knowledge base with tutorials and FAQs to help you navigate the platform effectively.

Get more for IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable

Find out other IC 002 Form 4T Wisconsin Exempt Organization Business Franchise Or Income Tax Return fillable

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors