RTF 3 State of NJ Division of Taxation Claim for Refund NJ Gov Form

What is the RTF 3 State Of NJ Division Of Taxation Claim For Refund

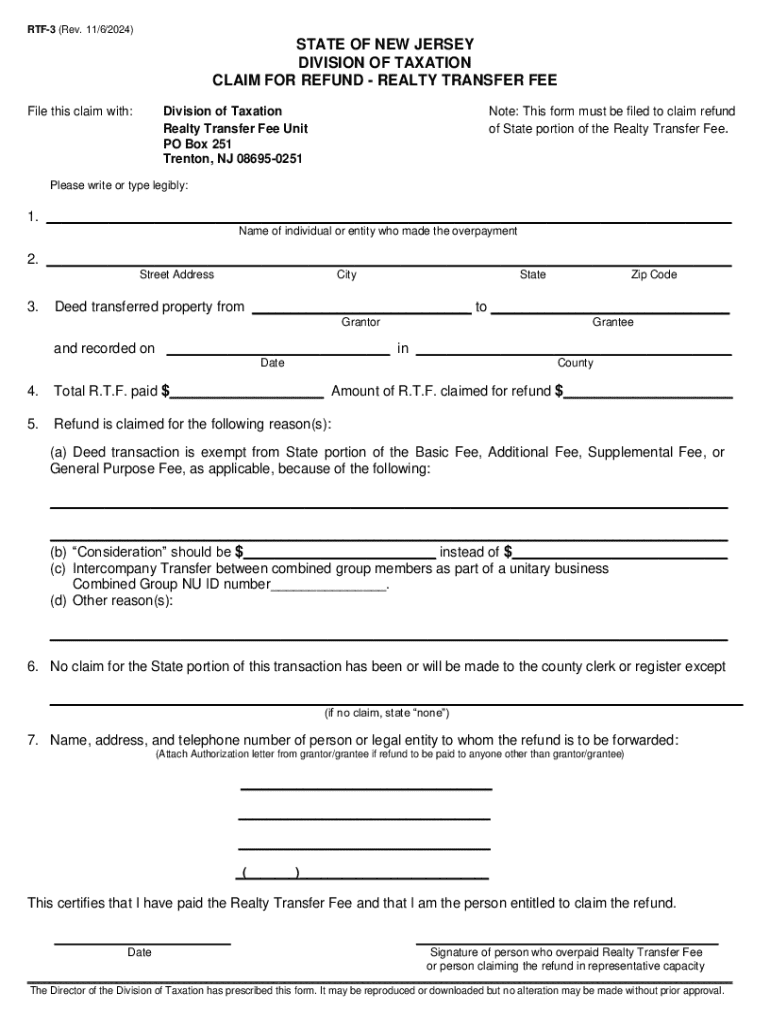

The RTF 3 form is a crucial document issued by the State of New Jersey's Division of Taxation. It is specifically designed for individuals and entities seeking a claim for a refund related to the Realty Transfer Fee. This fee is typically assessed during the transfer of real estate properties within the state. By completing the RTF 3 form, taxpayers can formally request a refund for any overpayment or erroneous charges associated with this fee.

Key Elements of the RTF 3 State Of NJ Division Of Taxation Claim For Refund

Understanding the key elements of the RTF 3 form is essential for successful completion. The form requires detailed information including:

- Property Information: Address, block, and lot number of the property involved.

- Taxpayer Details: Name, address, and identification number of the claimant.

- Claim Amount: The specific amount being claimed for refund.

- Reason for Claim: A clear explanation of why the refund is being requested.

Providing accurate and complete information is vital to avoid delays in processing the claim.

Steps to Complete the RTF 3 State Of NJ Division Of Taxation Claim For Refund

Completing the RTF 3 form involves several important steps:

- Gather all necessary documentation, including proof of payment and any relevant property transfer documents.

- Fill out the RTF 3 form accurately, ensuring all required fields are completed.

- Attach supporting documents that validate your claim, such as receipts or tax statements.

- Review the completed form for accuracy and completeness before submission.

- Submit the form via the designated method, either online or by mail, as per the instructions provided.

Following these steps carefully will help ensure that your claim is processed efficiently.

Eligibility Criteria for the RTF 3 State Of NJ Division Of Taxation Claim For Refund

To be eligible for a refund using the RTF 3 form, certain criteria must be met. Typically, the claimant must have:

- Paid the Realty Transfer Fee on a property transfer.

- Identified an overpayment or error in the fee assessment.

- Submitted the claim within the specified timeframe set by the New Jersey Division of Taxation.

Meeting these eligibility requirements is essential for a successful refund claim.

Form Submission Methods for the RTF 3 State Of NJ Division Of Taxation Claim For Refund

Submitting the RTF 3 form can be done through various methods to accommodate different preferences:

- Online Submission: Many taxpayers prefer to submit their claims electronically through the New Jersey Division of Taxation's online portal.

- Mail Submission: Completed forms can also be mailed to the appropriate address designated by the Division of Taxation.

- In-Person Submission: For those who prefer face-to-face interaction, submitting the form in person at a local tax office is an option.

Choosing the right submission method can help streamline the process and ensure timely handling of your claim.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the rtf 3 state of nj division of taxation claim for refund nj gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is nj taxation rtf 3 and how does it relate to airSlate SignNow?

NJ taxation RTF 3 refers to a specific tax form used in New Jersey for reporting certain tax information. airSlate SignNow simplifies the process of completing and eSigning this form, ensuring compliance and accuracy. With our platform, users can easily manage their NJ taxation RTF 3 documents digitally.

-

How can airSlate SignNow help with NJ taxation RTF 3 document management?

airSlate SignNow provides a user-friendly interface for managing NJ taxation RTF 3 documents. Users can create, edit, and eSign these forms quickly, reducing the time spent on paperwork. Our solution ensures that all documents are securely stored and easily accessible.

-

What are the pricing options for using airSlate SignNow for NJ taxation RTF 3?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those focused on NJ taxation RTF 3. Our plans are designed to be cost-effective, allowing businesses to choose the best option based on their document management requirements. You can start with a free trial to explore our features.

-

Are there any integrations available for NJ taxation RTF 3 with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications that can assist in managing NJ taxation RTF 3 documents. This includes popular accounting and tax software, which helps streamline the workflow. These integrations enhance productivity and ensure that all necessary data is synchronized.

-

What features does airSlate SignNow offer for NJ taxation RTF 3?

airSlate SignNow offers a range of features tailored for NJ taxation RTF 3, including customizable templates, automated workflows, and secure eSigning. These features help users efficiently handle their tax documents while ensuring compliance with New Jersey regulations. Our platform is designed to simplify the entire process.

-

How secure is airSlate SignNow for handling NJ taxation RTF 3 documents?

Security is a top priority at airSlate SignNow, especially for sensitive documents like NJ taxation RTF 3. We utilize advanced encryption and secure storage solutions to protect your data. Additionally, our platform complies with industry standards to ensure that your information remains confidential.

-

Can I access my NJ taxation RTF 3 documents from anywhere using airSlate SignNow?

Absolutely! airSlate SignNow is a cloud-based solution, allowing you to access your NJ taxation RTF 3 documents from anywhere with an internet connection. This flexibility enables you to manage your documents on-the-go, making it easier to stay organized and efficient.

Get more for RTF 3 State Of NJ Division Of Taxation Claim For Refund NJ gov

Find out other RTF 3 State Of NJ Division Of Taxation Claim For Refund NJ gov

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile