Schedule 1040 Form

What is the Schedule 1040

The Schedule 1040 is a crucial tax form used by U.S. taxpayers to report their annual income and calculate their tax liability. It serves as the foundation for individual income tax returns, allowing taxpayers to detail their earnings, deductions, and credits. The form is designed to accommodate various income sources, including wages, interest, dividends, and capital gains. Understanding the Schedule 1040 is essential for ensuring accurate reporting and compliance with IRS regulations.

How to use the Schedule 1040

Using the Schedule 1040 involves several steps to ensure that all income and deductions are accurately reported. Taxpayers begin by gathering necessary documents, such as W-2s, 1099s, and any records of deductible expenses. After compiling this information, they can fill out the form, starting with personal information and income details. It is important to follow the IRS instructions carefully, as mistakes can lead to delays or penalties. Once completed, the form can be submitted electronically or by mail, depending on the taxpayer's preference.

Steps to complete the Schedule 1040

Completing the Schedule 1040 involves a systematic approach:

- Gather all relevant financial documents, including income statements and receipts for deductions.

- Fill in personal information, such as name, address, and Social Security number.

- Report all sources of income, ensuring accuracy in amounts reported.

- Claim eligible deductions and tax credits, which can reduce overall tax liability.

- Review the completed form for errors or omissions.

- Submit the form electronically through a trusted eSignature solution or by mailing it to the appropriate IRS address.

IRS Guidelines

The IRS provides comprehensive guidelines for completing the Schedule 1040. These guidelines outline eligibility criteria for various deductions and credits, as well as specific instructions for reporting different types of income. Taxpayers should refer to the IRS website or the instructions included with the form for the most current information. Adhering to these guidelines helps ensure compliance and minimizes the risk of audits or penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule 1040 are critical for taxpayers to remember. Typically, the deadline for submitting individual tax returns is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any changes in deadlines due to special circumstances, such as natural disasters or legislative changes. Filing on time is essential to avoid penalties and interest on unpaid taxes.

Required Documents

To complete the Schedule 1040 accurately, taxpayers must gather several required documents:

- W-2 forms from employers, which report wages and withheld taxes.

- 1099 forms for other income sources, such as freelance work or interest earnings.

- Records of deductible expenses, including receipts for medical expenses, charitable contributions, and mortgage interest.

- Any documentation related to tax credits being claimed, such as education expenses.

Eligibility Criteria

Eligibility criteria for using the Schedule 1040 can vary based on individual circumstances. Generally, any U.S. citizen or resident alien who earns income must file a tax return. Specific criteria may apply for claiming deductions or credits, such as age, filing status, and income level. Understanding these criteria is essential for ensuring that taxpayers take full advantage of available tax benefits while remaining compliant with IRS regulations.

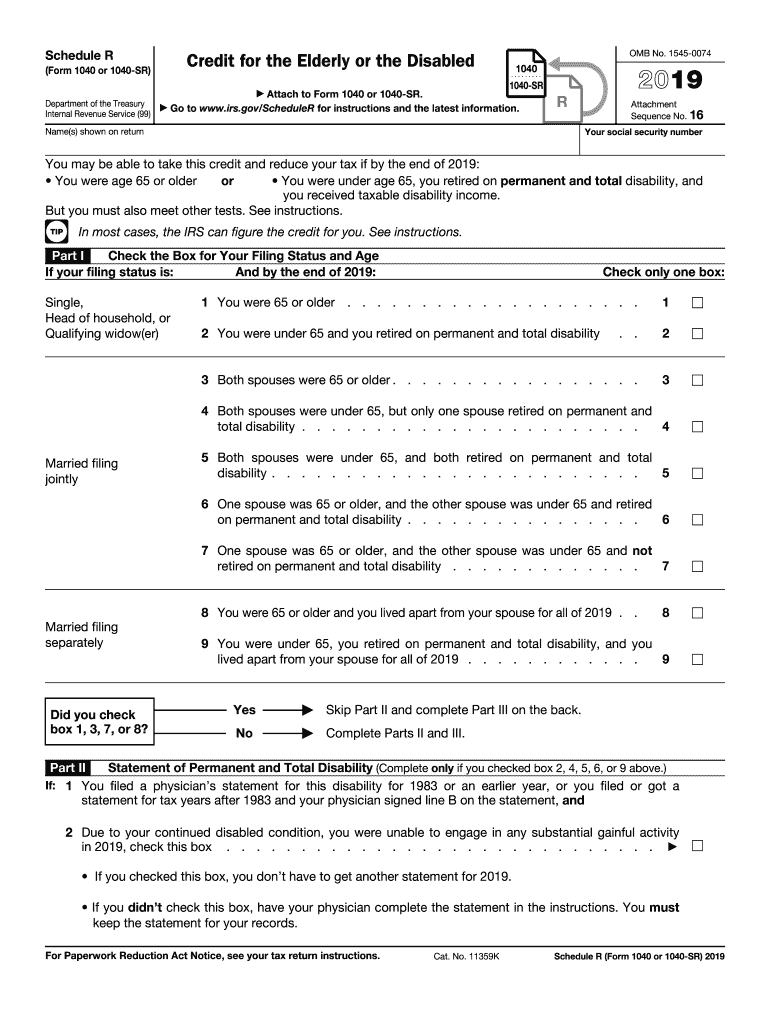

Quick guide on how to complete 2019 schedule r form 1040 or 1040 sr internal revenue

Complete Schedule 1040 effortlessly on any device

Online document management has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Schedule 1040 on any device using airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and electronically sign Schedule 1040 with ease

- Locate Schedule 1040 and click Get Form to begin.

- Use the tools we provide to finalize your document.

- Emphasize key sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate creating new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Alter and electronically sign Schedule 1040 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 schedule r form 1040 or 1040 sr internal revenue

How to create an eSignature for your 2019 Schedule R Form 1040 Or 1040 Sr Internal Revenue in the online mode

How to make an eSignature for the 2019 Schedule R Form 1040 Or 1040 Sr Internal Revenue in Chrome

How to create an eSignature for putting it on the 2019 Schedule R Form 1040 Or 1040 Sr Internal Revenue in Gmail

How to generate an electronic signature for the 2019 Schedule R Form 1040 Or 1040 Sr Internal Revenue from your smart phone

How to generate an eSignature for the 2019 Schedule R Form 1040 Or 1040 Sr Internal Revenue on iOS

How to generate an electronic signature for the 2019 Schedule R Form 1040 Or 1040 Sr Internal Revenue on Android OS

People also ask

-

What documentation is required for the 2019 IRS elderly tax credit?

To claim the 2019 IRS elderly tax credit, you generally need to provide proof of age, income documentation, and any relevant tax forms. It's important to keep these documents organized to ensure a smooth filing process. Using airSlate SignNow can help you easily send and eSign any required documentation securely.

-

How can airSlate SignNow assist with filing for the 2019 IRS elderly tax credit?

airSlate SignNow provides a streamlined process for sending and eSigning necessary tax forms related to the 2019 IRS elderly tax credit. Our solution simplifies document management, allowing you to sign digitally and ensure timely submissions. This can be particularly helpful for seniors or those assisting them with tax matters.

-

What are the key features of airSlate SignNow for seniors applying for the 2019 IRS elderly?

AirSlate SignNow offers user-friendly features tailored for seniors, especially those engaging with the 2019 IRS elderly tax credit. Key features include easy document creation, secure eSigning, and simplified sharing options. These tools help seniors navigate the tax filing process with ease and confidence.

-

Is there a free trial available for airSlate SignNow for seniors interested in the 2019 IRS elderly?

Yes, we offer a free trial of airSlate SignNow, allowing seniors or their caregivers to explore the platform for managing documents related to the 2019 IRS elderly tax credit. This trial provides full access to our features, ensuring you understand how we can assist in your tax filing process without any initial commitment.

-

What pricing plans does airSlate SignNow offer for eSigning services related to the 2019 IRS elderly?

AirSlate SignNow offers several pricing plans to fit different needs when dealing with documents, such as those related to the 2019 IRS elderly. Our plans are designed to be cost-effective, ensuring compliance and enabling easy access to necessary tax documentation. You can choose a plan that suits your budget and usage requirements.

-

Can airSlate SignNow integrate with other software to assist with the 2019 IRS elderly forms?

Absolutely! airSlate SignNow offers integrations with several popular accounting and financial software systems. This capability means you can seamlessly incorporate eSigning into your workflow, making it easier to manage the documentation needed for the 2019 IRS elderly forms.

-

How does airSlate SignNow ensure the security of my documents related to the 2019 IRS elderly?

At airSlate SignNow, we prioritize the security of your documents, especially sensitive ones related to the 2019 IRS elderly. Our platform employs advanced encryption protocols and compliance with industry standards to protect your data. This ensures that your documents are safe while you navigate your tax responsibilities.

Get more for Schedule 1040

- Purpose of the form persi idaho

- Business tax refund application illinois department of tax illinois form

- State of illinois hfs 2378h mail in application for medical benefits form

- Utah health insurance application 2009 form

- Iowa uniform group health application

- Illinois third party administrator license 2009 form

- 2013 il 1363 form

- Tc 20 utah corporation franchise or income tax forms publications

Find out other Schedule 1040

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure