Form 39NR, Part Year Resident and Nonresident Supplemental Schedule and Instructions 2023

Understanding the Idaho Tax Form 39NR

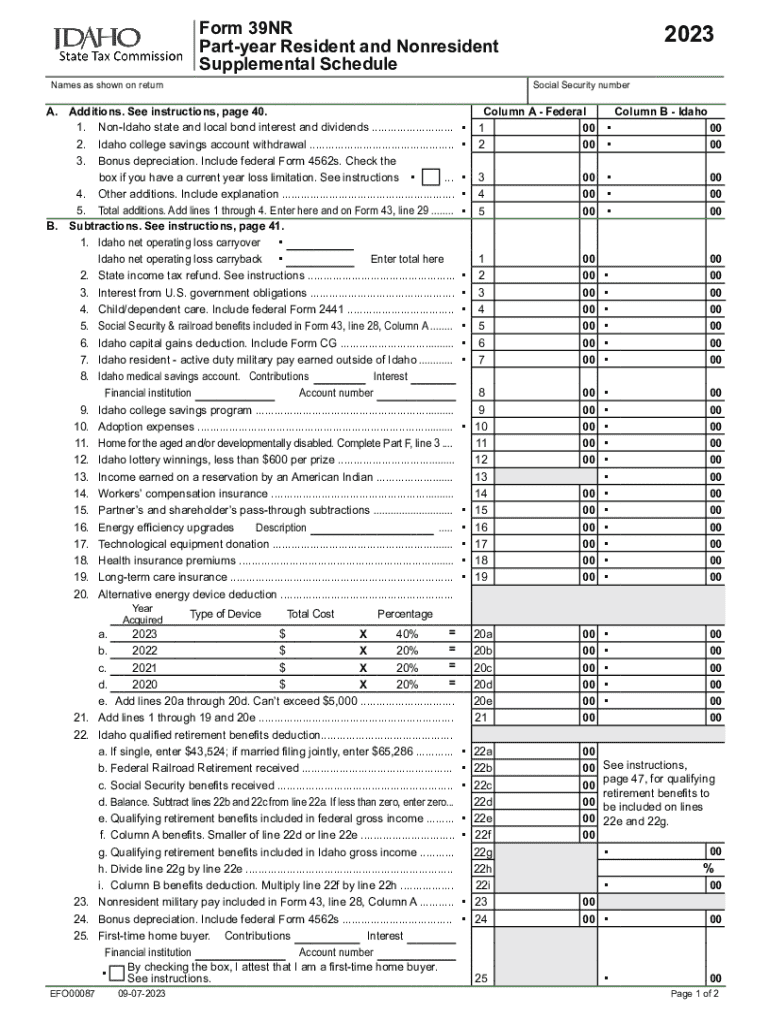

The Idaho Tax Form 39NR is designed for part-year residents and nonresidents who need to report their Idaho income. This form allows individuals to calculate their tax liability based on the income earned while residing or working in Idaho. It is essential for those who have moved to or from Idaho during the tax year and need to ensure compliance with state tax regulations.

Individuals filing this form must accurately report all income earned in Idaho and any applicable deductions. The 39NR form is particularly relevant for those who may have income from multiple states, ensuring that Idaho taxes are appropriately assessed based on the income attributable to the state.

Steps to Complete the Idaho Tax Form 39NR

Completing the Idaho Tax Form 39NR involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your residency status for the tax year, identifying the period you lived in Idaho.

- Report all income earned during your residency in Idaho, as well as any income sourced from Idaho while a nonresident.

- Calculate your deductions and credits available to you as a part-year resident or nonresident.

- Complete the form by following the provided instructions carefully, ensuring all calculations are accurate.

- Review the completed form for any errors before submission.

Obtaining the Idaho Tax Form 39NR

The Idaho Tax Form 39NR can be easily obtained through the Idaho State Tax Commission's official website. It is available in a printable format, allowing taxpayers to fill it out by hand or digitally. Additionally, many tax preparation software programs include the Idaho 39NR form, enabling users to complete their taxes electronically.

For those who prefer a physical copy, the form can also be requested directly from local tax offices or through mail. Ensure that you have the most current version of the form to avoid any compliance issues.

Key Elements of the Idaho Tax Form 39NR

Several key elements are crucial when filling out the Idaho Tax Form 39NR:

- Residency Status: Clearly indicate whether you are a part-year resident or nonresident.

- Income Reporting: Accurately report all income earned while in Idaho, including wages, business income, and other sources.

- Deductions and Credits: Identify any deductions or tax credits you may qualify for, which can lower your overall tax liability.

- Signature and Date: Ensure the form is signed and dated to validate your submission.

Legal Use of the Idaho Tax Form 39NR

The Idaho Tax Form 39NR is legally required for individuals who meet specific criteria regarding their residency and income sources. Filing this form accurately is essential to comply with Idaho state tax laws. Failure to file or incorrect reporting can result in penalties or additional taxes owed.

It is advisable to keep copies of all submitted forms and supporting documents for future reference in case of audits or inquiries from the Idaho State Tax Commission.

Filing Deadlines for the Idaho Tax Form 39NR

Taxpayers must be aware of the filing deadlines for the Idaho Tax Form 39NR to ensure timely submission and avoid penalties. Typically, the deadline aligns with the federal tax filing deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day.

It is important to check for any specific extensions or changes announced by the Idaho State Tax Commission each tax year, as these can affect filing requirements.

Create this form in 5 minutes or less

Find and fill out the correct form 39nr part year resident and nonresident supplemental schedule and instructions

Create this form in 5 minutes!

How to create an eSignature for the form 39nr part year resident and nonresident supplemental schedule and instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Idaho tax 39NR?

Idaho tax 39NR refers to the non-resident income tax form used by individuals who earn income in Idaho but do not reside in the state. This form is essential for ensuring compliance with Idaho tax laws and accurately reporting income earned within the state.

-

How can airSlate SignNow help with Idaho tax 39NR forms?

airSlate SignNow simplifies the process of completing and submitting Idaho tax 39NR forms by allowing users to eSign documents securely and efficiently. With our platform, you can easily manage your tax documents and ensure they are filed correctly and on time.

-

What are the pricing options for using airSlate SignNow for Idaho tax 39NR?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for individuals and teams. Our cost-effective solutions ensure that you can manage your Idaho tax 39NR forms without breaking the bank.

-

Are there any features specifically designed for Idaho tax 39NR users?

Yes, airSlate SignNow includes features tailored for users handling Idaho tax 39NR forms, such as customizable templates and automated reminders for filing deadlines. These features help streamline the tax preparation process and reduce the risk of errors.

-

Can I integrate airSlate SignNow with other tax software for Idaho tax 39NR?

Absolutely! airSlate SignNow integrates seamlessly with various tax software solutions, making it easy to manage your Idaho tax 39NR forms alongside your other financial documents. This integration enhances efficiency and ensures all your tax-related tasks are in one place.

-

What benefits does airSlate SignNow offer for managing Idaho tax 39NR documents?

Using airSlate SignNow for your Idaho tax 39NR documents provides numerous benefits, including enhanced security, easy access to documents, and the ability to track the status of your forms. Our platform ensures that your sensitive information is protected while simplifying the eSigning process.

-

Is airSlate SignNow user-friendly for first-time Idaho tax 39NR filers?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible for first-time Idaho tax 39NR filers. Our intuitive interface guides users through the eSigning process, ensuring that even those unfamiliar with tax forms can navigate easily.

Get more for Form 39NR, Part year Resident And Nonresident Supplemental Schedule And Instructions

- Security log book pdf form

- Afleveringsattest pdf form

- International sales representative agreement form

- Cancel laithwaites subscription form

- Hosted by date form

- Activities specific balance confidence scale form

- Nd docr phone application form

- Colorado division of fire prevention and control home form

Find out other Form 39NR, Part year Resident And Nonresident Supplemental Schedule And Instructions

- How To Sign Rhode Island Emergency Contact Form

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement