Nc 4 Form Fillable

What is the NC 5500 Form?

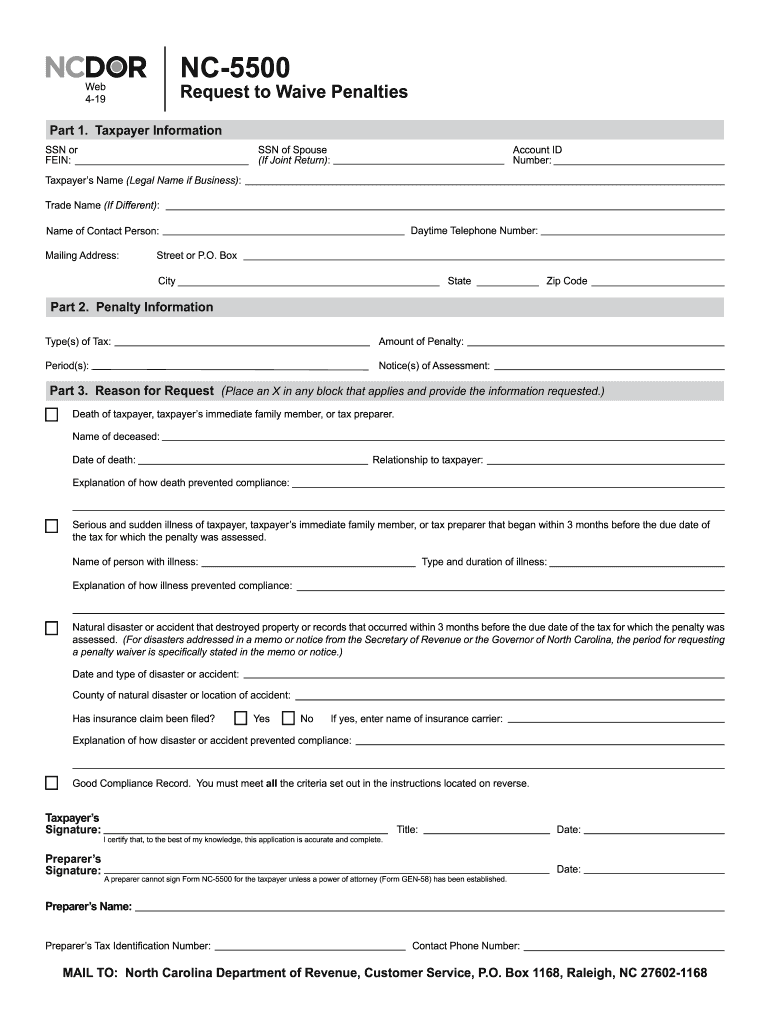

The NC 5500 form, also known as the North Carolina form 5500, is a document used by taxpayers in North Carolina to request a waiver of penalties related to tax obligations. This form is particularly relevant for individuals and businesses seeking relief from penalties imposed by the North Carolina Department of Revenue. It serves as an official request to waive penalties, which can arise from various issues such as late filings or payments.

Steps to Complete the NC 5500 Form

Completing the NC 5500 fillable form involves several important steps to ensure accuracy and compliance. First, gather all necessary information, including your tax identification number and details about the penalties you wish to waive. Next, fill out the form with clear and concise information, ensuring that all sections are completed. After completing the form, review it for any errors or omissions. Finally, submit the form according to the instructions provided, either online or by mail.

Legal Use of the NC 5500 Form

The NC 5500 form is legally binding when completed correctly and submitted according to state regulations. It is essential to understand that simply filling out the form does not guarantee the waiver of penalties. The North Carolina Department of Revenue will review your request based on established criteria and may require additional documentation to support your case. Compliance with all legal requirements is crucial for the form to be considered valid.

Form Submission Methods

The NC 5500 form can be submitted through various methods to accommodate different preferences. Taxpayers may choose to submit the form online through the North Carolina Department of Revenue's website, which offers a streamlined process for electronic submissions. Alternatively, the form can be mailed to the appropriate department or submitted in person at designated offices. It is important to follow the specific submission guidelines to ensure timely processing.

Examples of Using the NC 5500 Form

There are several scenarios where the NC 5500 form may be utilized. For instance, a small business owner who has incurred penalties due to a late tax payment may use the form to request a waiver based on mitigating circumstances. Similarly, an individual taxpayer who faced unexpected financial hardship and missed the filing deadline can submit the NC 5500 to seek relief from penalties. Each case will be evaluated on its own merits by the North Carolina Department of Revenue.

Penalties for Non-Compliance

Failure to comply with tax obligations can result in significant penalties, which may include fines and interest on unpaid amounts. If a taxpayer does not file the NC 5500 form when applicable, they may miss the opportunity to have penalties waived. Understanding the potential consequences of non-compliance is essential for taxpayers to avoid unnecessary financial burdens and to maintain good standing with the North Carolina Department of Revenue.

Quick guide on how to complete nc 5500 ncgov

Effortlessly Prepare Nc 4 Form Fillable on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to quickly create, modify, and electronically sign your documents without delays. Manage Nc 4 Form Fillable on any device using the airSlate SignNow apps for Android or iOS and streamline your document-related tasks today.

The easiest way to edit and eSign Nc 4 Form Fillable with ease

- Obtain Nc 4 Form Fillable and click on Get Form to initiate the process.

- Make use of the available tools to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides for this purpose.

- Generate your electronic signature with the Sign feature, which takes just a few seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Leave behind the hassles of lost or misplaced files, tedious form searching, and the need to print new document copies due to mistakes. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Nc 4 Form Fillable and ensure smooth communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nc 5500 ncgov

How to generate an electronic signature for your Nc 5500 Ncgov in the online mode

How to create an eSignature for your Nc 5500 Ncgov in Google Chrome

How to generate an electronic signature for signing the Nc 5500 Ncgov in Gmail

How to generate an electronic signature for the Nc 5500 Ncgov from your smartphone

How to make an electronic signature for the Nc 5500 Ncgov on iOS devices

How to make an electronic signature for the Nc 5500 Ncgov on Android devices

People also ask

-

What is the Nc 4 Form Fillable, and how does it work?

The Nc 4 Form Fillable is a digital version of the North Carolina Employee's Withholding Allowance Certificate that allows users to fill out their tax withholding information electronically. By utilizing airSlate SignNow, you can easily complete the Nc 4 Form Fillable and ensure that it is signed and submitted accurately. This streamlines the process of managing your tax withholdings, saving you time and reducing paperwork.

-

How do I access the Nc 4 Form Fillable on airSlate SignNow?

To access the Nc 4 Form Fillable, simply log in to your airSlate SignNow account and search for the form in the template library. You can fill it out online, customize it as needed, and save it for future use. This provides a convenient way to manage your withholding forms without the hassle of printed copies.

-

Is there a cost associated with using the Nc 4 Form Fillable on airSlate SignNow?

airSlate SignNow offers various pricing plans, and the Nc 4 Form Fillable is included in most of them. You can choose a plan that fits your business needs, which allows unlimited access to fillable forms, including the Nc 4 Form. Check our pricing page for detailed information on subscriptions.

-

Can I integrate the Nc 4 Form Fillable with other software?

Yes, the Nc 4 Form Fillable can be easily integrated with various applications and platforms through airSlate SignNow’s API. This allows you to connect your existing tools, such as CRM systems or document management software, enhancing your workflow. Integration ensures that your Nc 4 Form Fillable processes are seamless and efficient.

-

What are the benefits of using the Nc 4 Form Fillable compared to paper forms?

Using the Nc 4 Form Fillable offers numerous benefits over traditional paper forms, including time savings, reduced errors, and easy accessibility. Digital forms can be filled out and signed from anywhere, which enhances convenience for both employees and employers. Additionally, electronic storage means you can retrieve your Nc 4 Form Fillable whenever needed without sifting through physical paperwork.

-

Is the Nc 4 Form Fillable secure on airSlate SignNow?

Absolutely! The Nc 4 Form Fillable on airSlate SignNow is protected with advanced encryption and security measures to safeguard your sensitive information. We prioritize data protection, ensuring that your completed forms are stored securely and can only be accessed by authorized users.

-

Can multiple users collaborate on the Nc 4 Form Fillable?

Yes, airSlate SignNow allows multiple users to collaborate on the Nc 4 Form Fillable, making it easy for teams to work together. You can share the form with colleagues, collect input, and obtain necessary signatures online. This collaboration feature streamlines the completion process and ensures that all stakeholders are involved.

Get more for Nc 4 Form Fillable

Find out other Nc 4 Form Fillable

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy