Instructions Form 1098c

What is the cash donation tax form?

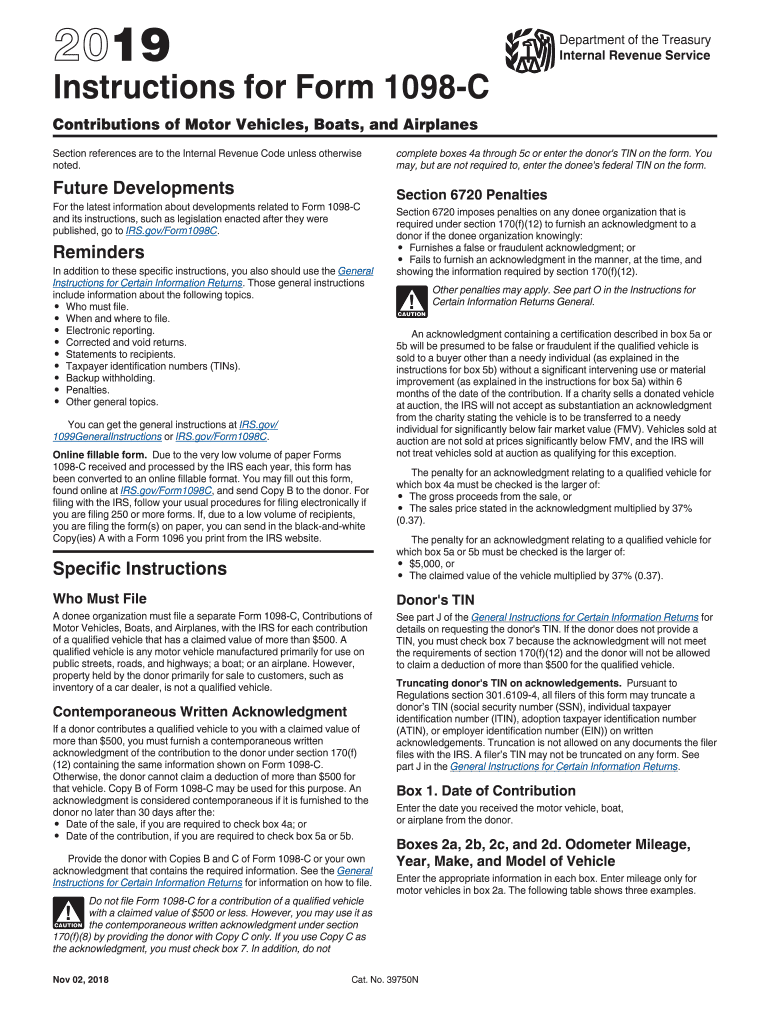

The cash donation tax form is a document used by taxpayers in the United States to report charitable contributions made in cash. This form is essential for individuals who wish to claim tax deductions for their donations. The most common form associated with cash donations is the Form 1098-C, which is specifically designed for reporting contributions of vehicles, boats, and airplanes. However, cash contributions can also be reported using Form 8283 when the total amount exceeds a certain threshold.

Steps to complete the cash donation tax form

Completing the cash donation tax form involves several key steps to ensure accuracy and compliance with IRS regulations. Follow these steps:

- Gather documentation: Collect receipts and records of your cash donations, including the date and amount donated.

- Obtain the correct form: Depending on the nature of your donation, download and print the appropriate form, such as Form 1098-C or Form 8283.

- Fill in your information: Enter your personal details, including your name, address, and Social Security number.

- Detail your contributions: Accurately report the amount of cash donated, along with any relevant details about the charitable organization.

- Sign and date the form: Ensure you sign and date the form before submission.

IRS Guidelines for cash donations

The IRS has specific guidelines regarding cash donations that taxpayers must follow to ensure their contributions are deductible. Key points include:

- Donations must be made to qualified charitable organizations recognized by the IRS.

- Taxpayers must maintain proper documentation, including receipts and bank statements, to substantiate their claims.

- For cash contributions exceeding $250, a written acknowledgment from the charity is required.

Required documents for cash donation tax form

When filing the cash donation tax form, certain documents are essential to support your claims. These include:

- Receipts: Keep all receipts from the charitable organization for donations made.

- Bank statements: Provide bank statements showing the cash withdrawals or payments made to the charity.

- Written acknowledgments: Obtain written acknowledgments from charities for donations over $250.

Filing deadlines for cash donation tax form

Filing deadlines for the cash donation tax form align with the general tax filing deadlines set by the IRS. Typically, individual taxpayers must submit their tax returns by April 15 of each year. If you are claiming cash donations, ensure that all forms and supporting documents are submitted by this deadline to avoid penalties.

Legal use of the cash donation tax form

The legal use of the cash donation tax form is governed by IRS regulations, which stipulate that taxpayers must accurately report their charitable contributions to qualify for deductions. Failing to comply with these regulations can result in penalties, including disallowance of the deduction and potential fines. It is crucial to ensure that all information provided on the form is truthful and substantiated with appropriate documentation.

Quick guide on how to complete 2019 instructions for form 1098 c instructions for form 1098 c contributions of motor vehicles boats and airplanes

Accomplish Instructions Form 1098c effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to obtain the required form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly and without delays. Handle Instructions Form 1098c on any device using airSlate SignNow's Android or iOS applications and simplify your document-based processes today.

How to modify and eSign Instructions Form 1098c effortlessly

- Locate Instructions Form 1098c and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method for sending your form—via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tiresome form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you choose. Adjust and eSign Instructions Form 1098c and ensure clear communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 instructions for form 1098 c instructions for form 1098 c contributions of motor vehicles boats and airplanes

How to make an eSignature for your 2019 Instructions For Form 1098 C Instructions For Form 1098 C Contributions Of Motor Vehicles Boats And Airplanes online

How to create an electronic signature for your 2019 Instructions For Form 1098 C Instructions For Form 1098 C Contributions Of Motor Vehicles Boats And Airplanes in Google Chrome

How to create an eSignature for putting it on the 2019 Instructions For Form 1098 C Instructions For Form 1098 C Contributions Of Motor Vehicles Boats And Airplanes in Gmail

How to make an electronic signature for the 2019 Instructions For Form 1098 C Instructions For Form 1098 C Contributions Of Motor Vehicles Boats And Airplanes straight from your smart phone

How to create an eSignature for the 2019 Instructions For Form 1098 C Instructions For Form 1098 C Contributions Of Motor Vehicles Boats And Airplanes on iOS devices

How to create an electronic signature for the 2019 Instructions For Form 1098 C Instructions For Form 1098 C Contributions Of Motor Vehicles Boats And Airplanes on Android

People also ask

-

What is a cash donation tax form?

A cash donation tax form is a document used to record cash contributions made to a charitable organization. It's crucial for individuals and businesses looking to claim tax deductions on their donations. This form typically requires details about the donation, the charity, and the donor.

-

How can airSlate SignNow help with cash donation tax forms?

airSlate SignNow streamlines the process of completing cash donation tax forms by allowing users to electronically sign and send documents securely. This can save time and reduce errors compared to traditional paperwork. With our platform, managing tax forms for donations is easier and more efficient.

-

Is there a cost associated with using airSlate SignNow for cash donation tax forms?

Yes, there is a subscription fee for using airSlate SignNow, but it offers a cost-effective solution for managing cash donation tax forms. Pricing plans vary based on features and user needs, ensuring you get the best value for your requirements. Our plans are designed to fit businesses of all sizes.

-

Are there any features specifically tailored for cash donation tax forms?

Yes, airSlate SignNow includes features like template creation, reminders, and automated workflows that are beneficial for managing cash donation tax forms. These tools enhance efficiency and ensure that all necessary information is collected. Additionally, you can easily track form statuses to ensure timely submissions.

-

Can I integrate airSlate SignNow with other software for processing cash donation tax forms?

Absolutely! airSlate SignNow integrates seamlessly with various platforms like CRM systems and accounting software, making it easier to process cash donation tax forms. This integration helps streamline your donation management processes, reducing the need for manual data entry and improving accuracy.

-

What benefits does airSlate SignNow provide for handling cash donation tax forms?

Using airSlate SignNow for cash donation tax forms offers numerous benefits, including electronic signatures, secure document storage, and easy retrieval. These features enhance compliance and organization, ensuring you can quickly access forms when needed for tax season. Furthermore, it promotes eco-friendly practices by reducing paper usage.

-

How secure is airSlate SignNow when managing cash donation tax forms?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive information like cash donation tax forms. We use advanced encryption and secure data storage to protect all documents and user information. Compliance with industry standards further enhances the safety of your transaction records.

Get more for Instructions Form 1098c

- Dss se 415a 2013 form

- Sc dhec application form

- Death certificate south carolina pdf form

- Dhec form 2802 fillable

- Affidavit form to obtain title for boat south carolina

- Sled regulatory form

- Class c non emergency in form

- Uncashed benefit payment check or unclaimed electronic benefit payment claim form de 903sd rev 1 2 24

Find out other Instructions Form 1098c

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile