1040x 2018

What is the 1040X?

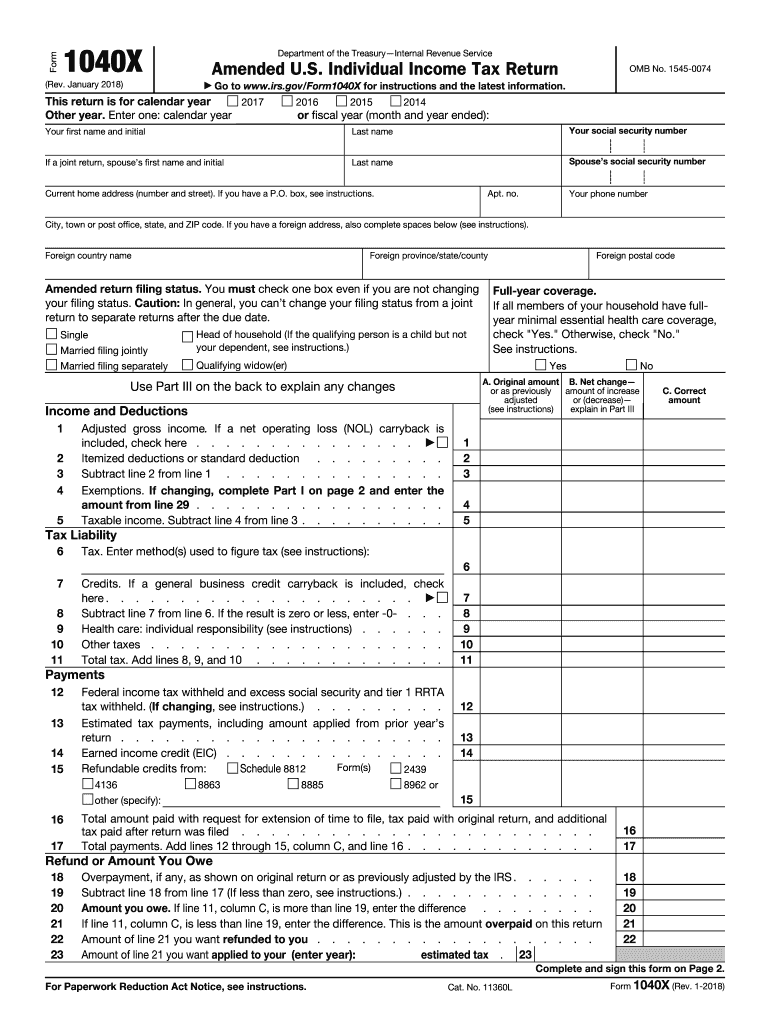

The 1040X form is the official IRS document used to amend a previously filed tax return. Taxpayers utilize this form to correct errors or make changes to their original Form 1040, 1040A, or 1040EZ. Common reasons for filing the 1040X include correcting income, deductions, credits, or filing status. It is important to note that the 1040X can only be used for amending returns for the tax years that are still within the statute of limitations, typically three years from the original filing date.

Steps to Complete the 1040X

Completing the 1040X involves several key steps to ensure accuracy and compliance. First, gather all relevant documents, including your original tax return and any supporting documentation for the changes you are making. Next, fill out the 1040X by providing your personal information, including your name, address, and Social Security number. Then, clearly indicate the changes you are making in the appropriate sections, ensuring that you explain each adjustment in detail. Finally, review the form for accuracy, sign it, and submit it to the IRS.

How to Obtain the 1040X

The 1040X form can be obtained directly from the IRS website, where it is available for download. Additionally, taxpayers can request a paper copy by calling the IRS or visiting a local IRS office. Many tax preparation software programs also include the 1040X form, making it easier to complete the amendment digitally. Ensure that you are using the correct version of the form for the tax year you are amending, such as the 2017 Form 1040X for amendments related to that year.

IRS Guidelines

The IRS provides specific guidelines for filing the 1040X, which include instructions on how to properly complete the form, what to include with your submission, and the timeline for processing. It is essential to follow these guidelines closely to avoid delays or complications. For example, if you are amending a return to claim a refund, the IRS typically processes 1040X forms within eight to twelve weeks. Always check the IRS website for the most current information regarding filing procedures and requirements.

Filing Deadlines / Important Dates

When filing a 1040X, it is crucial to be aware of the deadlines associated with amending your tax return. The general rule is that you must file the 1040X within three years of the original return due date or within two years of the date you paid the tax, whichever is later. For instance, if you are amending a 2017 return, you would need to file the 1040X by the respective deadline in 2020. Keeping track of these dates helps ensure that you do not miss the opportunity to amend your return.

Required Documents

To successfully file a 1040X, certain documents must be included to support your amendments. This typically includes a copy of your original tax return, any new or revised forms that reflect the changes being made, and any additional documentation that substantiates your claims, such as W-2s or 1099s. Providing thorough documentation can facilitate a smoother review process by the IRS and help ensure that your amendments are processed without issues.

Quick guide on how to complete amended return 2018 form

Uncover the easiest method to complete and sign your 1040x

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow offers an improved way to finalize and sign your 1040x and associated forms for public services. Our intelligent eSignature solution provides you with all the tools necessary to work on documents swiftly and in compliance with official requirements - robust PDF editing, management, protection, signing, and sharing features readily available within a user-friendly interface.

Only a few steps are needed to fill out and sign your 1040x:

- Upload the fillable template to the editor using the Get Form button.

- Verify the information you need to enter in your 1040x.

- Move between the fields with the Next button to ensure nothing is missed.

- Utilize Text, Check, and Cross tools to fill in the blanks with your details.

- Enhance the content with Text boxes or Images from the upper toolbar.

- Emphasize the important aspects or Blackout areas that are no longer relevant.

- Tap on Sign to create a legally binding eSignature using any method you prefer.

- Include the Date next to your signature and conclude your work with the Done button.

Store your completed 1040x in the Documents folder in your account, download it, or export it to your chosen cloud storage. Our solution also provides versatile form sharing. There's no need to print your templates when you need to submit them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Experience it today!

Create this form in 5 minutes or less

Find and fill out the correct amended return 2018 form

FAQs

-

For the amended tax return, the only thing I needed to correct was the filing status. Do I still need to fill out the rest of the form involving income, etc.?

Yes, it depends what kind of income. For social security incomes, there is a different threshold amount for single and Married Filing joint. Different filing status have a certain treatment and that tax rates are different for every filing status. The filing status change goes on the very top of the 1040X. When I was a Tax Auditor for the IRS, the 1040X was one of the hardest thing to calculate. Just a few years ago, the IRS decided to change but with disastrous results- people were more confused than the original. So IRS changed the 1040X to its original. Follow your program’s instruction or go to an Enrolled Agent. I found out throughout my career that a good majority of CPA’s do not know the mechanics of the 1040X. Chances are you may need to send the returns by mail.

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How do I fill out the CAT 2018 application form?

The procedure for filling up the CAT Application form is very simple. I’ll try to explain it to you in simple words.I have provided a link below for CAT registration.See, first you have to register, then fill in details in the application form, upload images, pay the registration fee and finally submit the form.Now, to register online, you have to enter details such as your name, date of birth, email id, mobile number and choose your country. You must and must enter your own personal email id and mobile number, as you will receive latest updates on CAT exam through email and SMS only.Submit the registration details, after which an OTP will be sent to the registered email id and mobile number.Once the registration part is over, you will get the Login credentials.Next, you need to fill in your personal details, academic details, work experience details, etc.Upload scanned images of your photograph, and signature as per the specifications.Pay the registration fee, which is Rs. 950 for SC/ST/PWD category candidates and Rs. 1900 for all other categories by online mode (Credit Card/ Debit Card/ Net Banking).Final step - Submit the form and do not forget to take the print out of the application form. if not print out then atleast save it somewhere.CAT 2018 Registration (Started): Date, Fees, CAT 2018 Online Application iimcat.ac.in

-

How can I fill out the income tax return of the year 2016-17 in 2018?

There is no option to file online return but you can prepare an offline return and went to the officer of your jurisdiction income tax commissioner and after his permission you can file the return with his office.

-

What is the official website to fill out the GST return form?

https://www.gst.gov.in/

-

How do I amend an outward supply in GSTR 3B after filling out a return?

This is a major issue with GST return that it can not be revised once you filed the same. There are so many taxpayers who are facing this problem. There is a way to correct this mistake.You can adjust outward supply in upcoming months. For example your outward supply was Rs. 30 K for the month of April’18 and you have mentioned only Rs. 20 K by mistake. There is a difference of Rs. 10 K and this amount can be adjusted in next month Return.You can refer GST Circular No. 26/26/2017 GST for more information in this regard.Hope it helps.

-

I am filling income tax return for AY 2018–19. How do I download ITR-1 form?

You can fill it online ate-Filing Home Page, Income Tax Department, Government of IndiaCreate a user id and file all your returns from here only. No need to do offline

Create this form in 5 minutes!

How to create an eSignature for the amended return 2018 form

How to create an eSignature for your Amended Return 2018 Form in the online mode

How to make an eSignature for your Amended Return 2018 Form in Google Chrome

How to create an eSignature for signing the Amended Return 2018 Form in Gmail

How to generate an electronic signature for the Amended Return 2018 Form from your smartphone

How to create an electronic signature for the Amended Return 2018 Form on iOS devices

How to generate an eSignature for the Amended Return 2018 Form on Android OS

People also ask

-

What is a 1040x form and how can airSlate SignNow help with it?

The 1040x form is an amendment to your federal tax return, allowing you to correct errors or make changes. airSlate SignNow simplifies the process of eSigning and sending your 1040x documents securely, ensuring you can quickly amend your tax filings without hassle.

-

How much does it cost to use airSlate SignNow for filing a 1040x?

airSlate SignNow offers a variety of pricing plans to accommodate your needs, starting at a competitive rate for individual users. Whether you're filing a 1040x or other documents, our cost-effective solutions are designed to save you time and money while ensuring compliance.

-

Can I integrate airSlate SignNow with my tax software for 1040x submissions?

Yes, airSlate SignNow integrates seamlessly with popular tax software, making it easy to submit your 1040x forms directly from your existing applications. This integration enhances workflow efficiency, allowing you to manage your documents all in one place.

-

Is airSlate SignNow secure for submitting sensitive 1040x documents?

Absolutely! airSlate SignNow prioritizes security, utilizing advanced encryption to protect your 1040x documents during transmission and storage. You can trust that your sensitive tax information is safe with us.

-

What features does airSlate SignNow offer for 1040x eSignatures?

airSlate SignNow provides a user-friendly interface for eSigning your 1040x forms, along with features such as templates, in-person signing, and audit trails. These tools streamline the amendment process, making it easier to manage your tax documents.

-

How long does it take to process a 1040x with airSlate SignNow?

Using airSlate SignNow, you can expect quick processing times for your 1040x documents. With our efficient eSigning and submission features, you can often complete the entire process in just a few minutes, allowing you to amend your tax return swiftly.

-

Can I track the status of my 1040x documents with airSlate SignNow?

Yes, airSlate SignNow offers tracking features that allow you to monitor the status of your 1040x documents in real-time. You'll receive notifications when your documents are viewed, signed, or completed, providing peace of mind throughout the process.

Get more for 1040x

Find out other 1040x

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document