Form or 41, Oregon Fiduciary Income Tax Return, 150 101 041 2024-2026

What is the Form OR 41, Oregon Fiduciary Income Tax Return

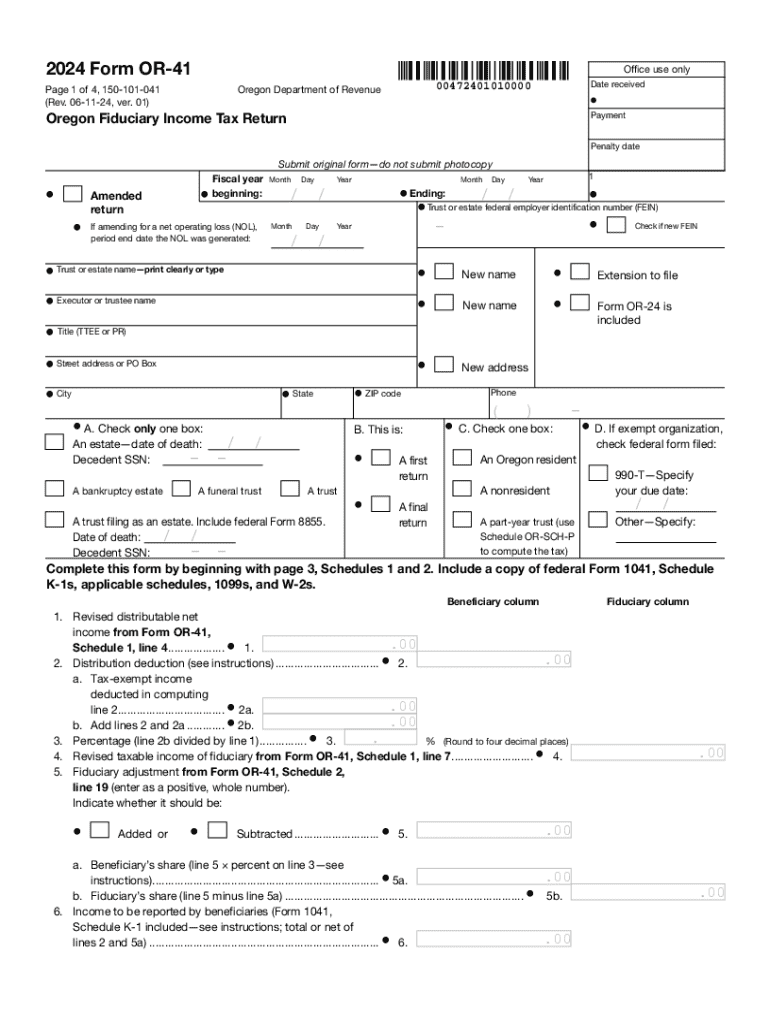

The Form OR 41 is the Oregon Fiduciary Income Tax Return, specifically designed for estates and trusts that generate income. This form allows fiduciaries to report income, deductions, and tax liability on behalf of the estate or trust. It is essential for ensuring compliance with Oregon tax laws and is used to calculate the state tax owed by the fiduciary. The form must be filed annually, reflecting the income earned during the tax year.

How to use the Form OR 41, Oregon Fiduciary Income Tax Return

Using the Form OR 41 involves several key steps. First, gather all necessary financial information related to the estate or trust, including income sources and deductible expenses. Next, complete the form by accurately reporting this information in the designated sections. It is crucial to follow the instructions carefully to ensure that all required fields are filled out correctly. Once completed, the form can be submitted to the Oregon Department of Revenue, either electronically or via mail.

Steps to complete the Form OR 41, Oregon Fiduciary Income Tax Return

Completing the Form OR 41 involves a systematic approach:

- Step 1: Gather all relevant financial documents, including income statements and receipts for deductible expenses.

- Step 2: Fill in the fiduciary information, including the name of the estate or trust and the fiduciary's contact details.

- Step 3: Report all income earned by the estate or trust, ensuring to categorize it correctly.

- Step 4: List any allowable deductions, such as administrative expenses or distributions to beneficiaries.

- Step 5: Calculate the total tax liability based on the reported income and deductions.

- Step 6: Review the completed form for accuracy before submission.

Key elements of the Form OR 41, Oregon Fiduciary Income Tax Return

The Form OR 41 consists of several critical components that must be accurately completed. These include:

- Fiduciary Information: Details about the estate or trust and the fiduciary responsible for filing.

- Income Reporting: Sections dedicated to detailing all income sources, such as dividends, interest, and rental income.

- Deductions: Areas for claiming allowable deductions that can reduce taxable income.

- Tax Calculation: A section for calculating the total tax owed based on the net income after deductions.

Filing Deadlines / Important Dates

It is important to adhere to the filing deadlines associated with the Form OR 41. Typically, the form is due on the fifteenth day of the fourth month following the close of the tax year. For estates and trusts that operate on a calendar year, this means the deadline is April 15. If this date falls on a weekend or holiday, the due date is extended to the next business day. Timely submission helps avoid penalties and interest on unpaid taxes.

Required Documents

When preparing to file the Form OR 41, certain documents are essential. These include:

- Financial Statements: Comprehensive records of income and expenses related to the estate or trust.

- Tax Documents: Any relevant IRS forms, such as the federal Form 1041, that provide additional context for the state filing.

- Receipts: Documentation for all deductible expenses claimed on the form.

Create this form in 5 minutes or less

Find and fill out the correct form or 41 oregon fiduciary income tax return 150 101 041

Create this form in 5 minutes!

How to create an eSignature for the form or 41 oregon fiduciary income tax return 150 101 041

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Oregon Form OR 41 instructions?

The Oregon Form OR 41 instructions provide detailed guidance on how to complete the Oregon tax form for individual income tax returns. These instructions help taxpayers understand the necessary information required, including income reporting and deductions. Following the Oregon Form OR 41 instructions ensures accurate filing and compliance with state tax laws.

-

How can airSlate SignNow assist with Oregon Form OR 41 instructions?

airSlate SignNow simplifies the process of completing and submitting the Oregon Form OR 41 by allowing users to eSign documents securely and efficiently. With its user-friendly interface, you can easily upload your completed form and send it for signatures. This streamlines the filing process, ensuring you meet deadlines with ease.

-

Is there a cost associated with using airSlate SignNow for Oregon Form OR 41 instructions?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. These plans provide access to features that facilitate the completion and signing of documents, including the Oregon Form OR 41 instructions. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for handling Oregon Form OR 41 instructions?

airSlate SignNow offers features such as document templates, eSignature capabilities, and secure cloud storage, all of which are beneficial for managing the Oregon Form OR 41 instructions. These tools help ensure that your documents are completed accurately and stored securely. Additionally, you can track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other software for Oregon Form OR 41 instructions?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow when dealing with the Oregon Form OR 41 instructions. You can connect it with CRM systems, cloud storage services, and other productivity tools. This integration allows for a more streamlined process in managing your documents.

-

What are the benefits of using airSlate SignNow for Oregon Form OR 41 instructions?

Using airSlate SignNow for Oregon Form OR 41 instructions offers numerous benefits, including time savings, increased accuracy, and enhanced security. The platform allows for quick document turnaround and reduces the risk of errors associated with manual processes. Additionally, your sensitive information is protected with advanced security measures.

-

How does airSlate SignNow ensure the security of my Oregon Form OR 41 instructions?

airSlate SignNow prioritizes security by employing encryption and secure access protocols to protect your documents, including the Oregon Form OR 41 instructions. All data is stored in compliance with industry standards, ensuring that your information remains confidential. You can trust that your documents are safe while using our platform.

Get more for Form OR 41, Oregon Fiduciary Income Tax Return, 150 101 041

Find out other Form OR 41, Oregon Fiduciary Income Tax Return, 150 101 041

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT