Form 41 Tax 2015

What is the Form 41 Tax

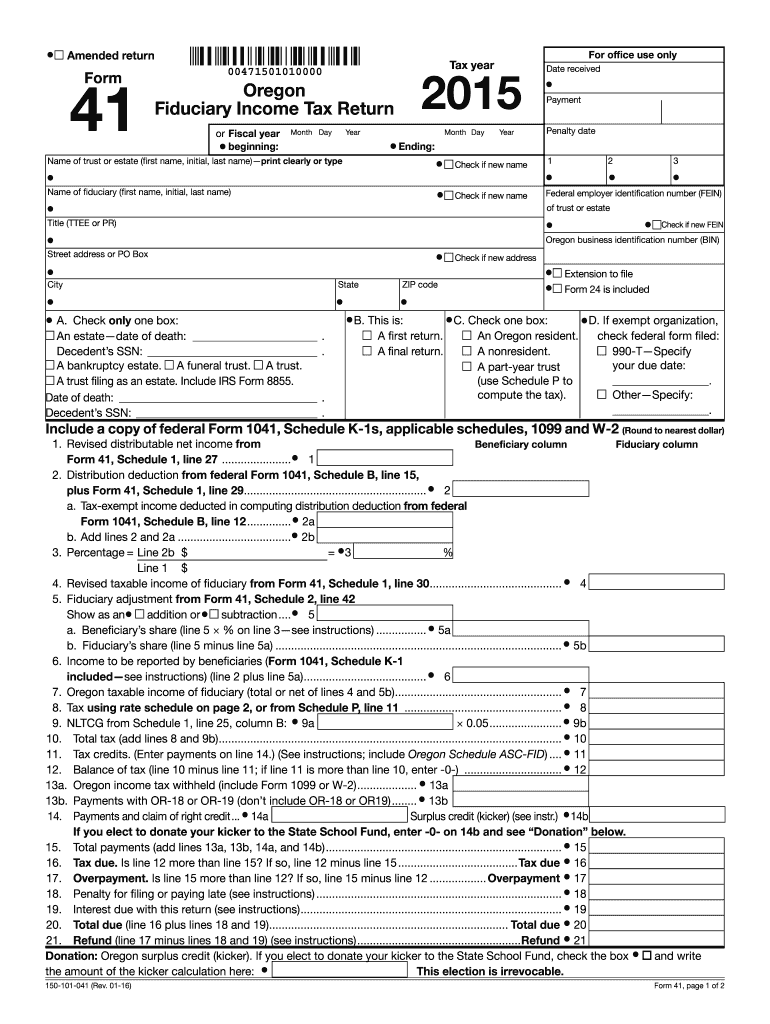

The Oregon Form 41 is a tax document specifically designed for fiduciary income tax returns in the state of Oregon. This form is utilized by estates and trusts to report income, deductions, and tax liabilities. It is essential for fiduciaries to accurately complete this form to ensure compliance with state tax regulations. The information provided on Form 41 helps the Oregon Department of Revenue determine the tax obligations of the fiduciary entity.

Steps to Complete the Form 41 Tax

Completing the Oregon Form 41 requires careful attention to detail. Here are the general steps to follow:

- Gather necessary documentation, including income statements, deductions, and any relevant financial records.

- Begin filling out the form by entering the basic information about the estate or trust, including its name, address, and federal employer identification number (EIN).

- Report all income received during the tax year, including interest, dividends, and capital gains.

- Detail any deductions that apply, such as administrative expenses or distributions made to beneficiaries.

- Calculate the total tax liability based on the income and deductions reported.

- Review the completed form for accuracy before submission.

Legal Use of the Form 41 Tax

The Oregon Form 41 holds legal significance as it serves as the official record of fiduciary income tax obligations. When properly filled out and submitted, it meets the requirements set forth by the Oregon Department of Revenue. Electronic signatures can be used to validate the submission, provided that the eSignature complies with applicable laws, such as the ESIGN Act and UETA. This ensures that the form is legally binding and recognized by state authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Oregon Form 41 are crucial for maintaining compliance. Generally, the form is due on the 15th day of the fourth month following the end of the tax year. For estates and trusts operating on a calendar year basis, this typically means an April 15 deadline. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to stay informed about any changes to deadlines or additional requirements issued by the Oregon Department of Revenue.

Required Documents

To successfully complete the Oregon Form 41, certain documents are necessary. These may include:

- Income statements for the estate or trust, such as K-1 forms.

- Records of distributions made to beneficiaries.

- Documentation of any deductions claimed, including receipts for administrative expenses.

- Federal Form 1041, if applicable, as it provides a comprehensive overview of the fiduciary's income tax situation.

Form Submission Methods

The Oregon Form 41 can be submitted through various methods to accommodate different preferences. Options include:

- Online submission through the Oregon Department of Revenue's electronic filing system.

- Mailing a paper copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices for those who prefer face-to-face assistance.

Key Elements of the Form 41 Tax

Understanding the key elements of the Oregon Form 41 is essential for accurate completion. Important components include:

- Identification section, where the fiduciary must provide basic information about the estate or trust.

- Income section, detailing all sources of income received during the tax year.

- Deductions section, where allowable expenses are reported to reduce taxable income.

- Tax calculation section, which determines the total tax liability based on reported income and deductions.

Quick guide on how to complete form 41 tax

Effortlessly Complete Form 41 Tax on Any Device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents rapidly and without holdups. Manage Form 41 Tax on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

How to Modify and eSign Form 41 Tax with Ease

- Obtain Form 41 Tax and click on Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Emphasize key sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 41 Tax and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 41 tax

Create this form in 5 minutes!

How to create an eSignature for the form 41 tax

The best way to generate an electronic signature for your PDF document in the online mode

The best way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

How to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

How to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the Oregon Form 41?

The Oregon Form 41 is a tax form used for reporting corporation excise or income tax in Oregon. Understanding this form is essential for businesses operating in Oregon, as it ensures compliance with state tax regulations. Utilizing airSlate SignNow can help you electronically sign and send your Oregon Form 41 quickly and securely.

-

How can airSlate SignNow help with completing the Oregon Form 41?

With airSlate SignNow, you can easily prepare, fill out, and eSign the Oregon Form 41. The platform provides a user-friendly interface that simplifies the form-filling process, ensuring that all required information is captured accurately. This helps reduce errors and speeds up submission to the state.

-

Is there a cost associated with using airSlate SignNow for the Oregon Form 41?

Yes, airSlate SignNow offers various pricing plans, making it a cost-effective solution for businesses needing to manage documents like the Oregon Form 41. Depending on the plan you choose, features such as unlimited document signing and advanced security options can enhance your experience. You can find the plan that best suits your business needs on our website.

-

What are the benefits of using airSlate SignNow for the Oregon Form 41?

Using airSlate SignNow for the Oregon Form 41 streamlines the document workflow, saving valuable time and resources. The platform ensures your forms are securely signed and stored, offering easy access when needed. Additionally, it provides tracking and reminders, helping you meet important tax deadlines.

-

Can I integrate airSlate SignNow with other software for handling the Oregon Form 41?

Yes, airSlate SignNow offers seamless integrations with various business applications, enhancing your workflows. You can connect with popular tools like Dropbox, Google Drive, and CRM systems to manage the Oregon Form 41 and other documents. This integration capability ensures all your documents are centralized and easily accessible.

-

Is airSlate SignNow secure for submitting the Oregon Form 41?

Absolutely! airSlate SignNow is designed with robust security features to protect your sensitive information, including the Oregon Form 41. We utilize encryption and secure access protocols to ensure that your documents are safe. You can feel confident that your electronic submissions are compliant and secure.

-

How fast can I send the Oregon Form 41 using airSlate SignNow?

airSlate SignNow enables you to send the Oregon Form 41 almost instantaneously after it is completed and signed. This speed helps you meet deadlines without unnecessary delays, allowing both you and your recipients to act promptly. Plus, the simple eSigning process means you won’t spend time waiting for physical documents.

Get more for Form 41 Tax

- Answer to complaint for defendant without children wyoming form

- Answer and counterclaim to complaint for divorce wyoming form

- Initial disclosures for defendant without children wyoming form

- Notice of service of required initial disclosures for defendant without children wyoming form

- Application for entry of default wyoming form

- Affidavit of defendant in support of default wyoming form

- Entry of default wyoming form

- Request for setting wyoming form

Find out other Form 41 Tax

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe