Long Term Care Claims 2023-2026

What is Long Term Care Claims

Long term care claims refer to the requests made by individuals seeking financial assistance for long-term care services. These services may include assistance with daily living activities, such as bathing, dressing, and eating, typically provided in nursing homes, assisted living facilities, or through home health care. Long term care insurance policies are designed to cover these expenses, ensuring that individuals can receive the necessary care without incurring overwhelming costs.

How to Use Long Term Care Claims

Using long term care claims involves a straightforward process. First, policyholders must review their insurance policy to understand the coverage details and eligibility requirements. Next, they should gather necessary documentation, including medical records and proof of care needs. Once the information is compiled, the claim form can be filled out accurately, ensuring all required sections are completed. Finally, the completed form must be submitted to the insurance company for review and approval.

Steps to Complete Long Term Care Claims

Completing long term care claims involves several key steps:

- Review your insurance policy to understand coverage limits and requirements.

- Collect necessary documentation, such as medical records and care plans.

- Fill out the claim form, ensuring accuracy in all details.

- Submit the completed form along with supporting documents to your insurance provider.

- Follow up with the insurance company to confirm receipt and inquire about the status of your claim.

Required Documents for Long Term Care Claims

When filing long term care claims, specific documents are typically required to support the claim. These may include:

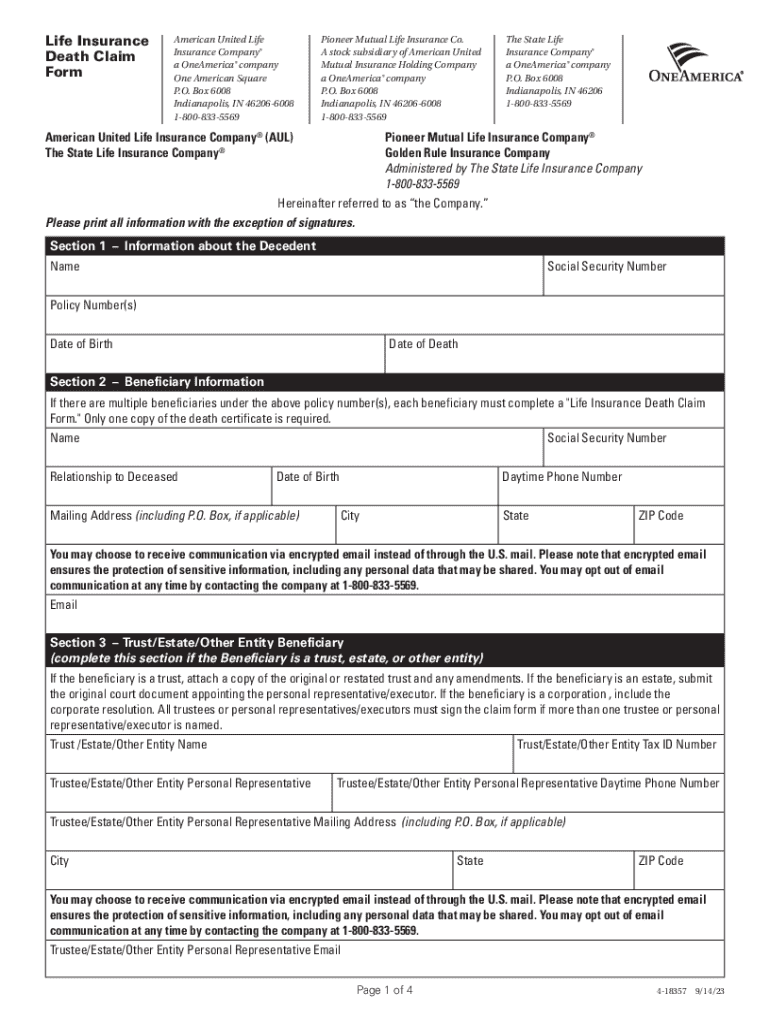

- A completed claim form provided by the insurance company.

- Medical documentation that outlines the need for long term care.

- Proof of the services received, such as invoices or receipts from care providers.

- Personal identification and policy details to verify coverage.

Eligibility Criteria for Long Term Care Claims

Eligibility for long term care claims varies by policy but generally includes criteria such as:

- The policyholder must have a qualifying condition that necessitates long term care.

- Care must be provided by licensed professionals or facilities recognized by the insurance provider.

- The policy must be active and in good standing at the time of the claim.

Legal Use of Long Term Care Claims

Long term care claims must adhere to legal standards set forth by insurance regulations. Policyholders should ensure that claims are filed within the time limits specified in their policy. Additionally, all documentation submitted must be truthful and accurate to avoid potential legal issues, such as claims of fraud. Understanding the legal framework surrounding long term care claims can help individuals navigate the process more effectively.

Quick guide on how to complete long term care claims

Prepare Long term Care Claims effortlessly on any device

Online document handling has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents promptly without interruptions. Manage Long term Care Claims on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Long term Care Claims effortlessly

- Locate Long term Care Claims and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which only takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new file copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Adjust and eSign Long term Care Claims to ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct long term care claims

Create this form in 5 minutes!

How to create an eSignature for the long term care claims

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Long term Care Claims and how can airSlate SignNow help?

Long term Care Claims refer to the processes involved in filing for benefits related to long-term care services. airSlate SignNow streamlines this process by allowing users to easily send and eSign necessary documents, ensuring that claims are processed quickly and efficiently.

-

How does airSlate SignNow ensure the security of Long term Care Claims?

Security is a top priority for airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect sensitive information related to Long term Care Claims, ensuring that your documents are safe from unauthorized access.

-

What features does airSlate SignNow offer for managing Long term Care Claims?

airSlate SignNow offers a variety of features tailored for managing Long term Care Claims, including customizable templates, automated workflows, and real-time tracking of document status. These tools help streamline the claims process and improve overall efficiency.

-

Is there a free trial available for airSlate SignNow to manage Long term Care Claims?

Yes, airSlate SignNow offers a free trial that allows users to explore our platform's capabilities for managing Long term Care Claims. This trial provides access to all features, enabling you to see how our solution can benefit your claims process.

-

What are the pricing options for airSlate SignNow for Long term Care Claims?

airSlate SignNow offers flexible pricing plans to accommodate different business needs when managing Long term Care Claims. Our plans are designed to be cost-effective, ensuring that you can find a solution that fits your budget while still accessing essential features.

-

Can airSlate SignNow integrate with other software for Long term Care Claims?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your ability to manage Long term Care Claims. This integration allows for a more cohesive workflow, connecting your claims process with other essential business tools.

-

What benefits can I expect from using airSlate SignNow for Long term Care Claims?

Using airSlate SignNow for Long term Care Claims provides numerous benefits, including increased efficiency, reduced processing time, and improved accuracy in document handling. Our platform simplifies the claims process, allowing you to focus on providing quality care.

Get more for Long term Care Claims

- Aiou fee installment form

- Pre tenancy application form 382428006

- Bewijs van garantstelling en of particuliere logiesverstrekking pdf form

- Approved supplier list template form

- Dc fr 500 pdf form

- Ct scan consent form

- Application for firearm control card for licensee form

- Always medical history 1 of 1 medical history pati form

Find out other Long term Care Claims

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors