Tda Withdrawal 2019

What is the TDA Withdrawal?

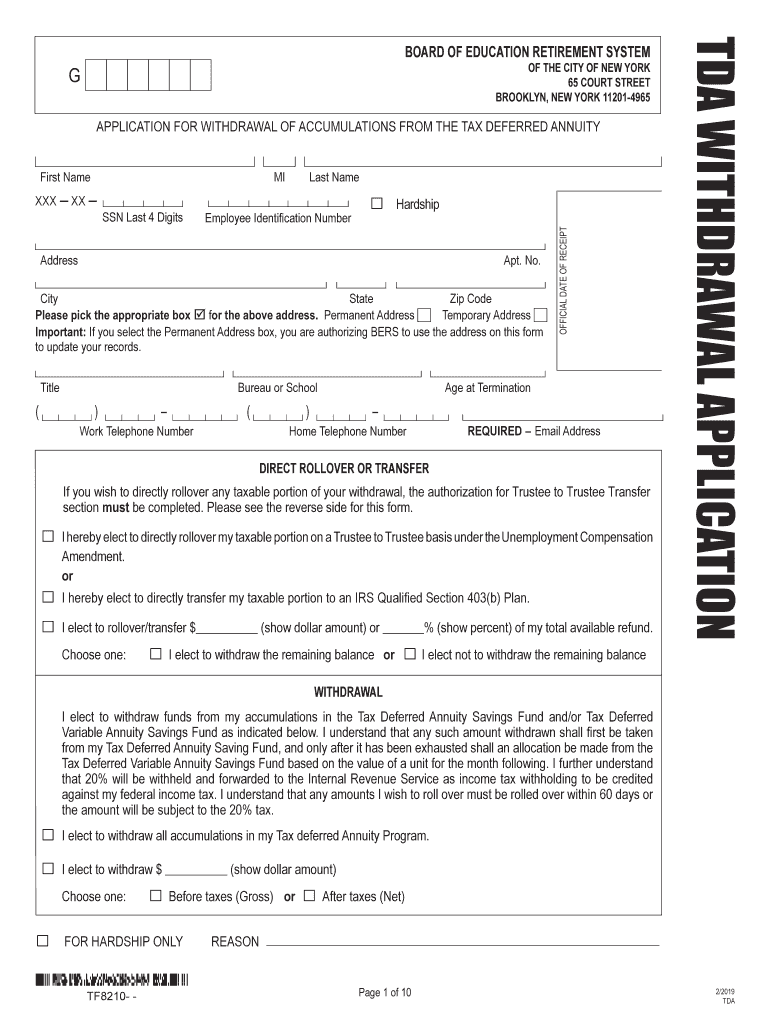

The TDA withdrawal refers to the process of withdrawing funds from the Tax-Deferred Annuity (TDA) plan, which is often utilized by employees of the New York City Teachers' Retirement System (NYC TRS). This type of withdrawal allows participants to access their savings accumulated in the TDA account, typically for retirement or other financial needs. Understanding the specifics of TDA withdrawals is crucial for members to make informed decisions about their finances.

Steps to Complete the TDA Withdrawal

Completing the TDA withdrawal involves several key steps to ensure that the process is smooth and compliant with regulations. Here is a general outline of the steps:

- Gather necessary documentation, including identification and any required forms.

- Complete the TDA withdrawal application, ensuring all information is accurate and complete.

- Submit the application through the appropriate channels, which may include online submission, mailing, or in-person delivery.

- Monitor the status of your withdrawal request and respond to any additional requests for information.

Required Documents

To successfully process a TDA withdrawal, certain documents are typically required. These may include:

- A completed TDA withdrawal application form.

- Proof of identity, such as a government-issued ID.

- Any additional documentation that may be specified by the NYC TRS.

Having these documents ready can expedite the withdrawal process and help avoid delays.

Legal Use of the TDA Withdrawal

The TDA withdrawal must be executed in accordance with the legal guidelines set forth by the NYC TRS and applicable federal regulations. This includes ensuring that the withdrawal is made for legitimate purposes, such as retirement or financial hardship. Compliance with these regulations is essential to avoid penalties and ensure that the withdrawal is recognized as valid by the organization.

Eligibility Criteria

Eligibility for a TDA withdrawal is determined by several factors, including:

- Length of service with the NYC TRS.

- Age of the participant at the time of withdrawal.

- Specific circumstances surrounding the withdrawal request, such as retirement or financial need.

Understanding these criteria can help participants assess their options and determine the appropriate timing for their withdrawal.

Form Submission Methods

There are various methods available for submitting the TDA withdrawal application. Participants can choose from:

- Online submission through the NYC TRS website.

- Mailing the completed form to the designated address.

- In-person submission at a local NYC TRS office.

Each method has its own advantages, and participants should select the one that best fits their needs and circumstances.

Quick guide on how to complete tda withdrawal

Complete Tda Withdrawal effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents rapidly without delays. Handle Tda Withdrawal on any device with airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign Tda Withdrawal with ease

- Obtain Tda Withdrawal and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign feature, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of submitting your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Tda Withdrawal and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tda withdrawal

Create this form in 5 minutes!

How to create an eSignature for the tda withdrawal

The best way to create an electronic signature for your PDF file online

The best way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to generate an eSignature straight from your mobile device

The way to create an electronic signature for a PDF file on iOS

How to generate an eSignature for a PDF document on Android devices

People also ask

-

What are NYC TRS TDA withdrawals?

NYC TRS TDA withdrawals refer to the process of accessing funds accumulated in the Tax Deferred Annuity program for members of the NYC Teachers' Retirement System. These withdrawals can be critical for teachers looking to utilize their retirement savings. Understanding the rules and regulations surrounding these withdrawals is essential for managing your financial future.

-

How can I initiate an NYC TRS TDA withdrawal?

To initiate an NYC TRS TDA withdrawal, you typically need to complete a specific application form provided by the NYC Teachers' Retirement System. It's important to gather any necessary documentation required to verify your eligibility. Utilizing services like airSlate SignNow can streamline the document signing process, making it easier to submit your request.

-

Are there any fees associated with NYC TRS TDA withdrawals?

There may be fees involved in processing NYC TRS TDA withdrawals, depending on your particular situation and the policies of the NYC Teachers' Retirement System. It’s advisable to check directly with the TRS for a detailed understanding of any applicable fees. Ensuring you are aware of these costs can help you plan effectively.

-

What documents do I need for NYC TRS TDA withdrawals?

When applying for NYC TRS TDA withdrawals, you’ll typically need to provide identification, completion of the required forms, and possibly your contribution records. Depending on individual circumstances, additional documentation may be needed. Keeping your records organized can assist in expediting the withdrawal process.

-

How long does it take to process an NYC TRS TDA withdrawal?

The processing time for NYC TRS TDA withdrawals can vary based on the volume of requests and specific individual circumstances. Generally, it may take several weeks for the NYC Teachers' Retirement System to complete the withdrawal process. Planning ahead can help you manage your finances effectively during this waiting period.

-

Can I withdraw from my NYC TRS TDA account if I am still employed?

Yes, teachers can make partial withdrawals from their NYC TRS TDA account while still employed, but there are specific rules to follow. It's important to understand these regulations to ensure you remain compliant with the NYC Teachers' Retirement System. Consulting with an advisor may provide clarity on the best approach.

-

What are the tax implications of NYC TRS TDA withdrawals?

NYC TRS TDA withdrawals could have tax implications, as funds typically become taxable upon withdrawal. Understanding how these implications can affect your overall tax situation is crucial. Consulting a tax professional can help you navigate the complexities of taxes related to NYC TRS TDA withdrawals.

Get more for Tda Withdrawal

Find out other Tda Withdrawal

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template