Form or 41, Oregon Fiduciary Income Tax Return, 150 101 041 2021

What is the Form OR 41, Oregon Fiduciary Income Tax Return?

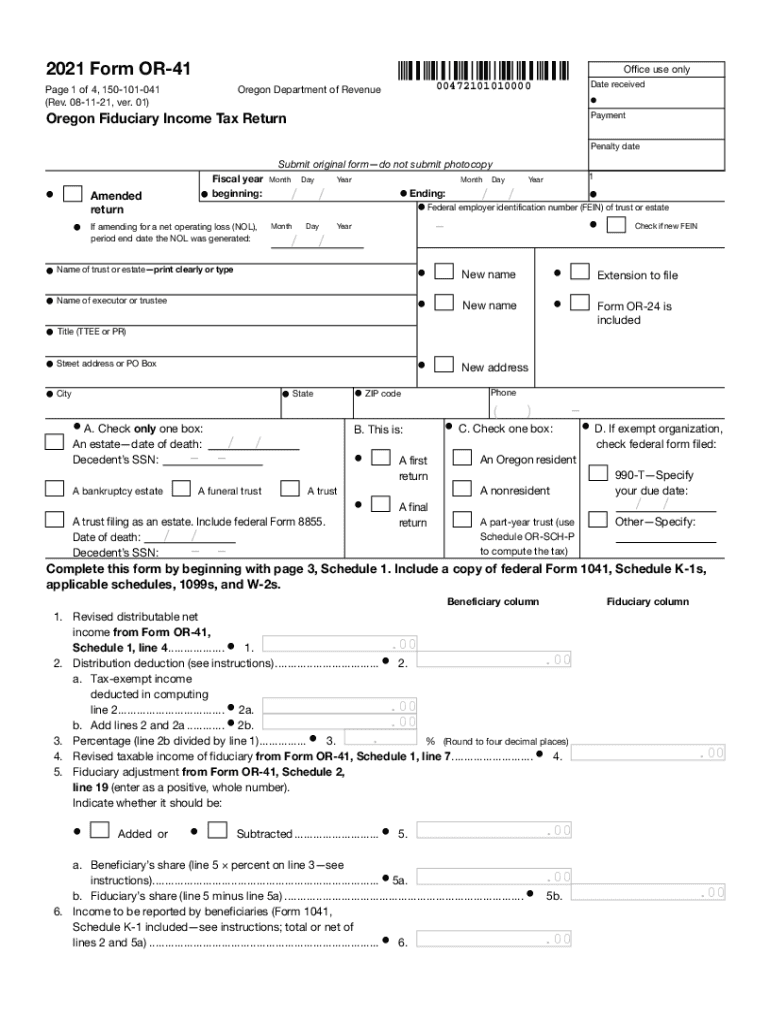

The Form OR 41 is the Oregon Fiduciary Income Tax Return, specifically designed for estates and trusts. This form is essential for reporting the income earned by these entities and ensuring compliance with Oregon state tax regulations. It allows fiduciaries to detail the income, deductions, and credits applicable to the estate or trust, ultimately determining the tax liability. Understanding this form is crucial for proper tax reporting and compliance.

Steps to complete the Form OR 41

Completing the Form OR 41 involves several key steps to ensure accuracy and compliance with state requirements. Begin by gathering all necessary financial information related to the trust or estate, including income statements, deductions, and any applicable credits. Next, follow these steps:

- Enter the identifying information for the fiduciary, including name, address, and taxpayer identification number.

- Report the total income earned by the estate or trust, including interest, dividends, and capital gains.

- Detail any deductions applicable to the estate or trust, such as administrative expenses or distributions to beneficiaries.

- Calculate the tax liability based on the net income after deductions.

- Review the completed form for accuracy and ensure all required signatures are present.

Once completed, the form can be submitted according to the specified filing methods.

Filing Deadlines / Important Dates

Filing deadlines for the Form OR 41 are critical for compliance. Typically, the form is due on the 15th day of the fourth month following the close of the tax year. For estates and trusts operating on a calendar year, this means the deadline is April 15. It is essential to mark this date on your calendar to avoid penalties and interest on late submissions. Additionally, if the due date falls on a weekend or holiday, the deadline may be adjusted accordingly.

How to obtain the Form OR 41

The Form OR 41 can be easily obtained through the Oregon Department of Revenue's official website. It is available for download in a printable format, allowing fiduciaries to complete it manually. Alternatively, many tax preparation software programs offer the capability to fill out and file the form electronically, streamlining the process for users. Ensure that you are using the most current version of the form to comply with the latest tax regulations.

Legal use of the Form OR 41

The legal use of the Form OR 41 is governed by Oregon state tax laws, which dictate how fiduciaries must report income and pay taxes on behalf of estates and trusts. To ensure the form is legally binding, it must be completed accurately and submitted by the specified deadline. Additionally, the fiduciary must retain copies of all supporting documentation for at least three years, as this may be required for audits or inquiries from the Department of Revenue.

Key elements of the Form OR 41

Several key elements must be included in the Form OR 41 to ensure it is complete and compliant. These include:

- Fiduciary's name and identification information.

- Income details, including sources and amounts.

- Applicable deductions and credits.

- Calculation of net income and tax owed.

- Signatures of the fiduciary or authorized representative.

Each of these elements plays a vital role in accurately reporting the financial activities of the estate or trust.

Quick guide on how to complete 2021 form or 41 oregon fiduciary income tax return 150 101 041

Complete Form OR 41, Oregon Fiduciary Income Tax Return, 150 101 041 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, as you can access the necessary forms and securely save them online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents quickly without delays. Handle Form OR 41, Oregon Fiduciary Income Tax Return, 150 101 041 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-driven process today.

How to edit and eSign Form OR 41, Oregon Fiduciary Income Tax Return, 150 101 041 effortlessly

- Locate Form OR 41, Oregon Fiduciary Income Tax Return, 150 101 041 and click Get Form to get started.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form OR 41, Oregon Fiduciary Income Tax Return, 150 101 041 and ensure effective communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 form or 41 oregon fiduciary income tax return 150 101 041

Create this form in 5 minutes!

How to create an eSignature for the 2021 form or 41 oregon fiduciary income tax return 150 101 041

How to create an electronic signature for your PDF online

How to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to create an e-signature straight from your smartphone

How to create an electronic signature for a PDF on iOS

The way to create an e-signature for a PDF document on Android

People also ask

-

What is the 2021 Oregon extension for airSlate SignNow?

The 2021 Oregon extension for airSlate SignNow is designed to simplify the process of sending and eSigning documents for businesses in Oregon. It offers a user-friendly interface and cost-effective solutions tailored to meet the specific needs of Oregon businesses. With this extension, users can ensure compliance with local regulations while enhancing their document management processes.

-

How can I get started with the 2021 Oregon extension?

Getting started with the 2021 Oregon extension is easy! Simply visit the airSlate SignNow website and sign up for an account. Once registered, you can activate the Oregon extension to access specialized features that streamline your document signing needs within the state.

-

What pricing options are available for the 2021 Oregon extension?

airSlate SignNow offers competitive pricing for the 2021 Oregon extension, catering to various business sizes and needs. Plans typically range from basic subscriptions for small businesses to advanced packages for larger enterprises. Pricing specifics can be found on the airSlate SignNow website, ensuring you find an option that suits your budget.

-

What features does the 2021 Oregon extension offer?

The 2021 Oregon extension includes features such as customizable templates, secure eSigning, and real-time tracking of document status. Additionally, it supports multiple file formats and integrates seamlessly with various third-party applications, making it a versatile tool for any business in Oregon looking to optimize its document workflow.

-

Can I integrate the 2021 Oregon extension with other software?

Yes, the 2021 Oregon extension for airSlate SignNow is designed to integrate smoothly with a variety of software applications. Whether you use CRM systems, cloud storage solutions, or productivity tools, you can easily connect your airSlate SignNow account to enhance your document management process. This integration helps streamline operations and improve overall efficiency.

-

What are the benefits of using the 2021 Oregon extension for my business?

The 2021 Oregon extension offers numerous benefits, including increased efficiency in sending and signing documents, reduced paper usage, and enhanced security for sensitive information. By digitizing your document processes, your business can save time and reduce costs, allowing you to focus on more important tasks while ensuring compliance with Oregon's regulations.

-

Is the 2021 Oregon extension secure for sensitive documents?

Absolutely! Security is a top priority for airSlate SignNow, and the 2021 Oregon extension employs advanced encryption methods to safeguard your documents. With features like password protection and secure storage options, you can confidently send and eSign sensitive documents without worrying about unauthorized access.

Get more for Form OR 41, Oregon Fiduciary Income Tax Return, 150 101 041

- Essential documents for the organized traveler package with personal organizer delaware form

- Postnuptial agreements package delaware form

- Letters of recommendation package delaware form

- Delaware mechanics lien form

- De corporation form

- Storage business package delaware form

- Child care services package delaware form

- Special or limited power of attorney for real estate sales transaction by seller delaware form

Find out other Form OR 41, Oregon Fiduciary Income Tax Return, 150 101 041

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement