County Net Profit Form

What is the County Net Profit

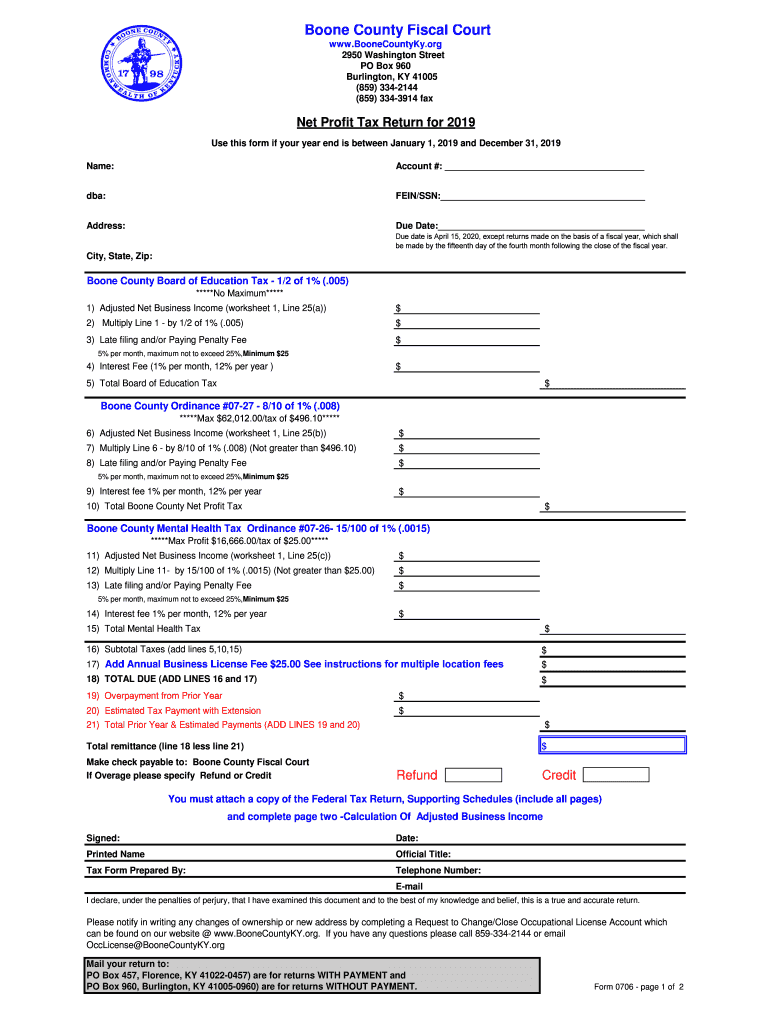

The County Net Profit refers to the taxable income that businesses operating within Boone County must report to the local government. This income is calculated after deducting allowable expenses from gross revenue. Understanding the net profit is crucial for businesses, as it directly affects tax obligations and compliance with local regulations. The Boone County net profit tax return is a specific form that businesses must complete to report this income accurately.

Steps to complete the County Net Profit

Completing the Boone County net profit tax return involves several key steps:

- Gather financial records: Collect all relevant documents, including income statements, expense receipts, and any other financial records that pertain to your business operations.

- Calculate gross income: Determine the total revenue generated by your business during the tax year.

- Deduct allowable expenses: Identify and subtract all eligible business expenses from your gross income to arrive at your net profit.

- Fill out the form: Use the Boone County net profit form to report your calculated net profit, ensuring all sections are completed accurately.

- Review for accuracy: Double-check all entries for correctness to avoid errors that could lead to penalties.

- Submit the form: File your completed net profit tax return by the designated deadline, either online or via mail.

Legal use of the County Net Profit

The Boone County net profit tax return is legally required for businesses operating within the county. Filing this return ensures compliance with local tax laws and regulations. It is important to understand that failing to file or inaccurately reporting income can result in penalties, including fines and interest on unpaid taxes. Maintaining accurate records and submitting the return on time helps businesses avoid legal issues and ensures they contribute to local community funding.

Filing Deadlines / Important Dates

Businesses must adhere to specific deadlines when filing the Boone County net profit tax return. Typically, the return is due on or before April 15 of the following tax year. It is essential to mark this date on your calendar to ensure timely submission. Additionally, if you need an extension, be sure to file the appropriate forms before the original deadline to avoid penalties.

Required Documents

To complete the Boone County net profit tax return, several documents are necessary:

- Income statements: These documents detail your business's revenue for the tax year.

- Expense receipts: Keep records of all business-related expenses that can be deducted.

- Previous tax returns: Having past returns can help in accurately reporting and comparing income.

- Bank statements: These can serve as additional proof of income and expenses.

Form Submission Methods (Online / Mail / In-Person)

Businesses have multiple options for submitting the Boone County net profit tax return. The preferred method is online submission, which is often faster and more efficient. Alternatively, businesses can mail their completed forms to the appropriate county office or submit them in person. Each method has its own advantages, so choose the one that best fits your needs while ensuring compliance with submission deadlines.

Quick guide on how to complete boone county fiscal court po box 457 florence ky 41022

Finalize County Net Profit effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the desired form and securely store it online. airSlate SignNow provides all the tools you require to produce, alter, and electronically sign your documents swiftly without delays. Handle County Net Profit on any platform using airSlate SignNow’s Android or iOS applications and streamline any document-driven process today.

How to modify and electronically sign County Net Profit effortlessly

- Locate County Net Profit and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Identify pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign County Net Profit and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the boone county fiscal court po box 457 florence ky 41022

How to create an eSignature for the Boone County Fiscal Court Po Box 457 Florence Ky 41022 online

How to generate an electronic signature for the Boone County Fiscal Court Po Box 457 Florence Ky 41022 in Google Chrome

How to generate an electronic signature for putting it on the Boone County Fiscal Court Po Box 457 Florence Ky 41022 in Gmail

How to make an eSignature for the Boone County Fiscal Court Po Box 457 Florence Ky 41022 right from your mobile device

How to create an electronic signature for the Boone County Fiscal Court Po Box 457 Florence Ky 41022 on iOS

How to generate an electronic signature for the Boone County Fiscal Court Po Box 457 Florence Ky 41022 on Android devices

People also ask

-

What is the Boone County return process with airSlate SignNow?

The Boone County return process with airSlate SignNow allows you to efficiently handle document signing and returns with ease. This platform empowers users to send and eSign documents quickly, ensuring compliance with local regulations. By using airSlate SignNow, you can streamline your Boone County return process and enhance overall productivity.

-

What features does airSlate SignNow offer for Boone County returns?

airSlate SignNow offers a variety of features to support your Boone County return needs, including customizable templates, secure eSigning, and automated workflows. These tools ensure that your documents are processed quickly and accurately, reducing the time spent on each Boone County return. With easy tracking and reminders, your team can stay organized and efficient.

-

How much does airSlate SignNow cost for handling Boone County returns?

airSlate SignNow provides cost-effective pricing plans optimized for handling Boone County returns and more. Depending on your business needs, you can choose from various subscription options that offer additional features at affordable rates. By selecting airSlate SignNow, you will save both time and money while managing your Boone County return process.

-

Is airSlate SignNow secure for Boone County return documents?

Yes, airSlate SignNow prioritizes security for Boone County return documents by using advanced encryption methods. Your data is protected throughout the signing process, ensuring that sensitive information remains confidential. This commitment to security helps to instill confidence when managing your Boone County returns.

-

Can airSlate SignNow integrate with my existing tools for Boone County returns?

Absolutely! airSlate SignNow integrates seamlessly with various applications to enhance your Boone County return processes. Whether you're using CRM software, project management tools, or document storage systems, airSlate SignNow can streamline operations by allowing for easy transfers and efficient data handling.

-

What are the benefits of using airSlate SignNow for Boone County returns?

Using airSlate SignNow for your Boone County returns has numerous benefits, including increased efficiency and improved accuracy. The platform automates much of the signing process, allowing you to focus on more critical tasks. With airSlate SignNow, your team can expedite Boone County returns and enhance customer satisfaction.

-

Is there a trial available for airSlate SignNow to manage Boone County returns?

Yes, airSlate SignNow offers a free trial that allows you to experience its capabilities for managing Boone County returns firsthand. This trial is a great way to explore features and see how the platform can streamline your document signing process. During your trial, you can evaluate its effectiveness in handling Boone County returns without any commitment.

Get more for County Net Profit

- Refer to the instructions for information about each

- Form 39nr part year resident and nonresident

- Form 850instructions sales and use tax return

- 0 00 0 00 0 00 0 00 0 00 0 00 0 00 0 00 0 form

- Collection ampamp compliance notices sc department of revenue form

- Other helpful information ct gov

- Mi 1040es michigan estimated income tax for individuals mi 1040es michigan estimated income tax for individuals form

- Controlling interest transfer taxes part two alston ampamp bird form

Find out other County Net Profit

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online