Get Your Used Vehicle Appraised for Tax Purposes during a 2019

Understanding the Used Vehicle Appraisal for Tax Purposes

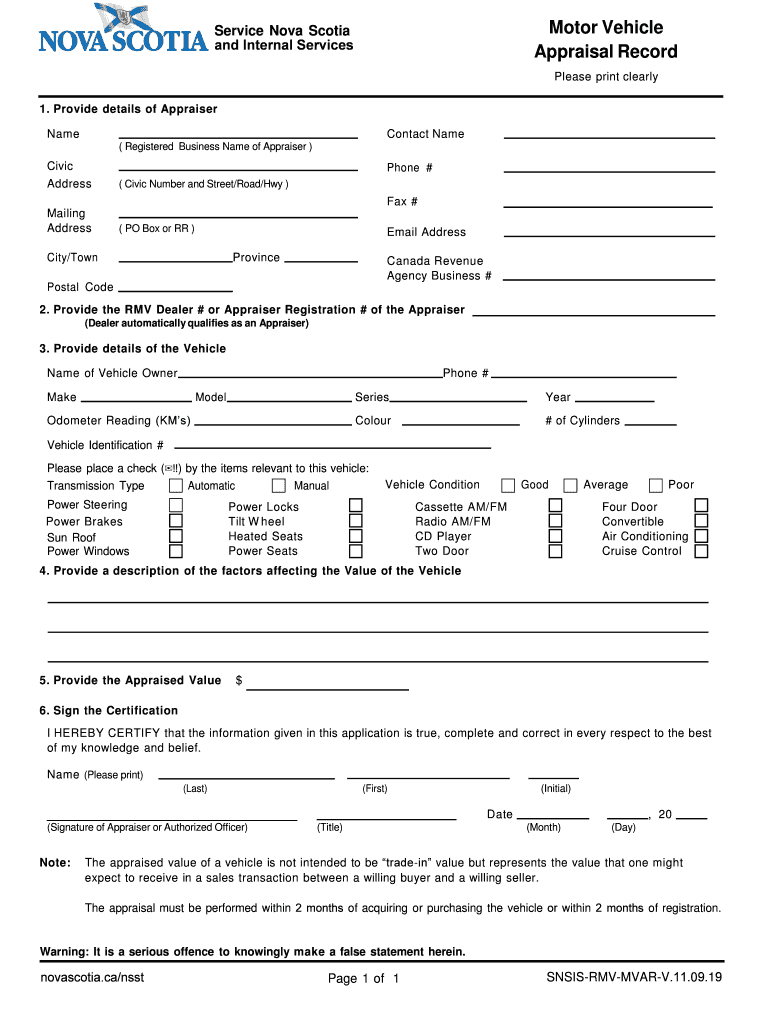

The process of getting your used vehicle appraised for tax purposes is essential for accurate reporting and compliance with IRS regulations. This appraisal helps determine the fair market value of your vehicle, which can affect your tax deductions or liabilities. Understanding the purpose and importance of this appraisal can help you navigate the tax landscape more effectively.

Steps to Complete the Appraisal Process

To complete the appraisal for your used vehicle, follow these steps:

- Gather necessary documentation, including the vehicle's title, registration, and any previous appraisal reports.

- Research the current market value using resources such as Kelley Blue Book or NADA Guides.

- Contact a certified appraiser or use a reputable online appraisal service to obtain an official appraisal.

- Ensure that the appraisal report includes detailed information about the vehicle's condition, mileage, and any modifications.

- Keep a copy of the appraisal report for your records and for submission with your tax documents.

Legal Considerations for Vehicle Appraisals

When getting your used vehicle appraised, it is essential to be aware of the legal implications. The IRS requires that the appraisal be conducted by a qualified professional to ensure accuracy and compliance. Additionally, maintaining proper documentation can protect you in case of an audit. Be sure to follow any state-specific regulations that may apply to vehicle appraisals.

Required Documents for the Appraisal

To facilitate the appraisal process, you will need to prepare several key documents:

- Vehicle title and registration

- Previous appraisal reports, if available

- Documentation of any modifications or repairs made to the vehicle

- Proof of ownership

Having these documents ready can streamline the appraisal process and ensure that you receive an accurate valuation.

IRS Guidelines for Vehicle Appraisals

The IRS has specific guidelines regarding vehicle appraisals for tax purposes. It is important to ensure that the appraisal reflects the fair market value and is conducted by a qualified appraiser. The IRS may require you to substantiate the value claimed on your tax return, so having a thorough and accurate appraisal can be crucial for compliance.

State-Specific Rules for Appraisals

Different states may have unique regulations regarding vehicle appraisals for tax purposes. It is important to familiarize yourself with your state's requirements, as they can impact the appraisal process and the documentation needed. Some states may have specific forms or procedures that must be followed to ensure compliance with local tax laws.

Quick guide on how to complete get your used vehicle appraised for tax purposes during a

Accomplish Get Your Used Vehicle Appraised For Tax Purposes During A effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Get Your Used Vehicle Appraised For Tax Purposes During A on any platform with airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Get Your Used Vehicle Appraised For Tax Purposes During A seamlessly

- Locate Get Your Used Vehicle Appraised For Tax Purposes During A and select Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Get Your Used Vehicle Appraised For Tax Purposes During A and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct get your used vehicle appraised for tax purposes during a

Create this form in 5 minutes!

How to create an eSignature for the get your used vehicle appraised for tax purposes during a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to Get Your Used Vehicle Appraised For Tax Purposes During A?

To Get Your Used Vehicle Appraised For Tax Purposes During A, you need to gather necessary documents such as the vehicle title and maintenance records. Then, you can use our online platform to submit your vehicle details for an appraisal. Our system will guide you through the steps to ensure a smooth appraisal process.

-

How much does it cost to Get Your Used Vehicle Appraised For Tax Purposes During A?

The cost to Get Your Used Vehicle Appraised For Tax Purposes During A varies based on the vehicle's make, model, and condition. We offer competitive pricing to ensure you receive a fair appraisal without breaking the bank. Check our pricing page for detailed information on costs.

-

What features does airSlate SignNow offer for vehicle appraisals?

airSlate SignNow provides a user-friendly interface that simplifies the process to Get Your Used Vehicle Appraised For Tax Purposes During A. Features include document eSigning, secure storage, and real-time tracking of your appraisal status. These tools enhance your experience and ensure efficiency.

-

What are the benefits of using airSlate SignNow for vehicle appraisals?

Using airSlate SignNow to Get Your Used Vehicle Appraised For Tax Purposes During A offers numerous benefits, including time savings and increased accuracy. Our platform streamlines the appraisal process, allowing you to focus on other important tasks. Additionally, our secure system protects your sensitive information.

-

Can I integrate airSlate SignNow with other applications for vehicle appraisals?

Yes, airSlate SignNow allows for seamless integrations with various applications to enhance your experience when you Get Your Used Vehicle Appraised For Tax Purposes During A. You can connect with accounting software, CRM systems, and more to streamline your workflow. Check our integrations page for a full list of compatible applications.

-

Is there customer support available when I Get Your Used Vehicle Appraised For Tax Purposes During A?

Absolutely! Our dedicated customer support team is available to assist you when you Get Your Used Vehicle Appraised For Tax Purposes During A. Whether you have questions about the process or need technical assistance, we are here to help via chat, email, or phone.

-

How long does it take to Get Your Used Vehicle Appraised For Tax Purposes During A?

The time it takes to Get Your Used Vehicle Appraised For Tax Purposes During A can vary, but typically, you can expect results within a few business days. Our efficient system ensures that your appraisal is completed as quickly as possible without sacrificing quality. You will receive updates throughout the process.

Get more for Get Your Used Vehicle Appraised For Tax Purposes During A

Find out other Get Your Used Vehicle Appraised For Tax Purposes During A

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form