NY TDA Withdrawal & Rollover Printable Template 2024-2026

Understanding the TDA Withdrawal Application

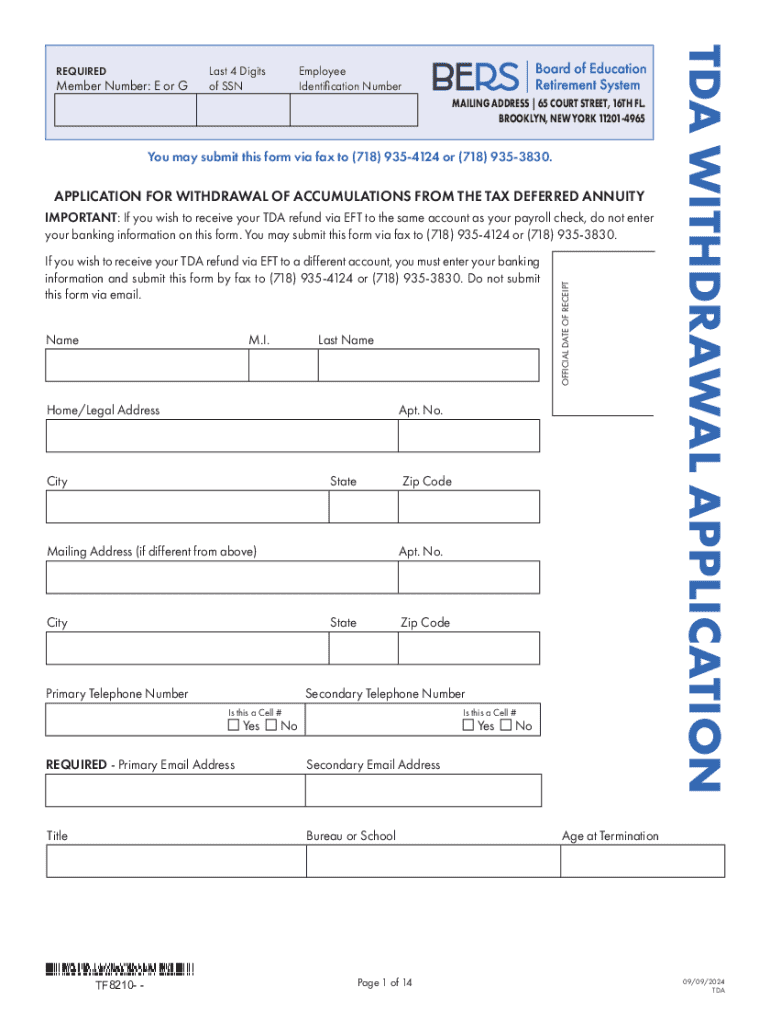

The TDA withdrawal application is a formal request used by individuals to withdraw funds from their Tax-Deferred Annuity (TDA) accounts. This process is essential for those who wish to access their retirement savings before retirement age or for other financial needs. The application typically requires personal information, account details, and the reason for the withdrawal. Understanding the application process is crucial to ensure compliance with regulations and to avoid potential penalties.

Steps to Complete the TDA Withdrawal Form

Completing the TDA withdrawal form involves several key steps:

- Gather Required Information: Collect personal identification, account numbers, and any relevant financial documents.

- Fill Out the Form: Accurately provide all requested information, ensuring clarity and correctness.

- Specify Withdrawal Amount: Indicate the amount you wish to withdraw, keeping in mind any minimum or maximum limits.

- Sign and Date: Ensure the form is signed and dated to validate your request.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in-person.

Eligibility Criteria for TDA Withdrawals

To qualify for a TDA withdrawal, applicants must meet specific eligibility criteria. Generally, these criteria include:

- Age requirements, often related to retirement age.

- Employment status, particularly if the individual is still working in a position that offers TDA benefits.

- Financial need, which may require documentation to support the request.

It is important to check the specific eligibility requirements set forth by the TDA provider, as these can vary.

Required Documents for TDA Withdrawal

When applying for a TDA withdrawal, several documents may be required to support the application. These typically include:

- A completed TDA withdrawal form.

- Proof of identity, such as a government-issued ID.

- Any supporting documentation relevant to the withdrawal reason, like financial statements or medical records.

Ensuring all necessary documents are included can expedite the approval process.

Form Submission Methods for TDA Withdrawal

Applicants have multiple options for submitting their TDA withdrawal forms. Common methods include:

- Online Submission: Many providers offer an online portal for quick and secure submissions.

- Mail: Forms can be printed and sent via postal service to the designated address.

- In-Person: Some individuals may prefer to submit their forms directly at a local office for immediate assistance.

Choosing the most convenient submission method can help streamline the process.

Key Elements of the TDA Withdrawal Process

The TDA withdrawal process involves several critical elements that applicants should be aware of:

- Processing Time: Understanding how long it typically takes for a withdrawal request to be processed can help with financial planning.

- Withdrawal Limits: Familiarizing oneself with any limits on withdrawal amounts is essential to avoid issues.

- Tax Implications: Being aware of the potential tax consequences of withdrawing funds from a TDA account is crucial for financial management.

Awareness of these elements can lead to a smoother withdrawal experience.

Create this form in 5 minutes or less

Find and fill out the correct ny tda withdrawal ampamp rollover printable template

Create this form in 5 minutes!

How to create an eSignature for the ny tda withdrawal ampamp rollover printable template

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a TDA withdrawal?

A TDA withdrawal refers to the process of withdrawing funds from a Tax Deferred Account. This type of withdrawal can have tax implications, so it's important to understand the rules and regulations surrounding it. airSlate SignNow can help streamline the documentation process for TDA withdrawals, making it easier for businesses to manage their financial transactions.

-

How does airSlate SignNow facilitate TDA withdrawals?

airSlate SignNow simplifies TDA withdrawals by providing an intuitive platform for eSigning and sending necessary documents. Users can create, send, and track withdrawal requests quickly, ensuring that all paperwork is completed efficiently. This not only saves time but also reduces the risk of errors in the withdrawal process.

-

Are there any fees associated with TDA withdrawals using airSlate SignNow?

While airSlate SignNow offers a cost-effective solution for document management, specific fees related to TDA withdrawals may depend on your financial institution. It's advisable to check with your bank or financial advisor regarding any potential charges. Using airSlate SignNow can help minimize administrative costs associated with managing these withdrawals.

-

What features does airSlate SignNow offer for managing TDA withdrawals?

airSlate SignNow provides features such as customizable templates, secure eSigning, and real-time tracking for TDA withdrawals. These tools enhance the user experience by ensuring that all documents are compliant and easily accessible. Additionally, the platform allows for seamless collaboration among team members involved in the withdrawal process.

-

Can I integrate airSlate SignNow with other financial tools for TDA withdrawals?

Yes, airSlate SignNow offers integrations with various financial tools and software, making it easier to manage TDA withdrawals alongside your existing systems. This interoperability ensures that all your financial data is synchronized and up-to-date. By integrating with your preferred tools, you can enhance the efficiency of your withdrawal processes.

-

What are the benefits of using airSlate SignNow for TDA withdrawals?

Using airSlate SignNow for TDA withdrawals provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform's user-friendly interface allows for quick document preparation and signing, which can signNowly speed up the withdrawal process. Additionally, the secure storage of documents ensures that sensitive information is protected.

-

Is airSlate SignNow suitable for businesses of all sizes handling TDA withdrawals?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, making it an ideal solution for managing TDA withdrawals. Whether you're a small startup or a large corporation, the platform can scale to meet your needs. Its flexibility and affordability make it accessible for any organization looking to streamline their withdrawal processes.

Get more for NY TDA Withdrawal & Rollover Printable Template

Find out other NY TDA Withdrawal & Rollover Printable Template

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe