Irs 709 Instructions Form

What is the IRS 709 Instructions

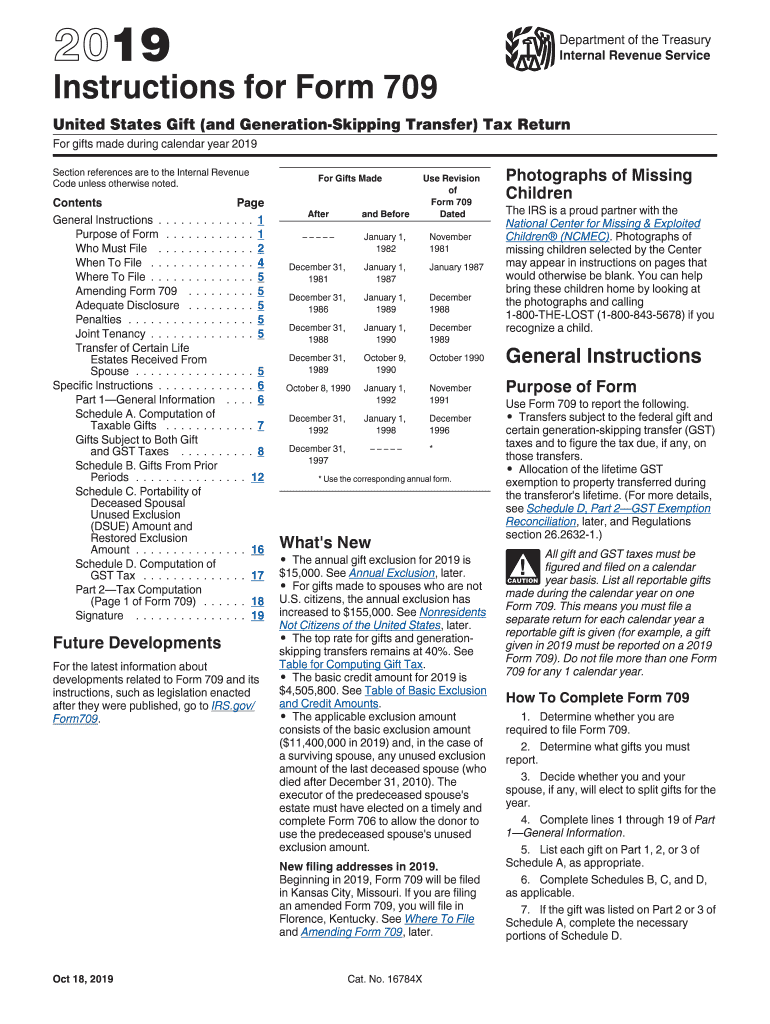

The IRS 709 instructions provide essential guidelines for individuals who are required to file the 2019 Form 709, which is used for reporting gifts and generation-skipping transfers. This form is crucial for taxpayers who exceed the annual exclusion limit for gifts, as it helps determine the amount of gift tax owed. Understanding the instructions ensures compliance with tax regulations and helps avoid potential penalties.

Steps to Complete the IRS 709 Instructions

Completing the IRS 709 form involves several key steps:

- Gather necessary information about the gifts made during the tax year, including recipient details and gift values.

- Determine if any gifts exceed the annual exclusion limit, which is $15,000 for 2019.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the instructions for any specific calculations related to gift tax liabilities.

- Sign and date the form before submission.

Legal Use of the IRS 709 Instructions

The legal use of the IRS 709 instructions is vital for ensuring that all gifts are reported correctly and that the taxpayer remains compliant with federal tax laws. The instructions outline the legal requirements for filing, including the necessity of reporting certain gifts that may not seem significant but could contribute to the overall taxable amount. Adhering to these guidelines can help prevent audits and ensure that the taxpayer fulfills their legal obligations.

Filing Deadlines / Important Dates

For the 2019 IRS 709 form, the filing deadline coincides with the individual income tax return due date, typically April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. It is essential to file on time to avoid penalties and interest on any taxes owed. Taxpayers should also be aware of any extensions that may apply to their specific situation.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers can submit the 2019 Form 709 through various methods. The form can be filed electronically using approved tax software that supports e-filing. Alternatively, individuals may choose to print the completed form and mail it to the appropriate IRS address. In-person submissions are generally not available for this form, so taxpayers should ensure they follow the correct procedures for electronic or mail submission.

Required Documents

When completing the 2019 Form 709, several documents may be required to support the information provided. These documents include:

- Records of all gifts made during the year, including appraisals for non-cash gifts.

- Documentation of any prior gift tax returns filed, if applicable.

- Identification details of recipients, including Social Security numbers for certain gifts.

Quick guide on how to complete 2019 instructions for form 709 instructions for form 709 united states gift and generation skipping transfer tax return

Complete Irs 709 Instructions effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without any holdups. Handle Irs 709 Instructions on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related procedure today.

How to modify and eSign Irs 709 Instructions with ease

- Obtain Irs 709 Instructions and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize crucial sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you would like to share your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate the hassles of lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign Irs 709 Instructions and ensure seamless communication at any phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 instructions for form 709 instructions for form 709 united states gift and generation skipping transfer tax return

How to create an electronic signature for the 2019 Instructions For Form 709 Instructions For Form 709 United States Gift And Generation Skipping Transfer Tax Return online

How to generate an electronic signature for the 2019 Instructions For Form 709 Instructions For Form 709 United States Gift And Generation Skipping Transfer Tax Return in Google Chrome

How to generate an eSignature for signing the 2019 Instructions For Form 709 Instructions For Form 709 United States Gift And Generation Skipping Transfer Tax Return in Gmail

How to create an eSignature for the 2019 Instructions For Form 709 Instructions For Form 709 United States Gift And Generation Skipping Transfer Tax Return from your smart phone

How to create an eSignature for the 2019 Instructions For Form 709 Instructions For Form 709 United States Gift And Generation Skipping Transfer Tax Return on iOS devices

How to generate an electronic signature for the 2019 Instructions For Form 709 Instructions For Form 709 United States Gift And Generation Skipping Transfer Tax Return on Android OS

People also ask

-

What are the key features of airSlate SignNow related to the 2019 709 instructions?

airSlate SignNow offers a range of features that simplify the process of managing the 2019 709 instructions. Users can easily eSign, send, and store their documents securely, ensuring compliance with the latest regulations. The intuitive interface makes it easy for anyone to navigate and utilize the functionality needed for the 2019 709 instructions.

-

How can airSlate SignNow assist in completing the 2019 709 instructions?

With airSlate SignNow, users can streamline the completion of the 2019 709 instructions by using templates and automated workflows. This ensures that all necessary fields are filled out correctly and efficiently. You’ll save time and reduce the risk of errors when preparing your 2019 709 instructions.

-

What is the pricing structure for airSlate SignNow when dealing with the 2019 709 instructions?

airSlate SignNow offers competitive pricing plans suitable for businesses of all sizes that need assistance with the 2019 709 instructions. Pricing is based on the number of users and the features needed. By choosing the right plan, organizations can enjoy cost-effective solutions for managing their documentation requirements.

-

Are there any integrations available with airSlate SignNow for the 2019 709 instructions?

Yes, airSlate SignNow integrates with various business applications to enhance the efficiency of managing the 2019 709 instructions. You can connect it with popular tools such as Google Workspace, Salesforce, and more. These integrations allow for seamless data transfer and better productivity when handling the 2019 709 instructions.

-

What security measures does airSlate SignNow implement for the 2019 709 instructions?

Security is a priority at airSlate SignNow, especially for sensitive documents like the 2019 709 instructions. The platform employs advanced encryption protocols and compliance with international security standards. This ensures that all transactions and documents related to the 2019 709 instructions are protected from unauthorized access.

-

How does airSlate SignNow enhance the collaboration process for the 2019 709 instructions?

airSlate SignNow enables effective collaboration among team members working on the 2019 709 instructions. Multiple users can comment, track changes, and sign documents in real-time, which enhances productivity and communication. This collaborative approach ensures that all team members are aligned when completing the 2019 709 instructions.

-

Can I use airSlate SignNow to submit my 2019 709 instructions electronically?

Absolutely! airSlate SignNow provides an efficient way to submit your 2019 709 instructions electronically. With its eSignature capabilities, you can complete and submit your documents securely online, reducing the hassle of traditional paper submissions and ensuring timely processing.

Get more for Irs 709 Instructions

- 2017 ohio it 1040 individual income tax return ohio department form

- Pit 110 adjustments to new mexico income real file form

- Irs form 8854 2018

- Schedule k 1 2018 form

- Form 2350 2018

- Nonrefundable individual tax credits available enter total available tax credits form

- It1040ez form 2014

- Top eight tax tips about deducting charitable contributions form

Find out other Irs 709 Instructions

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe