Form 990 Schedule J

What is the Form 990 Schedule J

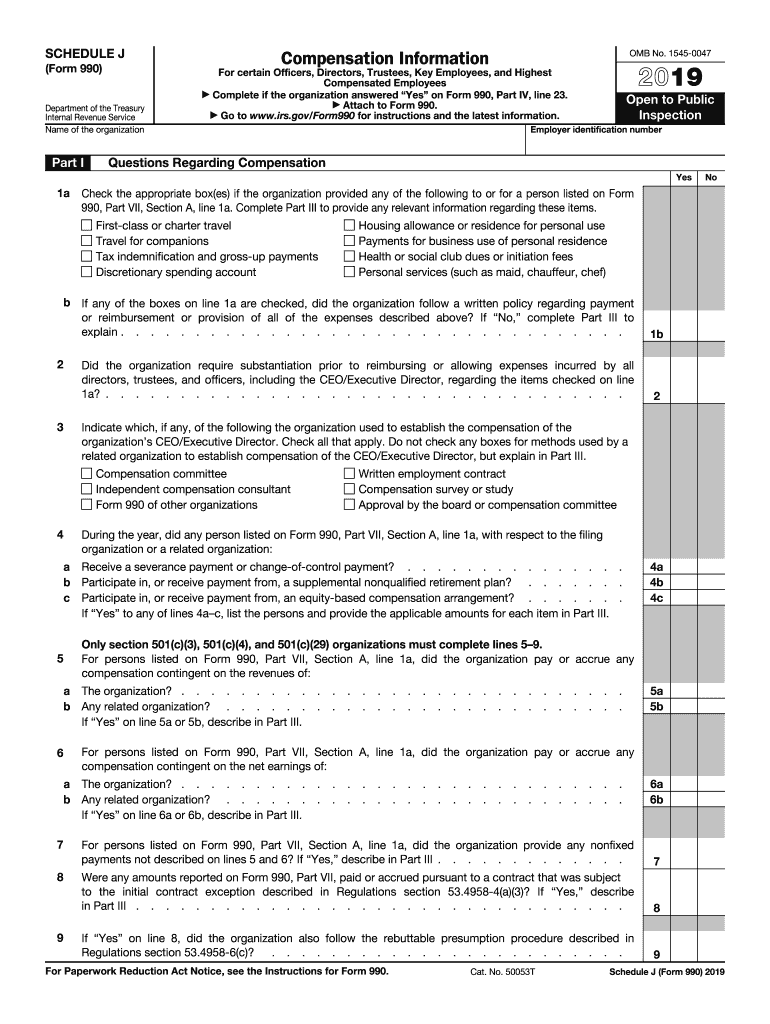

The Form 990 Schedule J is a supplementary document used by tax-exempt organizations to report compensation information for their highest-paid employees, officers, and directors. This form is part of the larger IRS Form 990, which provides the IRS with detailed information about the organization's financial activities. The Schedule J focuses specifically on compensation, detailing the amount paid to key individuals and how this compensation is determined. This transparency helps ensure compliance with IRS regulations and provides insight into the financial practices of nonprofit organizations.

How to use the Form 990 Schedule J

Using the Form 990 Schedule J involves accurately reporting compensation details for each individual listed. Organizations must include the total compensation for the year, including salary, bonuses, and other forms of remuneration. It is essential to follow the IRS guidelines closely, ensuring that all reported figures are accurate and reflect the organization's financial statements. Organizations should also maintain documentation that supports the compensation amounts reported, as this may be required during audits or reviews by the IRS.

Steps to complete the Form 990 Schedule J

Completing the Form 990 Schedule J requires careful attention to detail. Here are the steps to follow:

- Gather necessary information about the individuals whose compensation is being reported, including their names, titles, and total compensation amounts.

- Review the organization’s financial statements to ensure accuracy in the reported compensation figures.

- Fill out the form, ensuring that each section is completed according to IRS instructions.

- Double-check all entries for accuracy and completeness before submission.

- Retain copies of the completed form and any supporting documentation for your records.

Key elements of the Form 990 Schedule J

Several key elements must be included when filling out the Form 990 Schedule J:

- Compensation Details: Total compensation for each individual, including salary, bonuses, and other benefits.

- Position Titles: Accurate titles for each individual to clarify their role within the organization.

- Method of Compensation Determination: Explanation of how the compensation was determined, such as through a compensation committee or market analysis.

- Reporting Period: The specific tax year for which the compensation is being reported.

Legal use of the Form 990 Schedule J

The Form 990 Schedule J is legally required for tax-exempt organizations that meet certain criteria, including those with significant compensation paid to key employees. Accurate completion and submission of this form help organizations comply with IRS regulations and avoid potential penalties. It is crucial that organizations maintain transparency in their compensation practices, as failure to do so can lead to scrutiny from the IRS and damage to their reputation.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines for the Form 990 Schedule J, which typically align with the overall deadline for Form 990. Generally, the form is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. If an organization operates on a calendar year, the deadline would be May fifteenth of the following year. Extensions may be available, but organizations should ensure they file within the required timeframe to avoid penalties.

Quick guide on how to complete 2019 schedule j form 990 internal revenue service

Effortlessly prepare Form 990 Schedule J on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Manage Form 990 Schedule J on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and eSign Form 990 Schedule J with ease

- Find Form 990 Schedule J and select Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 990 Schedule J and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 schedule j form 990 internal revenue service

How to create an electronic signature for the 2019 Schedule J Form 990 Internal Revenue Service online

How to create an eSignature for the 2019 Schedule J Form 990 Internal Revenue Service in Chrome

How to generate an eSignature for putting it on the 2019 Schedule J Form 990 Internal Revenue Service in Gmail

How to make an electronic signature for the 2019 Schedule J Form 990 Internal Revenue Service from your mobile device

How to create an eSignature for the 2019 Schedule J Form 990 Internal Revenue Service on iOS

How to make an eSignature for the 2019 Schedule J Form 990 Internal Revenue Service on Android

People also ask

-

What is the 2019 Schedule J form?

The 2019 Schedule J form is used to report income and expenses related to farming and fishing activities. It helps taxpayers calculate their net earnings from these activities, providing essential information for their overall tax return. Understanding this form is crucial for accurate reporting and compliance.

-

How can airSlate SignNow help with the 2019 Schedule J form?

airSlate SignNow offers a seamless way to electronically sign and send the 2019 Schedule J form securely. This digital solution simplifies the handling of tax documents, allowing users to access and manage their forms efficiently. Our platform ensures that you meet deadlines without hassle and maintain compliance.

-

What features does airSlate SignNow offer for managing the 2019 Schedule J form?

With airSlate SignNow, you can easily create, edit, and send the 2019 Schedule J form. Key features include customizable templates, secure eSignatures, and tracking capabilities, enabling you to monitor the status of your documents in real time. This makes managing your tax documents straightforward and efficient.

-

Is there a pricing plan for using airSlate SignNow for the 2019 Schedule J form?

Yes, airSlate SignNow offers competitive pricing plans suitable for varying needs, whether you're an individual or part of a larger organization. Our plans are designed to provide flexibility and value, ensuring you can manage your 2019 Schedule J form and other documents without overspending. Check our website for detailed pricing information.

-

Can I integrate airSlate SignNow with other software for the 2019 Schedule J form?

Absolutely! airSlate SignNow supports numerous integrations with popular software, making it easy to manage your workflow related to the 2019 Schedule J form. Whether using accounting software or cloud storage solutions, our platform ensures you can streamline your processes effectively.

-

How does using airSlate SignNow benefit my business regarding tax documents like the 2019 Schedule J form?

Using airSlate SignNow enhances your business's efficiency by providing a secure, easy-to-use platform for managing tax documents like the 2019 Schedule J form. You can save time, reduce errors, and ensure compliance with our digital solution. This empowers you to focus on what matters most—growing your business.

-

Is airSlate SignNow suitable for individuals filing the 2019 Schedule J form?

Yes, airSlate SignNow is an excellent choice for individuals as well. Our user-friendly interface simplifies the process of signing and sending the 2019 Schedule J form, making it accessible even for those unfamiliar with e-signatures. Individual users can benefit from our cost-effective and efficient signature solutions.

Get more for Form 990 Schedule J

Find out other Form 990 Schedule J

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors