Idaho State Tax Commission St104 Hm Form

What is the Idaho State Tax Commission St104 Hm

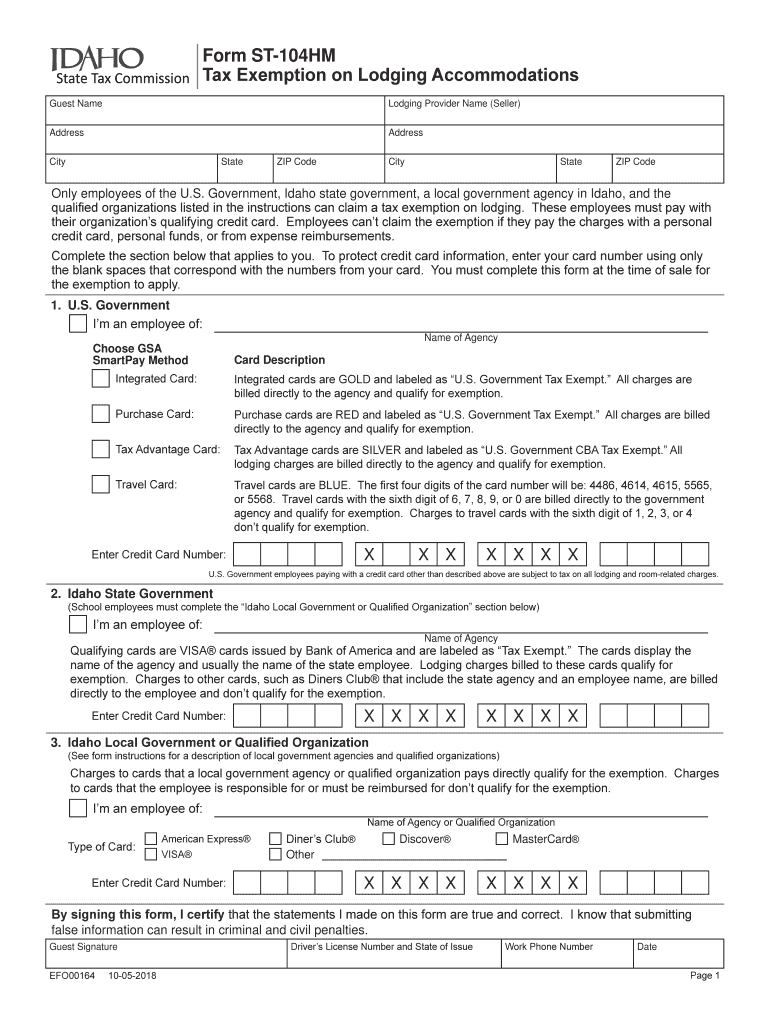

The Idaho State Tax Commission St104 Hm is a tax exemption form used in Idaho to allow certain entities to claim exemption from sales tax. This form is particularly relevant for non-profit organizations, government entities, and other qualifying groups that engage in transactions exempt from sales tax under Idaho law. By completing the St104 Hm, eligible organizations can avoid paying sales tax on purchases related to their exempt activities, which can lead to significant cost savings.

How to use the Idaho State Tax Commission St104 Hm

To use the Idaho State Tax Commission St104 Hm, eligible organizations must first ensure they meet the criteria for tax exemption. Once eligibility is confirmed, organizations can fill out the form by providing necessary information, including the name of the organization, the reason for exemption, and relevant identification details. After completing the form, it should be presented to vendors at the time of purchase to claim the sales tax exemption. It is important to retain a copy of the form for record-keeping purposes.

Steps to complete the Idaho State Tax Commission St104 Hm

Completing the Idaho State Tax Commission St104 Hm involves several key steps:

- Gather necessary information about your organization, including its legal name, address, and tax identification number.

- Clearly state the reason for the exemption, ensuring it aligns with Idaho's sales tax exemption criteria.

- Fill out the form accurately, ensuring all required fields are completed.

- Sign and date the form to validate it.

- Make copies of the completed form for your records and for submission to vendors.

Key elements of the Idaho State Tax Commission St104 Hm

Key elements of the Idaho State Tax Commission St104 Hm include:

- Organization Information: Details about the entity claiming exemption, including name and address.

- Exemption Reason: A clear explanation of why the organization qualifies for tax exemption.

- Signature: The form must be signed by an authorized representative of the organization.

- Date: The date of signing is crucial for record-keeping and compliance.

Eligibility Criteria

Eligibility for using the Idaho State Tax Commission St104 Hm generally includes non-profit organizations, government agencies, and educational institutions. These entities must demonstrate that their purchases are directly related to their exempt purposes. It is essential for organizations to review Idaho's sales tax exemption guidelines to confirm their eligibility before submitting the form.

Form Submission Methods

The Idaho State Tax Commission St104 Hm can be submitted in various ways. Organizations can present the completed form directly to vendors at the point of sale. Additionally, it is advisable to maintain a copy of the form for internal records. While the form itself does not require submission to the state tax commission, keeping it on file is important for compliance and audit purposes.

Quick guide on how to complete form st 104hm sales tax exemption on lodging accommodations

Complete Idaho State Tax Commission St104 Hm with ease on any device

Digital document administration has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely keep it online. airSlate SignNow provides all the tools you require to create, amend, and eSign your documents swiftly without any holdups. Manage Idaho State Tax Commission St104 Hm on any device with the airSlate SignNow applications for Android or iOS and enhance your document-related processes today.

The simplest way to amend and eSign Idaho State Tax Commission St104 Hm effortlessly

- Acquire Idaho State Tax Commission St104 Hm and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Adjust and eSign Idaho State Tax Commission St104 Hm and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form st 104hm sales tax exemption on lodging accommodations

How to make an eSignature for your Form St 104hm Sales Tax Exemption On Lodging Accommodations in the online mode

How to make an eSignature for your Form St 104hm Sales Tax Exemption On Lodging Accommodations in Google Chrome

How to make an eSignature for signing the Form St 104hm Sales Tax Exemption On Lodging Accommodations in Gmail

How to make an electronic signature for the Form St 104hm Sales Tax Exemption On Lodging Accommodations straight from your smartphone

How to make an electronic signature for the Form St 104hm Sales Tax Exemption On Lodging Accommodations on iOS

How to generate an eSignature for the Form St 104hm Sales Tax Exemption On Lodging Accommodations on Android devices

People also ask

-

What is the Idaho sales tax exemption form ST 104?

The Idaho sales tax exemption form ST 104 is a document that allows qualifying organizations and individuals to claim exemptions from sales tax for specific purchases. It is primarily used by non-profit organizations, governmental entities, and certain agricultural producers in Idaho.

-

How can I obtain the Idaho sales tax exemption form ST 104?

You can obtain the Idaho sales tax exemption form ST 104 by visiting the Idaho State Tax Commission's website or by contacting them directly. The form is available for download and can be filled out electronically before submission.

-

Is there a cost associated with filing the Idaho sales tax exemption form ST 104?

There is no cost to file the Idaho sales tax exemption form ST 104 itself; however, you may need to consider any associated costs for maintaining necessary documentation or consultations with tax professionals. Using airSlate SignNow simplifies the process by offering an affordable solution for eSigning and sending your forms.

-

What features does airSlate SignNow offer to assist with the Idaho sales tax exemption form ST 104?

airSlate SignNow provides various features to streamline the process of completing and eSigning the Idaho sales tax exemption form ST 104. Key features include cloud storage, customizable templates, and audit trails, allowing you to easily manage all your documents in one place.

-

Can I use airSlate SignNow for other tax exemption forms in Idaho?

Yes, airSlate SignNow can be used to manage a variety of tax exemption forms in Idaho, including the Idaho sales tax exemption form ST 104. With our user-friendly platform, you can create, eSign, and share all of your tax-related documents efficiently.

-

What are the benefits of using airSlate SignNow for the Idaho sales tax exemption form ST 104?

Utilizing airSlate SignNow for the Idaho sales tax exemption form ST 104 enhances efficiency and convenience. Our platform allows for quick eSigning, reduces paperwork, and provides easy tracking of your submissions, ensuring you never miss an important deadline.

-

Does airSlate SignNow integrate with other business tools for managing the Idaho sales tax exemption form ST 104?

Yes, airSlate SignNow offers seamless integration with various business tools such as CRMs, cloud storage services, and accounting software. This capability makes it easy to manage and file the Idaho sales tax exemption form ST 104 alongside your other business processes.

Get more for Idaho State Tax Commission St104 Hm

- State of utah division of occupational amp professional dopl utah form

- Printable utah state functional ability evaluation medical report form 2010

- Utah dopl alarm licensing form

- Dopl utah form

- Sample notice for election form

- Utah dopl application form

- Mo mo 1041 fill and sign printable template form

- 3k 1 formfill out and use this pdf

Find out other Idaho State Tax Commission St104 Hm

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement