Form 3809 Targeted Tax Area Deduction and Credit Summary

Overview of Form 3809 Targeted Tax Area Deduction and Credit

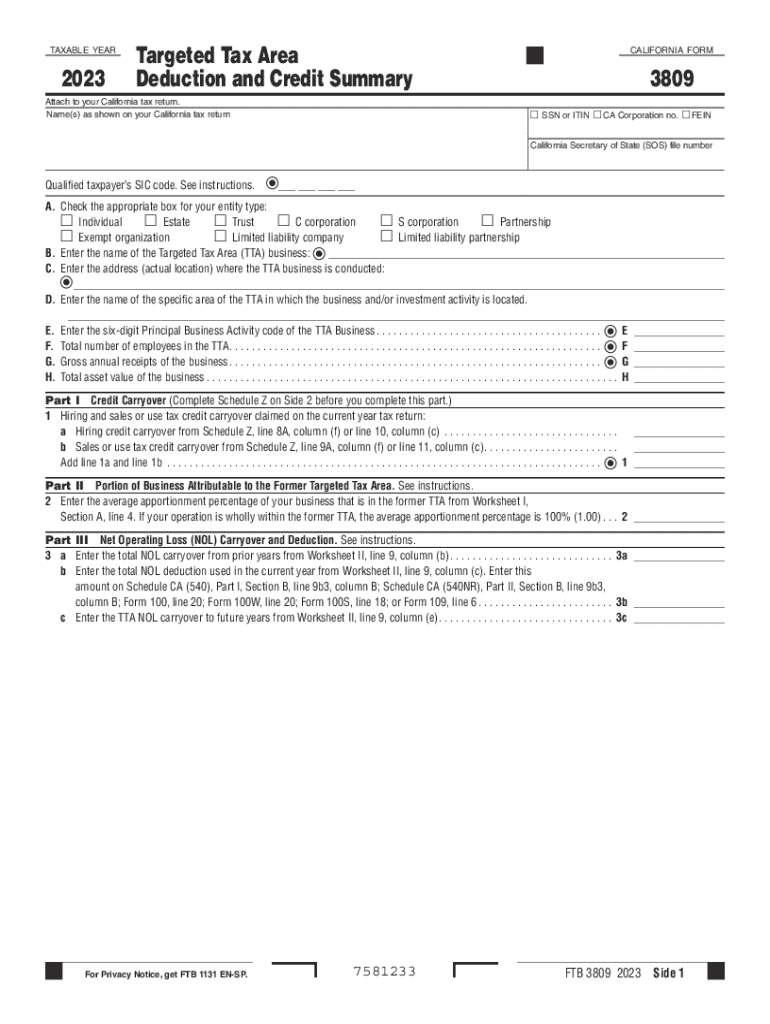

The Form 3809 is a crucial document for taxpayers in California seeking the targeted tax area credit. This form allows eligible businesses to claim deductions and credits for operating in designated economically disadvantaged areas. The targeted tax area credit aims to stimulate economic growth in these regions by providing financial incentives to businesses that contribute to job creation and community development.

Steps to Complete Form 3809

Completing the Form 3809 involves several key steps. First, ensure you have all necessary documentation, including proof of your business location and the number of employees. Next, accurately fill out the form by providing your business information, the targeted area details, and the amount of credit you are claiming. Be sure to review the instructions carefully to avoid common mistakes. Finally, submit the form by the specified deadline to the California Franchise Tax Board for processing.

Eligibility Criteria for the Targeted Tax Area Credit

To qualify for the targeted tax area credit using Form 3809, businesses must meet specific eligibility requirements. These include operating within a designated targeted tax area, maintaining a minimum number of employees, and demonstrating compliance with local and state regulations. Additionally, businesses must not have any outstanding tax liabilities that could disqualify them from receiving the credit.

Legal Use of Form 3809

The legal use of Form 3809 is governed by regulations set forth by the California Franchise Tax Board. Businesses must ensure that they are using the form in accordance with state laws and guidelines. Misuse or fraudulent claims can lead to penalties, including fines and disqualification from future credits. It is essential to keep accurate records and documentation to support your claims when using this form.

Filing Deadlines for Form 3809

Filing deadlines for Form 3809 are critical for taxpayers to observe. Typically, the form must be submitted by the due date of your tax return, which is generally April 15 for most businesses. However, if you file for an extension, ensure that the form is submitted by the extended deadline. Late submissions may result in the forfeiture of the targeted tax area credit.

Examples of Using Form 3809

Examples of using Form 3809 can help clarify its application. For instance, a small manufacturing business located in a targeted tax area that hires ten new employees may claim a credit based on the number of jobs created. Similarly, a retail business expanding its operations in an economically disadvantaged area can utilize the form to receive deductions on their state taxes. These examples illustrate how the targeted tax area credit can benefit businesses while contributing to local economic growth.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3809 targeted tax area deduction and credit summary

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the tax area credit and how does it work?

The tax area credit is a financial incentive designed to reduce tax liabilities for businesses operating in specific regions. By utilizing airSlate SignNow, you can easily manage and eSign documents related to tax area credits, ensuring compliance and maximizing your benefits.

-

How can airSlate SignNow help me with tax area credit documentation?

airSlate SignNow streamlines the process of preparing and signing documents necessary for claiming tax area credits. Our platform allows you to create, send, and eSign forms quickly, ensuring that you meet all deadlines and requirements for tax area credits.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Our plans are designed to provide cost-effective solutions for managing documents related to tax area credits, ensuring you get the best value for your investment.

-

Are there any features specifically for managing tax area credits?

Yes, airSlate SignNow includes features tailored for managing tax area credits, such as customizable templates and automated workflows. These tools help you efficiently handle the documentation process, making it easier to claim your tax area credits.

-

Can I integrate airSlate SignNow with other software for tax area credit management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your ability to manage tax area credits. This integration allows for a smoother workflow, ensuring that all necessary documents are easily accessible and properly managed.

-

What benefits does airSlate SignNow offer for businesses seeking tax area credits?

Using airSlate SignNow can signNowly simplify the process of claiming tax area credits. Our platform not only saves time but also reduces the risk of errors in documentation, helping you maximize your potential savings and benefits.

-

Is airSlate SignNow secure for handling sensitive tax area credit documents?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that all documents related to tax area credits are protected. Our platform uses advanced encryption and security measures to safeguard your sensitive information.

Get more for Form 3809 Targeted Tax Area Deduction And Credit Summary

Find out other Form 3809 Targeted Tax Area Deduction And Credit Summary

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple