Form 8919 Internal Revenue Service 2023

What is the Form 8919 Internal Revenue Service

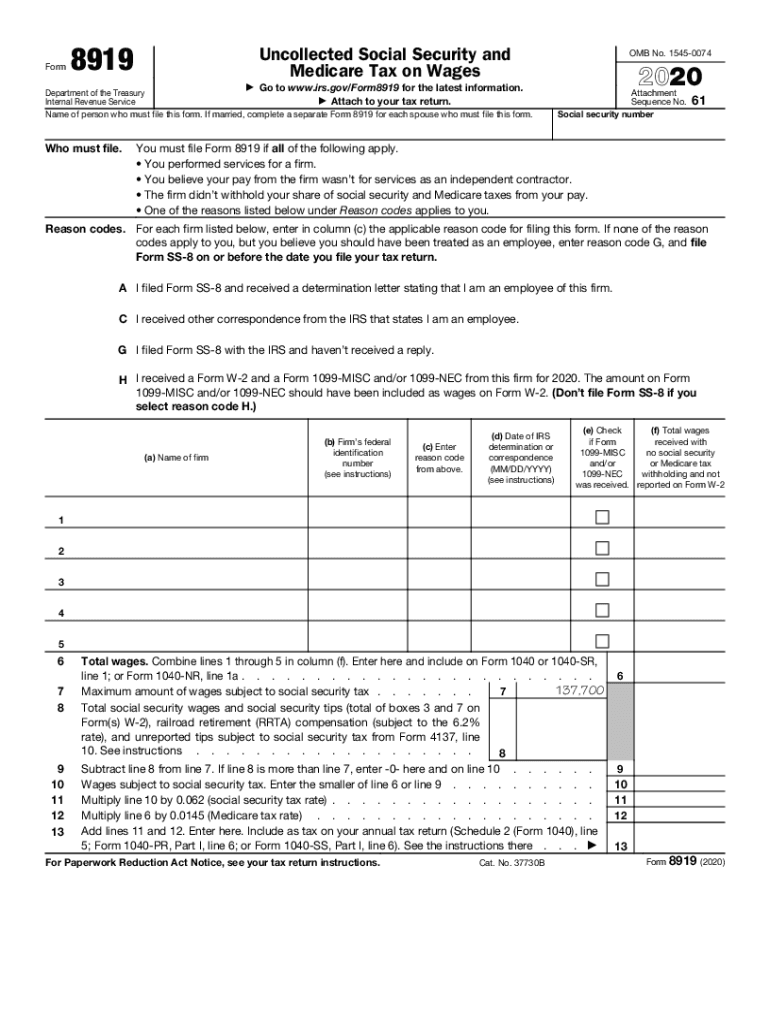

Form 8919 is a tax form used by the Internal Revenue Service (IRS) for individuals who believe they have been misclassified as independent contractors rather than employees. This form allows taxpayers to report their share of social security and Medicare taxes that should have been withheld by their employer. The purpose of Form 8919 is to ensure that individuals receive the correct benefits associated with their employment status.

How to use the Form 8919 Internal Revenue Service

To use Form 8919, individuals must first determine if they meet the eligibility criteria, which typically involves confirming that their employer did not withhold social security or Medicare taxes. Once eligibility is established, taxpayers should fill out the form by providing their personal information and the details of their employment. After completing the form, it should be attached to the individual’s tax return when filing with the IRS.

Steps to complete the Form 8919 Internal Revenue Service

Completing Form 8919 involves several key steps:

- Gather personal information, including your name, address, and Social Security number.

- Identify the employer who misclassified you and provide their details.

- Calculate the amount of social security and Medicare taxes that should have been withheld.

- Fill out the form accurately, ensuring all sections are completed.

- Attach Form 8919 to your tax return when you file it with the IRS.

Legal use of the Form 8919 Internal Revenue Service

Form 8919 is legally recognized by the IRS for reporting misclassification of employment status. It is essential for individuals who believe they have been incorrectly classified as independent contractors to use this form to ensure compliance with tax obligations. Proper use of Form 8919 can help individuals secure their rights to social security and Medicare benefits.

Filing Deadlines / Important Dates

It is crucial to file Form 8919 by the tax return deadline to avoid potential penalties. For most taxpayers, this deadline typically falls on April fifteenth of each year. If additional time is needed, individuals may file for an extension, but they must still submit Form 8919 by the extended deadline to ensure compliance.

Eligibility Criteria

To be eligible to file Form 8919, individuals must meet specific criteria, including:

- Being classified as an independent contractor by an employer.

- Having a reasonable belief that the classification is incorrect.

- Not having had social security or Medicare taxes withheld from their pay.

Meeting these criteria is essential for successfully using Form 8919 to report misclassification.

Quick guide on how to complete form 8919 internal revenue service

Easily prepare Form 8919 Internal Revenue Service on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can locate the appropriate form and safely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly without any hold-ups. Handle Form 8919 Internal Revenue Service on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to edit and electronically sign Form 8919 Internal Revenue Service effortlessly

- Obtain Form 8919 Internal Revenue Service and click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Select important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the information and click on the Done button to preserve your changes.

- Decide how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tiring form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Edit and electronically sign Form 8919 Internal Revenue Service and guarantee effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8919 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the form 8919 internal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8919 and why is it important for the Internal Revenue Service?

Form 8919 is used by employees to report uncollected Social Security and Medicare taxes on their wages. It is important for the Internal Revenue Service as it helps ensure that all taxes owed are reported and collected, maintaining compliance with tax laws.

-

How can airSlate SignNow help with the completion of Form 8919 for the Internal Revenue Service?

airSlate SignNow provides an easy-to-use platform that allows users to fill out and eSign Form 8919 efficiently. With its intuitive interface, you can quickly complete the form and ensure that it meets the requirements set by the Internal Revenue Service.

-

What are the pricing options for using airSlate SignNow for Form 8919 submissions?

airSlate SignNow offers various pricing plans to cater to different business needs, making it a cost-effective solution for submitting Form 8919 to the Internal Revenue Service. You can choose from monthly or annual subscriptions, with options that provide additional features for enhanced document management.

-

Are there any integrations available with airSlate SignNow for Form 8919 processing?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing you to streamline the process of completing and submitting Form 8919 to the Internal Revenue Service. These integrations enhance productivity by connecting with tools you already use.

-

What features does airSlate SignNow offer for managing Form 8919 submissions?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for Form 8919 submissions. These features ensure that your documents are handled efficiently and securely, meeting the standards of the Internal Revenue Service.

-

How does airSlate SignNow ensure the security of Form 8919 submissions?

Security is a top priority for airSlate SignNow, which employs advanced encryption and compliance measures to protect your Form 8919 submissions. This ensures that your sensitive information is safe while being processed for the Internal Revenue Service.

-

Can I access airSlate SignNow on mobile devices for Form 8919?

Absolutely! airSlate SignNow is accessible on mobile devices, allowing you to complete and eSign Form 8919 on the go. This flexibility ensures that you can manage your submissions to the Internal Revenue Service anytime, anywhere.

Get more for Form 8919 Internal Revenue Service

- Form 593 real estate withholding statement form 593 real estate withholding statement

- Spousal renunciation of rights affidavit omwbe omwbe wa form

- Bexar county constable pct form

- How to fill middlesex application form

- Form 3200 113 aquatic plant control mechanical manual permit application dnr wi

- Soil formation worksheet pdf

- Land transfer contract template form

- Landlord contract template form

Find out other Form 8919 Internal Revenue Service

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast

- eSign Iowa Car Dealer Limited Power Of Attorney Safe

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter