View a Complete List of Federal Tax Forms that Can Be Prepared Online and Efiled Together with State Tax Forms

Understanding Federal Tax Forms for Online Preparation and E-filing

The complete list of federal tax forms that can be prepared online and e-filed together with state tax forms includes various documents required for individual and business tax filings. These forms are essential for reporting income, claiming deductions, and ensuring compliance with tax laws. Common forms include the 1040 for individual income tax, the 1065 for partnerships, and the 1120 for corporations. Each form serves a specific purpose and must be filled out accurately to avoid penalties.

Steps to Prepare and E-file Federal Tax Forms

To prepare and e-file federal tax forms online, follow these steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Choose a reliable online tax preparation software that supports both federal and state forms.

- Input your personal and financial information into the software, ensuring accuracy.

- Review all entries for completeness and correctness before submission.

- Submit your federal tax forms electronically and follow up with state tax forms if applicable.

Legal Use of Federal Tax Forms

Federal tax forms must be used in accordance with IRS regulations. Each form has specific legal requirements regarding who must file and when. Failing to use the correct form or submitting it late can result in penalties. It is crucial to ensure that all information provided is truthful and accurate to maintain compliance with tax laws.

Required Documents for E-filing

When preparing to e-file federal tax forms, certain documents are necessary to ensure a smooth process. Required documents typically include:

- Social Security numbers for all dependents and taxpayers.

- Income statements such as W-2s and 1099s.

- Records of deductible expenses, including receipts for business expenses, medical bills, and charitable contributions.

- Last year’s tax return for reference and to ensure consistency.

Filing Deadlines for Federal Tax Forms

It is important to be aware of filing deadlines for federal tax forms to avoid late fees. Typically, individual tax returns are due on April 15. If this date falls on a weekend or holiday, the deadline may be extended. Extensions can be filed, but any taxes owed must still be paid by the original due date to avoid penalties.

Examples of Common Federal Tax Forms

Some commonly used federal tax forms include:

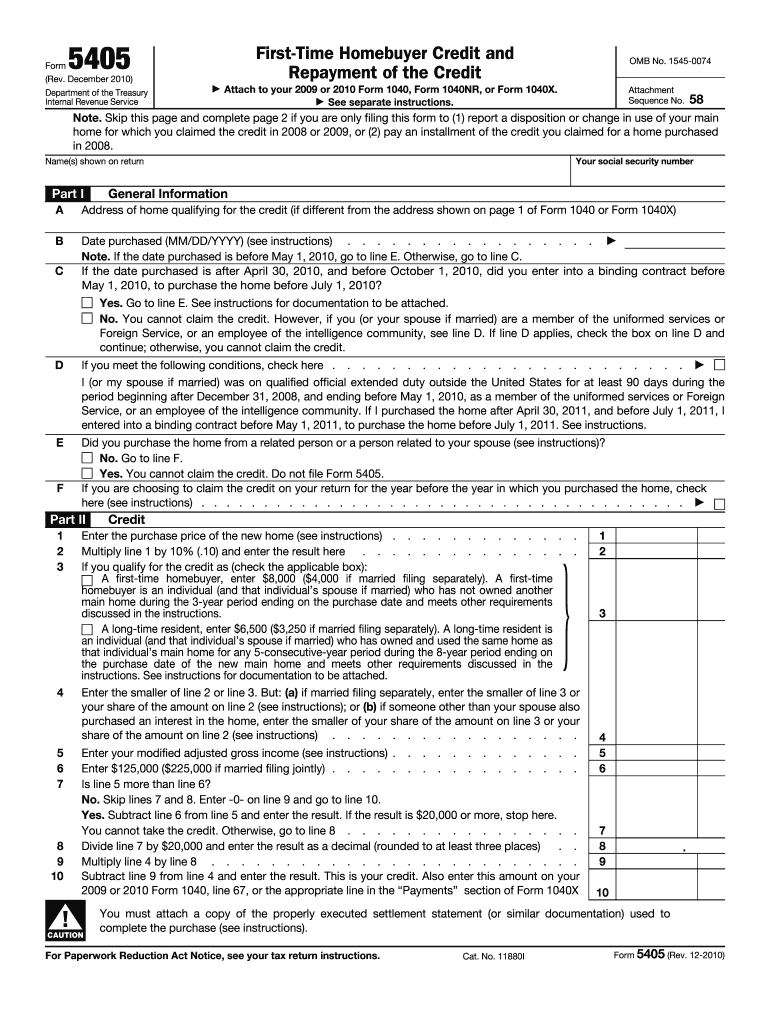

- Form 1040: The standard form for individual income tax returns.

- Form W-2: Issued by employers to report wages paid and taxes withheld.

- Form 1099: Used to report various types of income other than wages.

- Form 1065: Used for reporting income, deductions, and credits for partnerships.

Quick guide on how to complete view a complete list of federal tax forms that can be prepared online and efiled together with state tax forms

Prepare [SKS] effortlessly on any device

Web-based document management has become favored by companies and individuals alike. It offers a superb eco-friendly substitute to traditional printed and signed documents, as you can easily locate the correct form and securely keep it online. airSlate SignNow provides you with all the resources needed to create, adjust, and electronically sign your documents promptly without any hold-ups. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to adjust and electronically sign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the features we offer to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for such tasks.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a standard wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Put aside concerns about lost or misplaced documents, arduous form hunting, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from the device you prefer. Edit and electronically sign [SKS] and guarantee excellent communication at every phase of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to View A Complete List Of Federal Tax Forms That Can Be Prepared Online And Efiled Together With State Tax Forms

Create this form in 5 minutes!

How to create an eSignature for the view a complete list of federal tax forms that can be prepared online and efiled together with state tax forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What types of federal tax forms can I prepare online?

You can view a complete list of federal tax forms that can be prepared online and e-filed together with state tax forms on our platform. This includes popular forms like 1040, 1065, and 1120, ensuring you have all the necessary documents for your tax filing needs.

-

How does airSlate SignNow simplify the e-filing process?

airSlate SignNow streamlines the e-filing process by allowing you to view a complete list of federal tax forms that can be prepared online and e-filed together with state tax forms. Our user-friendly interface makes it easy to fill out, sign, and submit your tax documents efficiently.

-

Are there any costs associated with using airSlate SignNow for tax preparation?

Yes, airSlate SignNow offers various pricing plans to suit different needs. You can view a complete list of federal tax forms that can be prepared online and e-filed together with state tax forms at competitive rates, ensuring you get value for your investment.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, allowing you to view a complete list of federal tax forms that can be prepared online and e-filed together with state tax forms directly from your existing tools. This integration enhances your workflow and efficiency.

-

What are the benefits of using airSlate SignNow for tax filing?

Using airSlate SignNow for tax filing provides numerous benefits, including the ability to view a complete list of federal tax forms that can be prepared online and e-filed together with state tax forms. Our platform ensures accuracy, saves time, and offers secure document handling.

-

Is my data secure when using airSlate SignNow?

Yes, your data security is our top priority. When you view a complete list of federal tax forms that can be prepared online and e-filed together with state tax forms, you can trust that our platform employs advanced encryption and security measures to protect your sensitive information.

-

How can I get support if I have questions about tax forms?

Our customer support team is here to help! If you have questions about how to view a complete list of federal tax forms that can be prepared online and e-filed together with state tax forms, you can signNow out via chat, email, or phone for prompt assistance.

Get more for View A Complete List Of Federal Tax Forms That Can Be Prepared Online And Efiled Together With State Tax Forms

- Form it 634 empire state jobs retention program credit tax year 2022

- Form it 258 claim for nursing home assessment credit tax year 2022

- Maryland use of vehicle for form charitable

- State residential historic rehabilitation tax credit form

- State ampamp local tax forms ampamp instructions for the comptroller of

- Form hw 4 rev 2022 employees withholding allowance and status certificate

- Instructions on requirement to mail or retain this form

- Form it 239 claim for credit for taxicabs and livery service vehicles accessible to persons with disabilities tax year 2022

Find out other View A Complete List Of Federal Tax Forms That Can Be Prepared Online And Efiled Together With State Tax Forms

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure