8130 6 Form

Understanding the SC Form L 2172

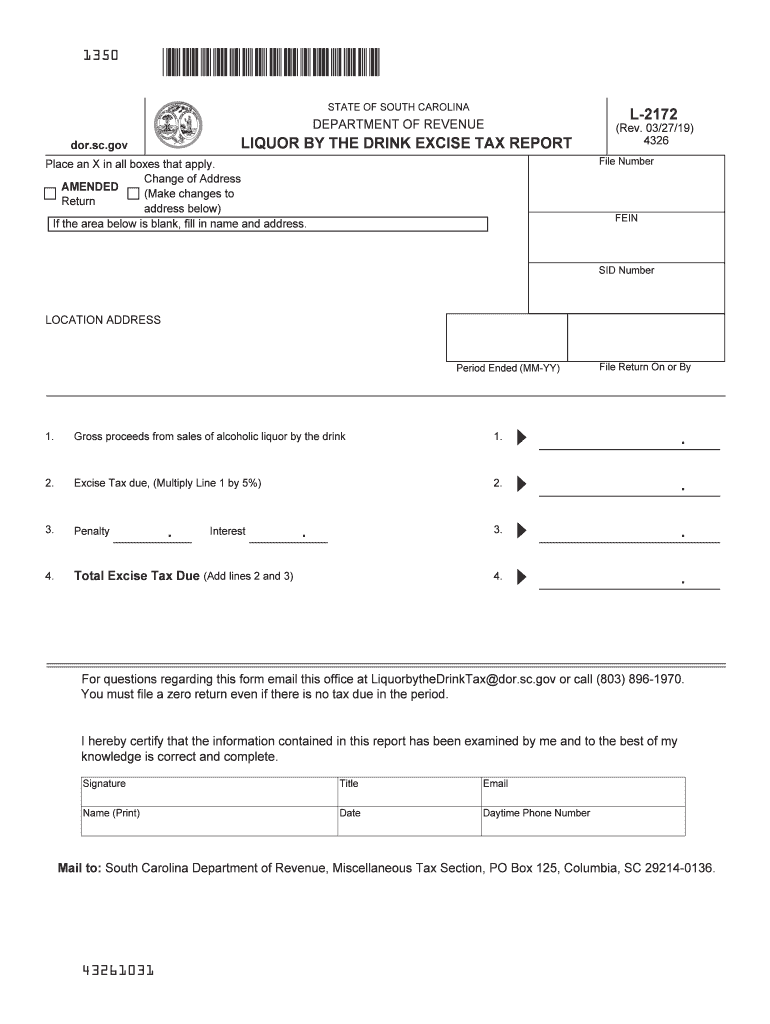

The SC Form L 2172, also known as the liquor excise tax form L 2172, is a crucial document for businesses involved in the sale of alcoholic beverages in South Carolina. This form is specifically designed to report and pay the liquor by the drink tax. Understanding its purpose and requirements is essential for compliance with state regulations.

Steps to Complete the SC Form L 2172

Completing the SC Form L 2172 involves several key steps:

- Gather necessary information, including your business details and sales data.

- Accurately calculate the total liquor sales to determine the tax owed.

- Fill out the form with the required information, ensuring accuracy to avoid penalties.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline to ensure compliance.

Legal Use of the SC Form L 2172

The SC Form L 2172 is legally binding when completed correctly and submitted on time. To ensure its legal standing, businesses must adhere to the guidelines set forth by the South Carolina Department of Revenue. This includes maintaining accurate records of sales and tax payments, which may be subject to audits.

Filing Deadlines for the SC Form L 2172

Timely filing of the SC Form L 2172 is critical to avoid penalties. The form is typically due on a monthly basis, with specific deadlines outlined by the South Carolina Department of Revenue. Businesses should mark these dates on their calendars to ensure compliance and avoid late fees.

Required Documents for the SC Form L 2172

When preparing to complete the SC Form L 2172, businesses should have the following documents ready:

- Sales records for the reporting period.

- Previous tax returns, if applicable.

- Any correspondence with the South Carolina Department of Revenue regarding liquor tax.

Penalties for Non-Compliance with the SC Form L 2172

Failure to file the SC Form L 2172 on time or inaccuracies in the submitted information can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for businesses to understand these risks and ensure compliance with all filing requirements.

Quick guide on how to complete various south carolina tax forms signnow

Complete 8130 6 effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage 8130 6 on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to adjust and electronically sign 8130 6 with ease

- Find 8130 6 and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your modifications.

- Select how you wish to deliver your form—by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign 8130 6 to guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the various south carolina tax forms signnow

How to generate an electronic signature for your Various South Carolina Tax Forms Signnow in the online mode

How to create an eSignature for the Various South Carolina Tax Forms Signnow in Google Chrome

How to generate an eSignature for signing the Various South Carolina Tax Forms Signnow in Gmail

How to generate an electronic signature for the Various South Carolina Tax Forms Signnow right from your smart phone

How to generate an eSignature for the Various South Carolina Tax Forms Signnow on iOS devices

How to make an electronic signature for the Various South Carolina Tax Forms Signnow on Android OS

People also ask

-

What is SC L 2172 and how does it relate to airSlate SignNow?

SC L 2172 is a product key that unlocks features tailored for efficient document signing and management. By using SC L 2172, businesses can leverage airSlate SignNow’s capabilities to streamline their eSignature processes, making them faster and more secure.

-

How much does airSlate SignNow cost with SC L 2172?

The pricing for airSlate SignNow with SC L 2172 varies depending on the chosen plan. Our plans are designed to be cost-effective, ensuring businesses of all sizes can find a suitable option that fits their budget while enjoying the benefits of advanced features.

-

What features does SC L 2172 include?

When you utilize SC L 2172 with airSlate SignNow, you gain access to a range of features such as document templates, customizable workflows, and real-time tracking. These tools help enhance productivity by simplifying the signing process and fostering collaboration among team members.

-

Can SC L 2172 integrate with other software?

Yes, airSlate SignNow with SC L 2172 offers seamless integration with popular applications like Salesforce, Google Workspace, and Microsoft Office. This allows you to maintain your existing workflows while enhancing them with advanced eSigning capabilities.

-

What are the benefits of using SC L 2172 for eSigning?

Utilizing SC L 2172 with airSlate SignNow provides signNow time and cost savings by eliminating the need for physical document handling. This solution empowers businesses to accelerate their operations while ensuring secure and legally compliant eSignatures.

-

Is SC L 2172 suitable for small businesses?

Absolutely! SC L 2172 is designed to cater to businesses of all sizes, including small enterprises. With its user-friendly interface and affordable pricing, small businesses can easily implement airSlate SignNow to enhance their document signing process.

-

How secure is airSlate SignNow with SC L 2172?

Security is a top priority with SC L 2172. airSlate SignNow employs advanced encryption methods and complies with industry standards, ensuring that all documents signed through the platform remain confidential and protected against unauthorized access.

Get more for 8130 6

- Instructions for filing mass transit system provider fuel tax form

- Mw506nrs49 010423 b mw506nrs49 010423 b form

- Motor fuel terminal operator west virginia tax division form

- Instructions for filing blender fuel tax return form

- Wv it 104 employees withholding exemption certificate form

- Supplier of diesel fuel tax return cdtfa form

- Mw506a49 011123 a form

- April mf 001 instr instructions fuel tax refund claim form

Find out other 8130 6

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement