Schedule L Form

What is the Schedule L?

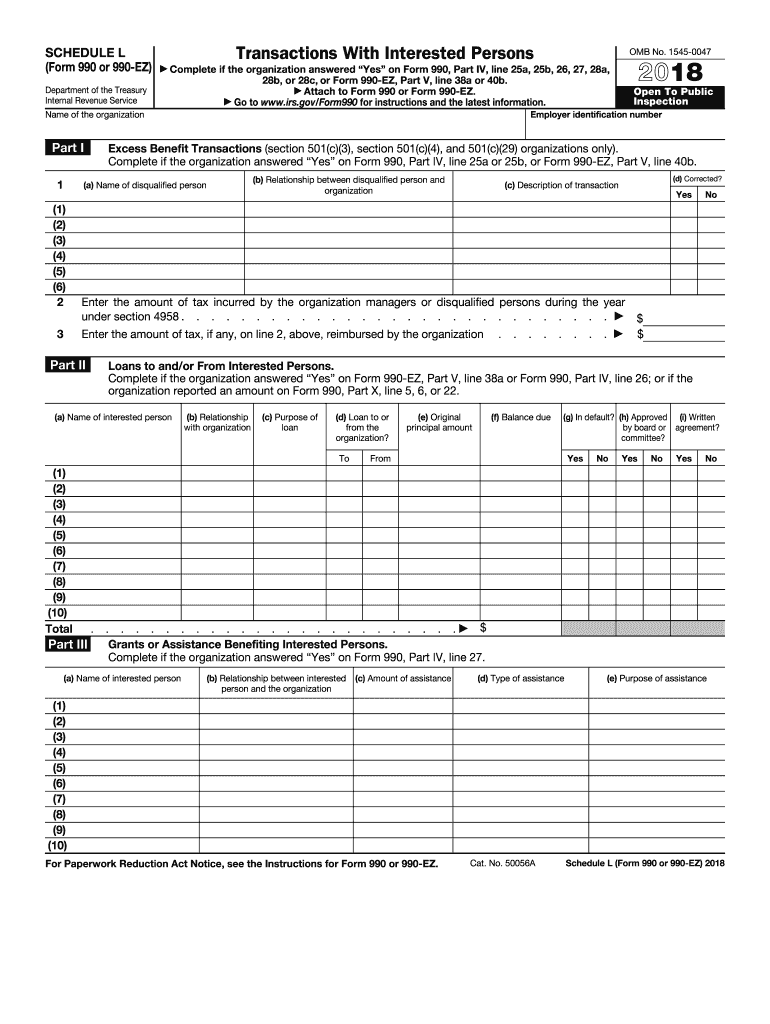

The Schedule L is a component of Form 990, which is used by tax-exempt organizations to provide detailed financial information to the IRS. Specifically, Schedule L focuses on the organization's relationships with interested parties, including transactions with board members, officers, and other key individuals. This schedule is crucial for ensuring transparency and compliance with tax regulations. It helps the IRS assess whether the organization is operating in accordance with its tax-exempt status and if it is engaging in any transactions that could pose conflicts of interest.

How to use the Schedule L

Using the Schedule L involves accurately reporting transactions and relationships that may affect your organization’s tax-exempt status. Organizations must disclose any financial transactions with interested parties, including loans, payments, and compensation arrangements. To use the Schedule L effectively, gather all relevant financial records and documentation related to these transactions. This includes invoices, contracts, and any communications that illustrate the nature of the relationship. Completing this schedule accurately is essential for maintaining compliance and avoiding potential penalties.

Steps to complete the Schedule L

Completing the Schedule L requires a systematic approach to ensure all necessary information is included. Follow these steps:

- Gather documentation related to transactions with interested parties.

- Identify all board members, officers, and key employees who have engaged in transactions with the organization.

- Detail each transaction, including amounts, dates, and the nature of the relationship.

- Review IRS guidelines to ensure compliance with reporting requirements.

- Double-check all entries for accuracy before submission.

Key elements of the Schedule L

Several key elements must be included when completing the Schedule L. These include:

- Identification of interested parties involved in transactions.

- Details of the transactions, including amounts and types.

- Descriptions of the nature of the relationships.

- Any potential conflicts of interest that may arise from these transactions.

Including these elements ensures that the Schedule L meets IRS requirements and provides a clear picture of the organization’s financial dealings.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule L, which are essential for ensuring compliance. Organizations should refer to the IRS instructions for Form 990 and Schedule L, which outline the reporting requirements, definitions of interested parties, and examples of transactions that need to be reported. Familiarity with these guidelines helps organizations avoid common pitfalls and ensures that all necessary information is disclosed accurately.

Penalties for Non-Compliance

Failure to comply with the reporting requirements of the Schedule L can result in significant penalties. The IRS may impose fines for incomplete or inaccurate filings, which can jeopardize an organization’s tax-exempt status. Additionally, non-compliance can lead to increased scrutiny from the IRS, potentially resulting in audits or further investigations. It is crucial for organizations to take the completion of the Schedule L seriously to avoid these repercussions.

Quick guide on how to complete form 990 or 990 ez sch l

Complete Schedule L seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed papers, enabling you to locate the appropriate form and securely preserve it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Schedule L on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Schedule L effortlessly

- Locate Schedule L and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or mask confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors necessitating the printing of new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Schedule L while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 990 or 990 ez sch l

How to make an electronic signature for the Form 990 Or 990 Ez Sch L online

How to generate an eSignature for your Form 990 Or 990 Ez Sch L in Chrome

How to make an eSignature for putting it on the Form 990 Or 990 Ez Sch L in Gmail

How to make an electronic signature for the Form 990 Or 990 Ez Sch L straight from your mobile device

How to generate an electronic signature for the Form 990 Or 990 Ez Sch L on iOS devices

How to create an eSignature for the Form 990 Or 990 Ez Sch L on Android devices

People also ask

-

What is Schedule L and how can it benefit my business?

Schedule L is a key feature within airSlate SignNow that allows businesses to manage their document workflows efficiently. By utilizing Schedule L, you can schedule document signings, track their status, and ensure timely completion. This streamlines processes and helps reduce administrative burdens, allowing your team to focus on more important tasks.

-

How does airSlate SignNow pricing work with Schedule L?

AirSlate SignNow offers flexible pricing plans that incorporate Schedule L features, ensuring your business only pays for what it needs. Whether you're a small business or a large enterprise, you can find a plan that fits your budget while providing access to essential tools like Schedule L. For detailed pricing, visit our website or contact our sales team.

-

Can I integrate Schedule L with other tools my business uses?

Absolutely! Schedule L is designed to seamlessly integrate with a variety of third-party applications such as CRM systems and project management tools. This integration enhances your document workflow by enabling automatic updates and tracking, leading to greater efficiency and fewer errors. Explore our integrations page to see the full list of supported applications.

-

What security measures are in place for documents signed via Schedule L?

Security is a top priority at airSlate SignNow when using Schedule L for document management. We implement industry-leading encryption protocols, secure data storage, and multi-factor authentication to protect your sensitive information. Additionally, we comply with various industry standards to ensure that your documents remain safe throughout the signing process.

-

How user-friendly is Schedule L for new users?

Schedule L is designed with a focus on user-friendliness, making it accessible for everyone, regardless of their tech-savviness. The intuitive interface guides users through the scheduling and signing process with step-by-step prompts. We also provide comprehensive resources, including tutorials and customer support, to ensure a smooth onboarding experience.

-

What types of documents can I manage with Schedule L?

With Schedule L, you can manage a wide variety of documents, including contracts, agreements, forms, and approvals. This versatility allows businesses across different industries to leverage Schedule L for their specific document needs. Whether you need internal approvals or customer-facing contracts, Schedule L can handle it all efficiently.

-

Is there a free trial available for trying out Schedule L?

Yes, airSlate SignNow offers a free trial that includes access to Schedule L features. This allows prospective customers to experience the benefits firsthand before committing to a subscription. Sign up on our website, and you'll be able to explore how Schedule L can optimize your document signing process.

Get more for Schedule L

- Sign permit application city of foristell form

- Cake tasting amp consultation form nina s cookies

- Certified payroll reporting form

- New jersey park fire form

- New jersey direct deposit form

- Pemberton township recreation department 500 pemberton form

- Assistance for seniorsfood and nutrition service usda form

- South bound brook fire department chili cook off form

Find out other Schedule L

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document