Form or 41, Oregon Fiduciary Income Tax Return, 150 2020

What is the Oregon 41 Form?

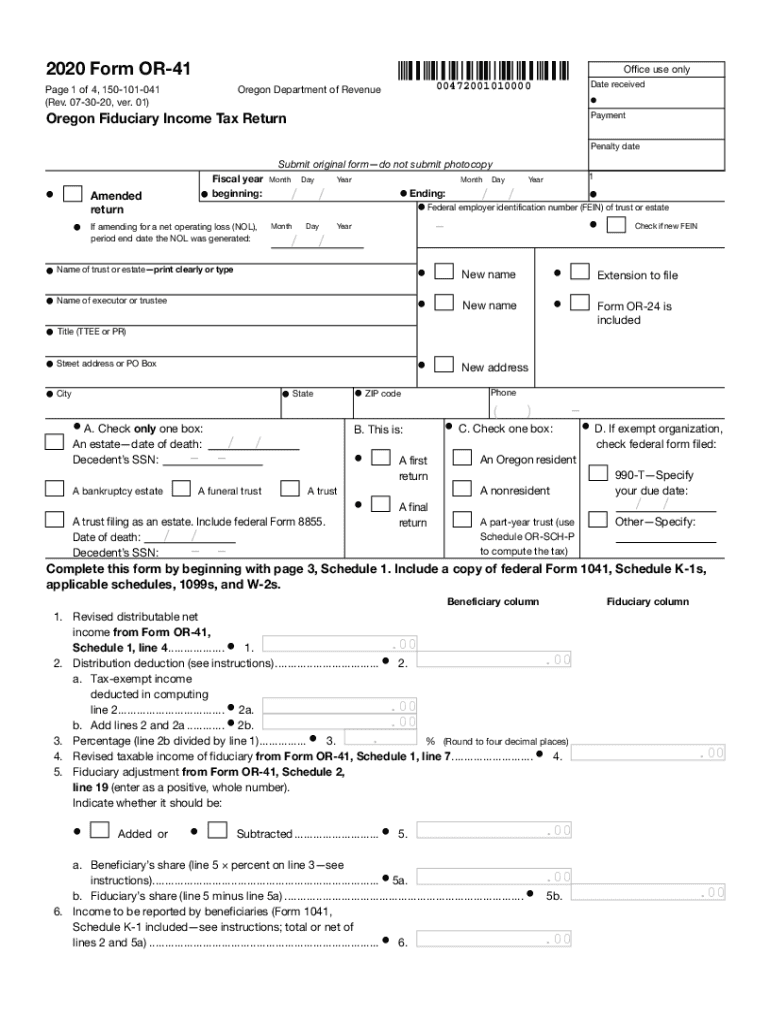

The Oregon 41 form, officially known as the Oregon Fiduciary Income Tax Return, is used by fiduciaries to report income, deductions, and credits on behalf of estates and trusts in the state of Oregon. This form is essential for ensuring that fiduciaries comply with state tax laws while accurately reporting the financial activities of the estate or trust they manage. The form captures various financial details, including income from dividends, interest, and capital gains, as well as allowable deductions related to the administration of the estate or trust.

How to Obtain the Oregon 41 Form

The Oregon 41 form can be easily obtained through the Oregon Department of Revenue's official website. It is available for download in PDF format, allowing users to print and fill it out manually. Additionally, the form may be accessible through various tax preparation software that supports Oregon tax filings. It is important to ensure that you are using the most current version of the form to comply with state regulations.

Steps to Complete the Oregon 41 Form

Completing the Oregon 41 form involves several key steps. First, gather all necessary financial documents related to the estate or trust, including income statements and expense records. Next, fill out the form by entering the required information, such as the fiduciary's name, address, and taxpayer identification number. Be sure to report all sources of income and claim any applicable deductions. After completing the form, review it for accuracy and ensure that all required signatures are included before submission.

Key Elements of the Oregon 41 Form

The Oregon 41 form includes several important sections that must be accurately completed. Key elements include:

- Fiduciary Information: Details about the fiduciary managing the estate or trust.

- Income Reporting: Sections to report various types of income, including dividends and interest.

- Deductions: Areas to claim deductions related to the administration of the estate or trust.

- Tax Calculation: A section for calculating the total tax owed based on reported income and deductions.

Filing Deadlines for the Oregon 41 Form

Filing deadlines for the Oregon 41 form are crucial to avoid penalties. Typically, the form must be filed by the fifteenth day of the fourth month following the close of the tax year for the estate or trust. If the fiduciary requires additional time, they may file for an extension, which allows for a six-month extension to submit the form. However, any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Legal Use of the Oregon 41 Form

The Oregon 41 form is legally binding when completed and submitted according to state regulations. It is essential for fiduciaries to understand that inaccuracies or omissions on the form can lead to legal repercussions, including fines or audits. Properly completing the form ensures that the fiduciary fulfills their legal obligations while providing transparency regarding the financial activities of the estate or trust.

Quick guide on how to complete 2020 form or 41 oregon fiduciary income tax return 150

Effortlessly Prepare Form OR 41, Oregon Fiduciary Income Tax Return, 150 on Any Device

Managing documents online has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed materials, allowing you to securely access and store the necessary forms digitally. airSlate SignNow equips you with all the essential tools to create, edit, and eSign your documents quickly and without delays. Manage Form OR 41, Oregon Fiduciary Income Tax Return, 150 on any device using the airSlate SignNow applications for Android or iOS and simplify your document-based tasks today.

How to Edit and eSign Form OR 41, Oregon Fiduciary Income Tax Return, 150 with Ease

- Locate Form OR 41, Oregon Fiduciary Income Tax Return, 150 and click Get Form to begin.

- Utilize the tools available to complete your form.

- Mark important sections of your documents or obscure sensitive details with specialized tools provided by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal standing as a traditional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your PC.

Eliminate the hassle of lost or misplaced documents, tiresome form searches, or mistakes that require making new copies. airSlate SignNow meets all your document management needs in just a few clicks from your selected device. Edit and eSign Form OR 41, Oregon Fiduciary Income Tax Return, 150 and promote excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form or 41 oregon fiduciary income tax return 150

Create this form in 5 minutes!

How to create an eSignature for the 2020 form or 41 oregon fiduciary income tax return 150

How to generate an eSignature for your PDF file online

How to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The way to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

The way to make an eSignature for a PDF document on Android devices

People also ask

-

What is the Oregon 41 form and how is it used?

The Oregon 41 form is a state-specific document used for various legal and administrative purposes in Oregon. It often plays a crucial role in tax-related filings and other official transactions. By leveraging airSlate SignNow, users can easily send, receive, and eSign the Oregon 41 form securely and efficiently.

-

How can I electronically sign the Oregon 41 form?

With airSlate SignNow, electronically signing the Oregon 41 form is a simple process. Users can create a signature directly through the platform or upload an existing signature for use. This enhances the efficiency of document workflows and ensures compliance with legal requirements.

-

Is there a cost associated with using the Oregon 41 form through airSlate SignNow?

Yes, there are pricing plans available for airSlate SignNow that cater to different business needs. These plans offer a range of features, including signing of the Oregon 41 form. It's essential to compare the plans to find one that fits your budget and document management requirements.

-

What features does airSlate SignNow offer for managing the Oregon 41 form?

AirSlate SignNow provides several features for managing the Oregon 41 form, including customizable templates, secure storage, and real-time tracking. Users can collaborate easily with team members and ensure that all required signatures are collected efficiently, enhancing the overall document management experience.

-

Can I integrate airSlate SignNow with other applications for processing the Oregon 41 form?

Absolutely! AirSlate SignNow offers seamless integrations with various applications, making it easy to process the Oregon 41 form alongside other tools you may already be using. This integration capability ensures a streamlined workflow and enhances productivity across different platforms.

-

What benefits does using airSlate SignNow for the Oregon 41 form provide?

Using airSlate SignNow for the Oregon 41 form offers numerous benefits, such as increased efficiency, reduced paperwork, and enhanced security. The platform is designed to make document handling hassle-free, allowing businesses to focus on core activities while ensuring compliance and fast processing.

-

How secure is the signing process for the Oregon 41 form with airSlate SignNow?

AirSlate SignNow prioritizes security, employing industry-leading encryption to safeguard your documents, including the Oregon 41 form. The platform complies with various legal standards, ensuring that your eSignatures are valid and that sensitive information is protected throughout the process.

Get more for Form OR 41, Oregon Fiduciary Income Tax Return, 150

- Legal last will and testament form for married person with adult and minor children from prior marriage west virginia

- Legal last will and testament form for married person with adult and minor children west virginia

- Mutual wills package with last wills and testaments for married couple with adult and minor children west virginia form

- Legal last will and testament form for a widow or widower with adult children west virginia

- Legal last will and testament form for widow or widower with minor children west virginia

- Legal last will form for a widow or widower with no children west virginia

- Legal last will and testament form for a widow or widower with adult and minor children west virginia

- Legal last will and testament form for divorced and remarried person with mine yours and ours children west virginia

Find out other Form OR 41, Oregon Fiduciary Income Tax Return, 150

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free

- eSignature Pennsylvania Sales Invoice Template Secure