Schedule SE Form 1040 Sp 2022

Understanding the Schedule SE Form 1040

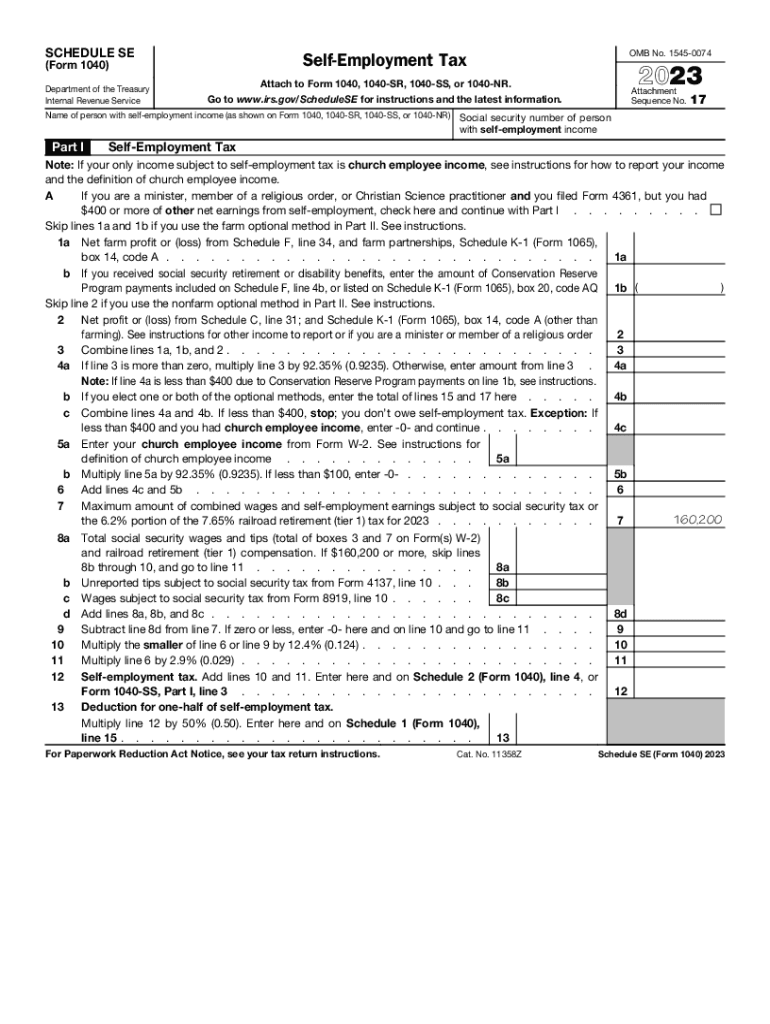

The Schedule SE Form 1040 is a crucial document for self-employed individuals in the United States. It is used to calculate self-employment tax, which consists of Social Security and Medicare taxes for individuals who work for themselves. This form is essential for those who earn income from self-employment, allowing them to report their earnings accurately and fulfill their tax obligations. Understanding the purpose and requirements of this form can help ensure compliance with IRS regulations.

Steps to Complete the Schedule SE Form 1040

Completing the Schedule SE Form 1040 involves several key steps:

- Gather necessary documents: Collect all relevant financial records, including income statements and expense receipts.

- Calculate net earnings: Determine your net earnings from self-employment, which is typically your gross income minus any allowable business expenses.

- Fill out the form: Enter your information in the appropriate sections of the Schedule SE, including your net earnings and any applicable deductions.

- Review calculations: Ensure that all figures are accurate and that you have included all required information.

- Submit with your tax return: Attach the completed Schedule SE to your Form 1040 when filing your annual tax return.

How to Obtain the Schedule SE Form 1040

The Schedule SE Form 1040 can be easily obtained through several channels:

- IRS website: Download the form directly from the IRS website, where it is available in PDF format.

- Tax preparation software: Many tax software programs include the Schedule SE as part of their package, allowing for easy completion and filing.

- Local IRS office: Visit a local IRS office to request a physical copy of the form.

IRS Guidelines for the Schedule SE Form 1040

The IRS provides specific guidelines for completing the Schedule SE Form 1040. These guidelines outline eligibility criteria, filing requirements, and important deadlines. It is essential to adhere to these guidelines to avoid penalties and ensure accurate reporting of self-employment income. The IRS also offers resources and publications that provide additional information on self-employment tax obligations.

Key Elements of the Schedule SE Form 1040

Several key elements are included in the Schedule SE Form 1040:

- Part I: This section is used to calculate the self-employment tax based on net earnings.

- Part II: This part allows for the calculation of the optional method for self-employment tax for those who qualify.

- Net earnings: Accurate reporting of net earnings is critical for determining the correct amount of self-employment tax owed.

Filing Deadlines for the Schedule SE Form 1040

Filing deadlines for the Schedule SE Form 1040 align with the annual tax return deadlines. Typically, the deadline for submitting your Form 1040, along with the Schedule SE, is April 15 of each year. If you require additional time, you may file for an extension, but it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties.

Quick guide on how to complete schedule se form 1040 sp

Complete Schedule SE Form 1040 sp effortlessly on any device

Online document management has gained popularity among enterprises and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documentation, as you can easily find the appropriate form and securely keep it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly and without delays. Manage Schedule SE Form 1040 sp on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign Schedule SE Form 1040 sp with ease

- Find Schedule SE Form 1040 sp and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhausting form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Schedule SE Form 1040 sp and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule se form 1040 sp

Create this form in 5 minutes!

How to create an eSignature for the schedule se form 1040 sp

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a schedule se form and how can airSlate SignNow help?

A schedule se form is a tax document used by self-employed individuals to report income and expenses. airSlate SignNow simplifies this process by allowing users to easily fill out, send, and eSign the schedule se form electronically, ensuring a smooth filing experience.

-

What features does airSlate SignNow offer for handling schedule se forms?

airSlate SignNow offers a range of features for managing schedule se forms, such as customizable templates, electronic signatures, and secure document storage. These features facilitate an efficient workflow for self-employed users to complete their forms accurately and quickly.

-

Are there any pricing plans for using airSlate SignNow to schedule se forms?

Yes, airSlate SignNow provides various pricing plans tailored to different business needs. Whether you are a freelancer or a larger organization, you can choose a plan that suits your requirements to efficiently manage your schedule se forms.

-

How secure is my data when using airSlate SignNow for schedule se forms?

airSlate SignNow adheres to strict security protocols to protect your data, including encryption and compliance with major security standards. When you use airSlate SignNow for your schedule se forms, you can rest assured that your sensitive information is safe and secure.

-

Can I integrate airSlate SignNow with other applications for schedule se forms?

Absolutely! airSlate SignNow offers APIs and integrations with various popular applications. This allows you to seamlessly connect your workflow, making it easier to manage schedule se forms alongside other business processes.

-

How does airSlate SignNow improve the efficiency of submitting schedule se forms?

With airSlate SignNow, users can streamline the submission process of schedule se forms by eliminating paper-based tasks. The platform's user-friendly interface and electronic signature capabilities enhance efficiency, allowing for quicker processing and submission.

-

Is airSlate SignNow user-friendly for someone unfamiliar with schedule se forms?

Yes, airSlate SignNow is designed to be intuitive and easy to use, even for individuals unfamiliar with schedule se forms. The platform provides step-by-step guidance and support, ensuring a smooth experience for all users.

Get more for Schedule SE Form 1040 sp

Find out other Schedule SE Form 1040 sp

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement