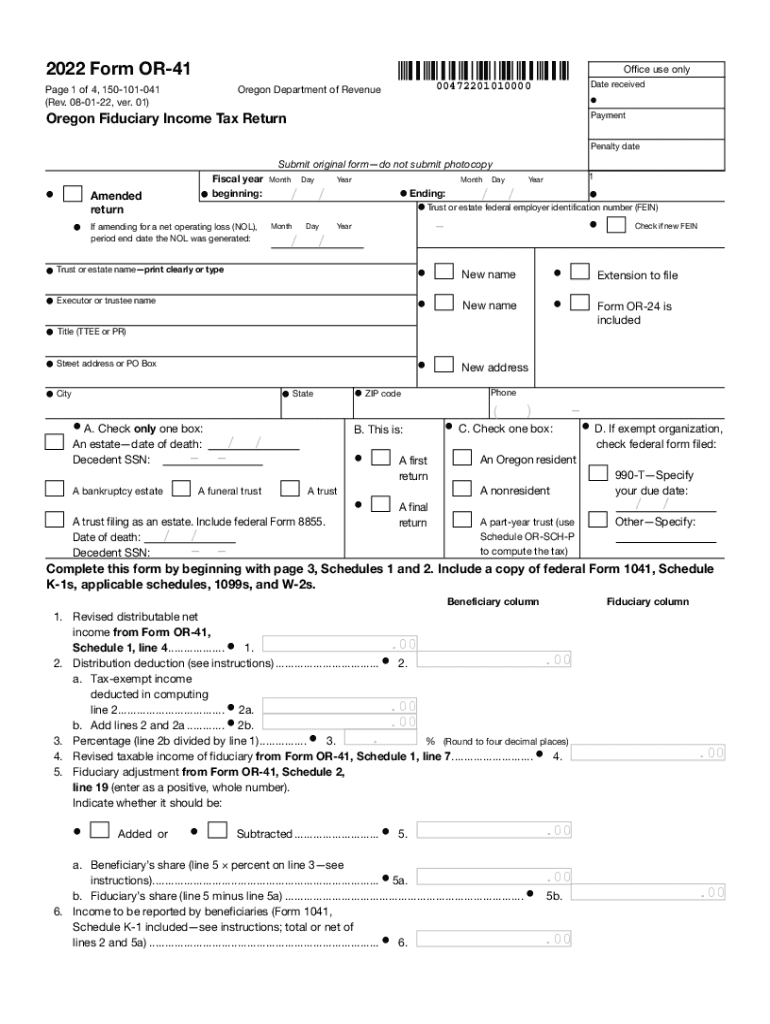

Form or 41, Oregon Fiduciary Income Tax Return, 150 101 041 2022

What is the Oregon Form OR 41?

The Oregon Form OR 41 is the Oregon Fiduciary Income Tax Return, designed for estates and trusts that generate income. This form is essential for fiduciaries to report income, deductions, and tax liabilities associated with the estate or trust. It ensures that the fiduciary complies with state tax laws while providing a clear accounting of the financial activities of the estate or trust during the tax year.

How to use the Oregon Form OR 41

Using the Oregon Form OR 41 involves several steps to ensure accurate reporting of income and deductions. First, gather all necessary financial documents related to the estate or trust, including income statements, receipts for deductions, and prior year tax returns. Next, complete the form by entering the required information, such as the fiduciary's details, income sources, and applicable deductions. Finally, ensure that the form is signed by the fiduciary before submission to the Oregon Department of Revenue.

Steps to complete the Oregon Form OR 41

Completing the Oregon Form OR 41 requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents, including income and deduction records.

- Fill out the fiduciary's information at the top of the form.

- Report all sources of income received by the estate or trust, including interest, dividends, and capital gains.

- List allowable deductions, such as administrative expenses and distributions to beneficiaries.

- Calculate the total income and deductions to determine the taxable amount.

- Sign and date the form, ensuring it is submitted by the deadline.

Key elements of the Oregon Form OR 41

The Oregon Form OR 41 includes several key elements that must be accurately reported. These elements consist of:

- Fiduciary's name and address.

- Details of the estate or trust, including its name and tax identification number.

- Income sources, such as rental income, dividends, and interest.

- Allowable deductions, including administrative expenses and distributions to beneficiaries.

- Tax calculation based on the net income reported.

Filing Deadlines / Important Dates

Filing deadlines for the Oregon Form OR 41 are crucial for compliance. Typically, the form is due on the 15th day of the fourth month following the end of the tax year. For estates and trusts operating on a calendar year, this means the form is generally due by April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is essential to stay informed about any changes in deadlines or requirements that may arise.

Penalties for Non-Compliance

Failure to file the Oregon Form OR 41 on time or accurately can result in significant penalties. The Oregon Department of Revenue may impose fines for late submissions, which can increase over time. Additionally, incorrect information may lead to audits and further complications. It is vital for fiduciaries to ensure that all information is complete and accurate to avoid these penalties and maintain compliance with state tax laws.

Quick guide on how to complete 2022 form or 41 oregon fiduciary income tax return 150 101 041

Complete Form OR 41, Oregon Fiduciary Income Tax Return, 150 101 041 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without any holdups. Handle Form OR 41, Oregon Fiduciary Income Tax Return, 150 101 041 on any platform with airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The simplest method to modify and eSign Form OR 41, Oregon Fiduciary Income Tax Return, 150 101 041 with ease

- Obtain Form OR 41, Oregon Fiduciary Income Tax Return, 150 101 041 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Form OR 41, Oregon Fiduciary Income Tax Return, 150 101 041 to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form or 41 oregon fiduciary income tax return 150 101 041

Create this form in 5 minutes!

How to create an eSignature for the 2022 form or 41 oregon fiduciary income tax return 150 101 041

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Oregon Form 41?

The Oregon Form 41 is a tax return form specifically designed for corporations and tax-exempt organizations operating in Oregon. It is essential for filing the state taxes accurately and ensures compliance with state tax regulations. Using airSlate SignNow, you can easily fill out and eSign the Oregon Form 41 efficiently.

-

How can airSlate SignNow help with the Oregon Form 41?

airSlate SignNow streamlines the process of preparing and signing the Oregon Form 41 by providing an intuitive platform for document management. Our solution allows users to fill out forms online, obtain necessary signatures, and ensure secure filing. This saves time and helps avoid common pitfalls in the filing process.

-

Is there a cost associated with using airSlate SignNow for the Oregon Form 41?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs and sizes. Our competitive pricing ensures you can access powerful features for managing documents like the Oregon Form 41 without breaking the bank. You can choose a plan that fits your budget and workflow requirements.

-

What features does airSlate SignNow offer for handling the Oregon Form 41?

airSlate SignNow includes features such as eSignatures, templates, and document sharing capabilities, specifically beneficial for forms like the Oregon Form 41. Users can easily customize templates, track document status, and collaborate with others in real-time. These features enhance the overall efficiency of managing tax documents.

-

Can I integrate airSlate SignNow with other applications for the Oregon Form 41?

Absolutely! airSlate SignNow seamlessly integrates with popular applications like Google Workspace, Salesforce, and Dropbox. This integration allows you to manage the Oregon Form 41 alongside your other business tools, creating a more cohesive workflow to handle all your document needs.

-

How secure is airSlate SignNow when submitting the Oregon Form 41?

Security is a top priority at airSlate SignNow. Our platform employs industry-standard encryption protocols to ensure your Oregon Form 41 and other documents are protected during transmission and storage. Additionally, features like two-factor authentication provide an extra layer of security for your sensitive information.

-

What are the benefits of using airSlate SignNow for my business when managing the Oregon Form 41?

Using airSlate SignNow to manage the Oregon Form 41 offers several benefits, including increased efficiency, reduced paperwork, and improved accuracy. Our easy-to-use platform simplifies the filing process, allowing businesses to focus more on their core activities rather than administrative burdens. Moreover, eSigning speeds up approvals and ensures timely submissions.

Get more for Form OR 41, Oregon Fiduciary Income Tax Return, 150 101 041

- Warranty deed from individual to a trust rhode island form

- Warranty deed from husband and wife to a trust rhode island form

- Warranty deed from husband to himself and wife rhode island form

- Quitclaim deed from husband to himself and wife rhode island form

- Quitclaim deed from husband and wife to husband and wife rhode island form

- Rhode island husband form

- Rhode island agreement 497325030 form

- Rhode island agreement contract form

Find out other Form OR 41, Oregon Fiduciary Income Tax Return, 150 101 041

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form