Supplemental Income and Loss SCHEDULE E Form 1040 Department of the Treasury Internal Revenue Service 99 Names Shown on Return P

Understanding the Supplemental Income and Loss Schedule E Form 1040

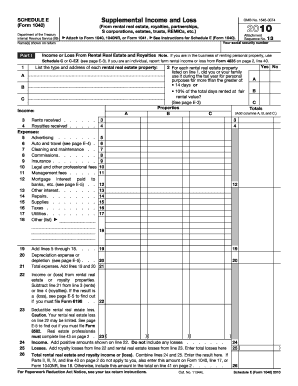

The Supplemental Income and Loss Schedule E Form 1040 is a crucial document used by taxpayers in the United States to report income or loss from various sources, including rental properties, partnerships, S corporations, estates, and trusts. This form is essential for individuals who have income from these sources and need to accurately report it to the Internal Revenue Service (IRS). The form helps ensure that all supplemental income is accounted for in the taxpayer's overall income tax return, which can affect the amount of tax owed or refunded.

Steps to Complete the Supplemental Income and Loss Schedule E Form 1040

Completing the Supplemental Income and Loss Schedule E Form 1040 involves several key steps:

- Gather necessary documentation, including records of income and expenses related to rental properties or partnerships.

- Fill out Part I of the form, which requires reporting income from rental real estate. Include the address of each property and the type of property.

- Detail any expenses associated with the properties, such as repairs, maintenance, and property management fees.

- Complete Part II for reporting income or loss from partnerships and S corporations, ensuring that you include the names of the entities and your share of income or loss.

- Review all entries for accuracy before submitting the form with your main tax return.

Legal Use of the Supplemental Income and Loss Schedule E Form 1040

The Supplemental Income and Loss Schedule E Form 1040 is legally required for taxpayers who earn income from rental properties, partnerships, S corporations, estates, or trusts. Failing to report this income can lead to penalties and interest on unpaid taxes. It is important to ensure compliance with IRS regulations and to keep accurate records to support the information reported on the form.

Obtaining the Supplemental Income and Loss Schedule E Form 1040

Taxpayers can obtain the Supplemental Income and Loss Schedule E Form 1040 directly from the IRS website or through tax preparation software. The form is typically available in PDF format for easy printing. Additionally, many tax professionals can provide the form as part of their services, ensuring that it is filled out correctly and submitted on time.

IRS Guidelines for Completing the Supplemental Income and Loss Schedule E Form 1040

The IRS provides specific guidelines for completing the Supplemental Income and Loss Schedule E Form 1040. Taxpayers should refer to the IRS instructions that accompany the form for detailed information on how to report income and deductions accurately. It is essential to follow these guidelines to avoid errors that could lead to audits or penalties.

Filing Deadlines for the Supplemental Income and Loss Schedule E Form 1040

The filing deadline for the Supplemental Income and Loss Schedule E Form 1040 aligns with the general tax return deadline, which is typically April 15. If taxpayers need additional time, they can file for an extension, but they must still pay any taxes owed by the original deadline to avoid penalties. It is important to stay informed about any changes to tax deadlines that may occur each year.

Quick guide on how to complete supplemental income and loss schedule e form 1040 department of the treasury internal revenue service 99 names shown on return

Effortlessly Prepare [SKS] on Any Device

Managing documents online has become increasingly popular among companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools for you to create, edit, and electronically sign your documents swiftly and without delays. Manage [SKS] on any device with the airSlate SignNow apps available for Android or iOS, and simplify your document-related processes today.

How to Modify and Electronically Sign [SKS] with Ease

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for this purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Verify all the details and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether via email, text message (SMS), invitation link, or by downloading it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and electronically sign [SKS] to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Supplemental Income And Loss SCHEDULE E Form 1040 Department Of The Treasury Internal Revenue Service 99 Names Shown On Return P

Create this form in 5 minutes!

How to create an eSignature for the supplemental income and loss schedule e form 1040 department of the treasury internal revenue service 99 names shown on return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Supplemental Income And Loss SCHEDULE E Form 1040?

The Supplemental Income And Loss SCHEDULE E Form 1040 is a tax form used by the Internal Revenue Service to report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and more. It is essential for accurately reporting your income and ensuring compliance with tax regulations.

-

How can airSlate SignNow help with the Supplemental Income And Loss SCHEDULE E Form 1040?

airSlate SignNow provides an efficient platform for electronically signing and sending the Supplemental Income And Loss SCHEDULE E Form 1040. Our solution simplifies the document management process, allowing you to focus on your financial reporting without the hassle of paper forms.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as eSignature, document templates, and secure cloud storage, making it easy to manage your Supplemental Income And Loss SCHEDULE E Form 1040. These tools streamline the process, ensuring that your documents are signed and stored securely.

-

Is airSlate SignNow cost-effective for small businesses handling tax forms?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses. With competitive pricing plans, you can efficiently manage your Supplemental Income And Loss SCHEDULE E Form 1040 without breaking the bank, ensuring you have the resources to focus on your business growth.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing you to manage your Supplemental Income And Loss SCHEDULE E Form 1040 alongside your financial records. This integration enhances your workflow and ensures that all your documents are in sync.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. By utilizing our platform for your Supplemental Income And Loss SCHEDULE E Form 1040, you can streamline your processes and ensure compliance with IRS regulations.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your sensitive tax documents, including the Supplemental Income And Loss SCHEDULE E Form 1040. You can trust that your information is safe and secure while using our platform.

Get more for Supplemental Income And Loss SCHEDULE E Form 1040 Department Of The Treasury Internal Revenue Service 99 Names Shown On Return P

Find out other Supplemental Income And Loss SCHEDULE E Form 1040 Department Of The Treasury Internal Revenue Service 99 Names Shown On Return P

- How To eSign Maine Church Directory Form

- How To eSign New Hampshire Church Donation Giving Form

- eSign North Dakota Award Nomination Form Free

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple