1099 Oid Form Instructions

What is the 1099 Oid Form Instructions

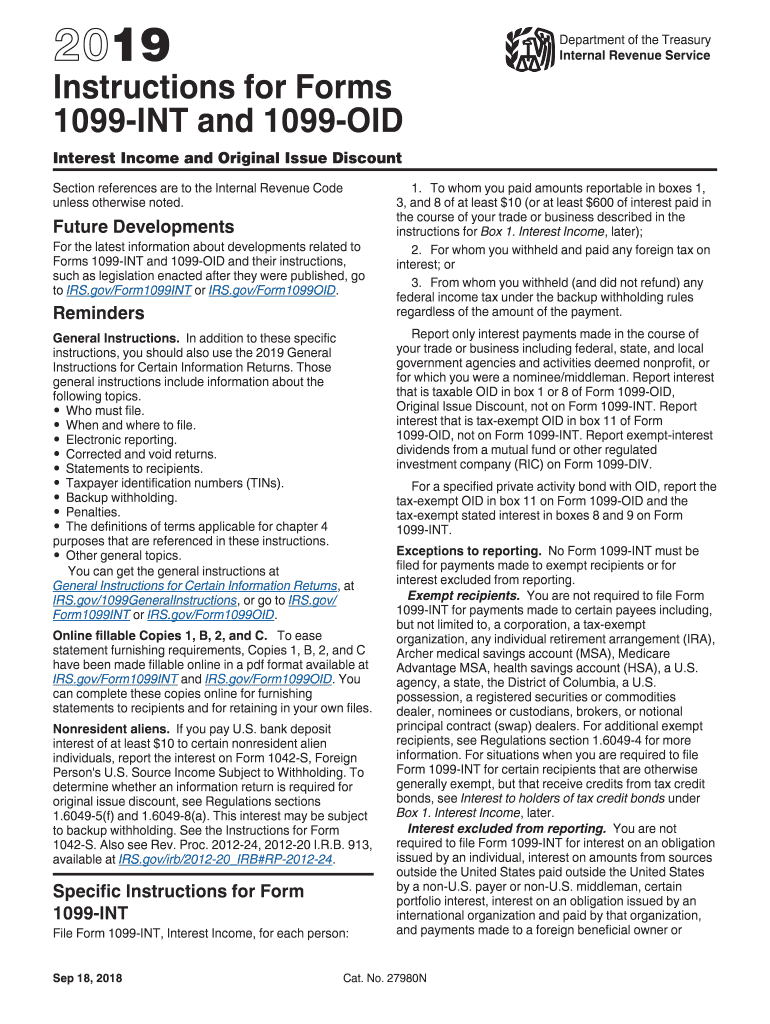

The 1099 OID form is used to report original issue discount (OID) income. This income arises when a bond or other debt instrument is issued at a discount to its face value. The instructions for this form guide taxpayers on how to accurately report OID income to the Internal Revenue Service (IRS). It is essential for individuals and businesses who have received OID income during the tax year to understand the requirements outlined in the 1099 OID instructions to ensure compliance and avoid penalties.

Steps to complete the 1099 Oid Form Instructions

Completing the 1099 OID form involves several key steps. First, gather all relevant financial documents that reflect the OID income received. Next, ensure you have the correct form version for the tax year. Fill out the form by entering the payer's information, the recipient's details, and the amount of OID income. It is crucial to double-check all entries for accuracy. Once completed, the form must be submitted to the IRS and a copy sent to the recipient. Following these steps carefully can help prevent errors and ensure timely filing.

Legal use of the 1099 Oid Form Instructions

The legal use of the 1099 OID form is governed by IRS regulations. Taxpayers must use this form to report OID income accurately, as failure to do so can result in penalties. The instructions outline the legal obligations of both the payer and the recipient regarding the reporting of OID income. Understanding these legal requirements is essential for compliance and for protecting oneself from potential audits or penalties from the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 OID form are critical for compliance. Typically, the form must be submitted to the IRS by the end of January following the tax year in which the OID income was received. Recipients should also receive their copies by this deadline. It is important to stay informed about any changes to these deadlines, as the IRS may adjust them based on specific circumstances or legislative changes.

Required Documents

To complete the 1099 OID form, certain documents are required. Taxpayers should have access to financial statements that detail the OID income, including any relevant bonds or debt instruments. Additionally, personal identification information, such as Social Security numbers or Employer Identification Numbers, is necessary for both the payer and recipient sections of the form. Having these documents ready can simplify the completion process and ensure accuracy.

Who Issues the Form

The 1099 OID form is typically issued by financial institutions or corporations that have paid OID income to a taxpayer. This includes banks, investment firms, and other entities that manage debt instruments. It is the responsibility of these issuers to provide accurate information on the form and to ensure that recipients receive their copies in a timely manner. Understanding who issues the form can help taxpayers know where to expect their 1099 OID forms each tax season.

Quick guide on how to complete 2019 instructions for forms 1099 int and 1099 oid instructions for forms 1099 int and 1099 oid interest income and original

Complete 1099 Oid Form Instructions seamlessly on any device

Digital document management has become increasingly popular among organizations and individuals alike. It offers an excellent eco-friendly option to conventional printed and signed paperwork, allowing you to find the correct template and securely store it online. airSlate SignNow provides all the features you need to create, edit, and electronically sign your documents promptly without delays. Handle 1099 Oid Form Instructions on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The easiest way to edit and electronically sign 1099 Oid Form Instructions effortlessly

- Find 1099 Oid Form Instructions and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive information using features provided specifically for that purpose by airSlate SignNow.

- Create your electronic signature utilizing the Sign tool, which takes mere seconds and carries the same legal force as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Edit and electronically sign 1099 Oid Form Instructions and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 instructions for forms 1099 int and 1099 oid instructions for forms 1099 int and 1099 oid interest income and original

How to make an electronic signature for the 2019 Instructions For Forms 1099 Int And 1099 Oid Instructions For Forms 1099 Int And 1099 Oid Interest Income And Original in the online mode

How to create an eSignature for the 2019 Instructions For Forms 1099 Int And 1099 Oid Instructions For Forms 1099 Int And 1099 Oid Interest Income And Original in Google Chrome

How to make an electronic signature for putting it on the 2019 Instructions For Forms 1099 Int And 1099 Oid Instructions For Forms 1099 Int And 1099 Oid Interest Income And Original in Gmail

How to make an electronic signature for the 2019 Instructions For Forms 1099 Int And 1099 Oid Instructions For Forms 1099 Int And 1099 Oid Interest Income And Original from your mobile device

How to create an eSignature for the 2019 Instructions For Forms 1099 Int And 1099 Oid Instructions For Forms 1099 Int And 1099 Oid Interest Income And Original on iOS

How to create an electronic signature for the 2019 Instructions For Forms 1099 Int And 1099 Oid Instructions For Forms 1099 Int And 1099 Oid Interest Income And Original on Android devices

People also ask

-

What are 1099 OID instructions?

1099 OID instructions detail how to report Original Issue Discount (OID) income on your tax return. They guide taxpayers in understanding what qualifies as OID and how to properly report it, ensuring compliance with IRS regulations. Familiarizing yourself with these instructions can simplify your tax season.

-

How can airSlate SignNow help with filing 1099 OID forms?

AirSlate SignNow offers a straightforward way to send and eSign 1099 OID forms, making the filing process easier and more efficient. With our electronic signature capabilities, you can ensure that your forms are signed quickly and securely. This means you can focus on accuracy in reporting rather than paperwork delays.

-

What features does airSlate SignNow provide for handling 1099 OID document workflows?

AirSlate SignNow includes features like customizable templates for 1099 OID forms, an intuitive interface for easy document management, and secure sharing options. These features streamline the preparation and execution of your 1099 OID documents, minimizing errors and enhancing productivity. Using our platform helps you remain compliant with the IRS guidelines.

-

Is airSlate SignNow a cost-effective solution for managing 1099 OID documents?

Yes, airSlate SignNow is designed to be a cost-effective solution for handling 1099 OID documents and other digital documentation needs. With flexible pricing plans tailored to your business size, you can choose an option that fits your budget while still accessing valuable features. This cost efficiency is crucial for small to medium-sized businesses.

-

Can I integrate airSlate SignNow with accounting software for 1099 OID reporting?

Absolutely! AirSlate SignNow integrates seamlessly with popular accounting software, allowing you to sync your 1099 OID reporting for better accuracy. This integration helps streamline your financial processes and ensures that all your data is up-to-date across platforms. Therefore, managing your documents alongside your accounting becomes much simpler.

-

How secure is airSlate SignNow when handling sensitive 1099 OID information?

AirSlate SignNow prioritizes your security by employing industry-standard encryption and secure access controls for handling sensitive information, including 1099 OID details. We take the protection of your documents seriously, ensuring that all data exchanged is secure and compliant with regulations. Feel confident that your information remains confidential and protected.

-

What are the benefits of using airSlate SignNow for 1099 OID processes?

Using airSlate SignNow for your 1099 OID processes provides numerous benefits including increased efficiency, reduced paperwork, and enhanced compliance. The ability to eSign documents in real-time means you won't have to deal with delays that come with traditional methods. Additionally, our user-friendly interface makes it easy for anyone to navigate and use effectively.

Get more for 1099 Oid Form Instructions

Find out other 1099 Oid Form Instructions

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy