LAMBADA HAIL DSLAM NEVER MALAYSIACP55B BORIN Form

Understanding the LAMBADA HAIL DSLAM NEVER MALAYSIACP55B BORIN

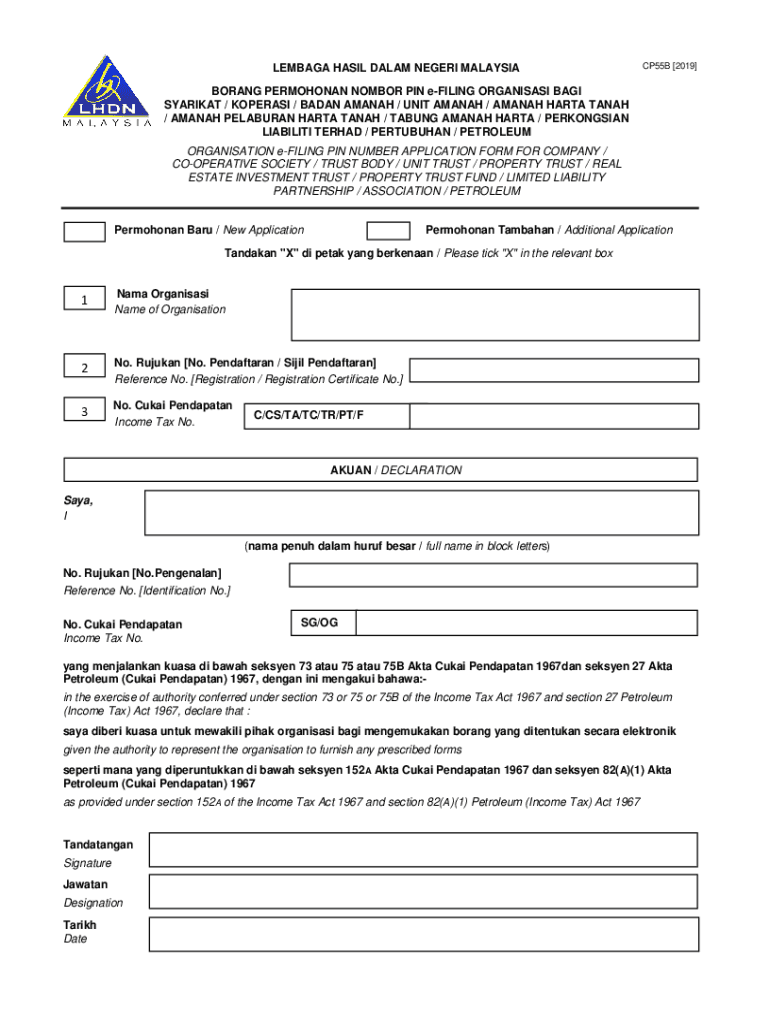

The LAMBADA HAIL DSLAM NEVER MALAYSIACP55B BORIN is a specialized form used in various administrative and regulatory contexts. It serves a unique purpose, often related to telecommunications or data management. Understanding its function is essential for compliance and operational efficiency. This form may include specific fields that require detailed information about the user or entity submitting it. Familiarity with the form's intent can help streamline the submission process and ensure that all necessary information is accurately provided.

How to Complete the LAMBADA HAIL DSLAM NEVER MALAYSIACP55B BORIN

Completing the LAMBADA HAIL DSLAM NEVER MALAYSIACP55B BORIN involves several key steps. First, gather all required information, including identification details and any supporting documentation. Next, carefully fill out each section of the form, ensuring accuracy to avoid delays. It is important to review the form for completeness before submission. In some cases, electronic submission may be available, which can expedite the process. If submitting by mail, ensure that you send it to the correct address as specified in the guidelines.

Legal Considerations for the LAMBADA HAIL DSLAM NEVER MALAYSIACP55B BORIN

The legal use of the LAMBADA HAIL DSLAM NEVER MALAYSIACP55B BORIN is governed by specific regulations that vary by jurisdiction. It is crucial to understand these legal frameworks to avoid potential penalties or compliance issues. Users should be aware of any state-specific rules that may apply, as these can affect how the form is completed and submitted. Consulting with a legal expert can provide clarity on obligations and ensure adherence to all relevant laws.

Required Documentation for Submission

When submitting the LAMBADA HAIL DSLAM NEVER MALAYSIACP55B BORIN, certain documents may be required to support your application. These documents can include identification, proof of residency, and any relevant business licenses or permits. It is advisable to compile these documents ahead of time to facilitate a smooth submission process. Ensure that all documents are current and accurately reflect the information provided on the form.

Examples of Applications for the LAMBADA HAIL DSLAM NEVER MALAYSIACP55B BORIN

There are various scenarios in which the LAMBADA HAIL DSLAM NEVER MALAYSIACP55B BORIN may be utilized. For instance, telecommunications companies may use this form to register new services or update existing accounts. Additionally, businesses seeking compliance with regulatory requirements may also need to submit this form. Understanding these applications can help users identify when and how to use the form effectively.

Submission Methods for the LAMBADA HAIL DSLAM NEVER MALAYSIACP55B BORIN

The LAMBADA HAIL DSLAM NEVER MALAYSIACP55B BORIN can typically be submitted through several methods, including online platforms, mail, or in-person submissions. Online submission is often the most efficient option, allowing for quicker processing times. If opting for mail, ensure that the form is sent to the designated address and consider using a trackable mailing option. In-person submissions may be available at specific locations, depending on the regulatory body overseeing the form.

Quick guide on how to complete lambada hail dslam never malaysiacp55b borin

Effortlessly Prepare LAMBADA HAIL DSLAM NEVER MALAYSIACP55B BORIN on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can access the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly and without interruptions. Manage LAMBADA HAIL DSLAM NEVER MALAYSIACP55B BORIN on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Edit and eSign LAMBADA HAIL DSLAM NEVER MALAYSIACP55B BORIN Effortlessly

- Acquire LAMBADA HAIL DSLAM NEVER MALAYSIACP55B BORIN and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and hit the Done button to save your modifications.

- Choose your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign LAMBADA HAIL DSLAM NEVER MALAYSIACP55B BORIN and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the lambada hail dslam never malaysiacp55b borin

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is LAMBADA HAIL DSLAM NEVER MALAYSIACP55B BORIN?

LAMBADA HAIL DSLAM NEVER MALAYSIACP55B BORIN is a cutting-edge solution designed to enhance document management and eSigning processes. It integrates seamlessly with existing workflows, providing businesses with a reliable and efficient way to handle important documents.

-

How does LAMBADA HAIL DSLAM NEVER MALAYSIACP55B BORIN improve document security?

LAMBADA HAIL DSLAM NEVER MALAYSIACP55B BORIN employs advanced encryption and authentication methods to ensure that your documents are secure. This means that sensitive information remains protected throughout the signing process, giving you peace of mind.

-

What are the pricing options for LAMBADA HAIL DSLAM NEVER MALAYSIACP55B BORIN?

LAMBADA HAIL DSLAM NEVER MALAYSIACP55B BORIN offers flexible pricing plans tailored to meet the needs of businesses of all sizes. You can choose from monthly or annual subscriptions, ensuring that you only pay for what you need.

-

Can LAMBADA HAIL DSLAM NEVER MALAYSIACP55B BORIN integrate with other software?

Yes, LAMBADA HAIL DSLAM NEVER MALAYSIACP55B BORIN is designed to integrate with various third-party applications, enhancing its functionality. This allows businesses to streamline their processes and improve overall efficiency.

-

What are the key features of LAMBADA HAIL DSLAM NEVER MALAYSIACP55B BORIN?

LAMBADA HAIL DSLAM NEVER MALAYSIACP55B BORIN includes features such as customizable templates, real-time tracking, and automated reminders. These features help businesses manage their documents more effectively and ensure timely responses.

-

How can LAMBADA HAIL DSLAM NEVER MALAYSIACP55B BORIN benefit my business?

By using LAMBADA HAIL DSLAM NEVER MALAYSIACP55B BORIN, businesses can save time and reduce costs associated with traditional document signing methods. This solution enhances productivity and allows teams to focus on more critical tasks.

-

Is there a free trial available for LAMBADA HAIL DSLAM NEVER MALAYSIACP55B BORIN?

Yes, LAMBADA HAIL DSLAM NEVER MALAYSIACP55B BORIN offers a free trial for new users. This allows you to explore its features and benefits before committing to a subscription.

Get more for LAMBADA HAIL DSLAM NEVER MALAYSIACP55B BORIN

- Sc dhec immunization program vaccine order form childhood

- Scso application and background booklet spalding county ga form

- Fax 404 361 8395 form

- Wc207authorization and consent to release medical form

- Application to waive filing fees and service vermont judiciary form

- Maryland ged identification waiver request form

- Biote comtishomingo610 e 24th st 73460biote providerbiote hormone replacement therapy at 610 e form

- Agency notice of employment or termination form

Find out other LAMBADA HAIL DSLAM NEVER MALAYSIACP55B BORIN

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later