Form 39NR, Part Year Resident and Nonresident Supplemental Schedule and Instructions 2024-2026

Understanding the 39NR Form: Part-Year Resident and Nonresident Supplemental Schedule

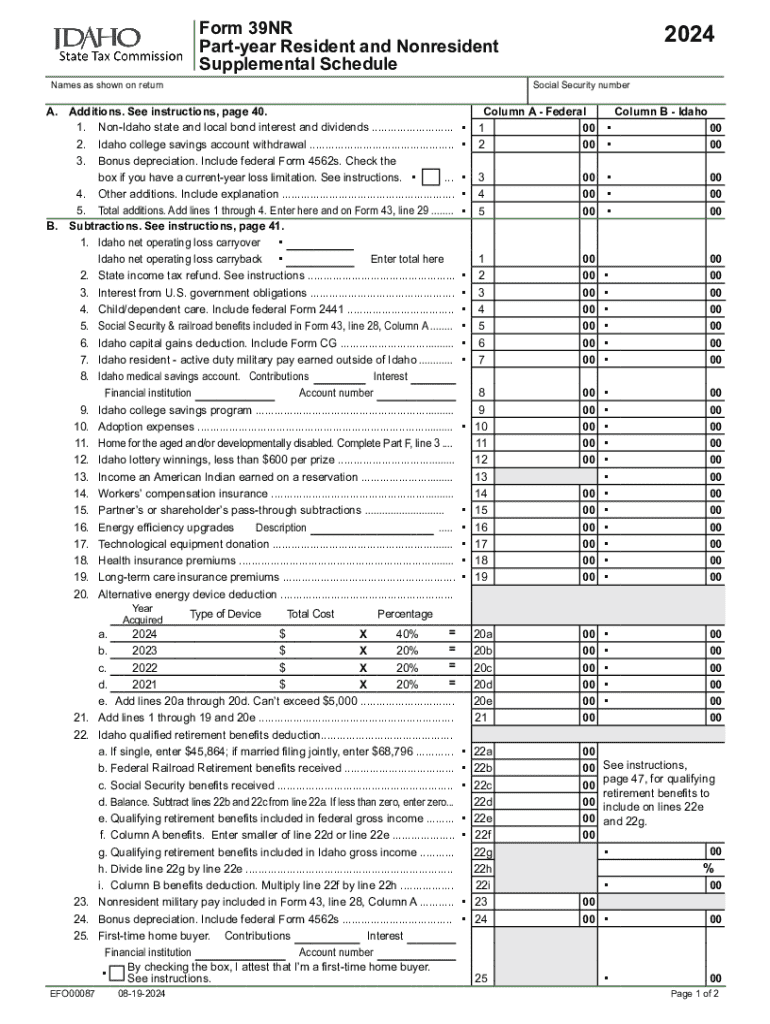

The 39NR form is designed for individuals who are part-year residents or nonresidents of Idaho. This form is essential for reporting income earned in Idaho during the tax year. It helps taxpayers calculate their Idaho taxable income and determine the appropriate tax liability. The form is especially relevant for those who have moved in or out of the state within the tax year, ensuring that they only pay taxes on income sourced from Idaho.

Steps to Complete the 39NR Form

Completing the 39NR form involves several key steps:

- Gather Necessary Information: Collect all relevant financial documents, including W-2s, 1099s, and records of any income earned while residing in Idaho.

- Determine Residency Status: Clearly identify the periods during which you were a resident and nonresident of Idaho.

- Fill Out the Form: Carefully enter your income details, deductions, and credits as applicable. Ensure that you follow the instructions provided with the form.

- Review for Accuracy: Double-check all entries for accuracy to avoid potential issues with your tax filing.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person, and ensure you meet the filing deadline.

Obtaining the 39NR Form

The 39NR form can be obtained through the Idaho State Tax Commission's official website. It is available for download in a printable format. Additionally, taxpayers may request a physical copy by contacting the Tax Commission directly. Having the most recent version of the form is crucial, as updates may occur annually.

Legal Use of the 39NR Form

The 39NR form is legally required for part-year residents and nonresidents who earn income in Idaho. Filing this form accurately ensures compliance with state tax laws and helps avoid penalties. It is important to understand that failing to file or misreporting income can lead to legal repercussions, including fines and interest on unpaid taxes.

Filing Deadlines for the 39NR Form

Taxpayers must be aware of the filing deadlines associated with the 39NR form. Generally, the form is due on the same date as the federal tax return, which is typically April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any specific state announcements regarding changes to deadlines.

Examples of Using the 39NR Form

Consider a scenario where an individual moves to Idaho on June first and earns income from a job in the state until December thirty-first. This person would use the 39NR form to report the income earned during their residency in Idaho, ensuring they only pay taxes on that income. Another example includes a student who resides in Idaho for part of the year while attending college but earns income from a job located outside the state. This student would also need to file the 39NR form to accurately report their Idaho income.

Create this form in 5 minutes or less

Find and fill out the correct form 39nr part year resident and nonresident supplemental schedule and instructions 772050893

Create this form in 5 minutes!

How to create an eSignature for the form 39nr part year resident and nonresident supplemental schedule and instructions 772050893

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 39nr form and how does it work?

The 39nr form is a specific document used for tax purposes, particularly for non-resident individuals. With airSlate SignNow, you can easily fill out, sign, and send the 39nr form electronically, streamlining the process and ensuring compliance with tax regulations.

-

How can airSlate SignNow help me with the 39nr form?

airSlate SignNow provides a user-friendly platform that allows you to create, edit, and eSign the 39nr form quickly. Our solution ensures that you can manage your documents efficiently, reducing the time spent on paperwork and enhancing your productivity.

-

Is there a cost associated with using airSlate SignNow for the 39nr form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. You can choose a plan that fits your budget while gaining access to features that simplify the completion and signing of the 39nr form.

-

What features does airSlate SignNow offer for the 39nr form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which enhance the experience of managing the 39nr form. These features ensure that your documents are handled securely and efficiently.

-

Can I integrate airSlate SignNow with other applications for the 39nr form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage the 39nr form alongside your existing tools. This integration helps streamline your workflow and enhances overall efficiency.

-

What are the benefits of using airSlate SignNow for the 39nr form?

Using airSlate SignNow for the 39nr form offers numerous benefits, including time savings, improved accuracy, and enhanced security. Our platform ensures that your documents are processed quickly and securely, giving you peace of mind.

-

Is airSlate SignNow compliant with regulations for the 39nr form?

Yes, airSlate SignNow is designed to comply with relevant regulations, ensuring that your use of the 39nr form meets legal requirements. Our commitment to compliance helps protect your business and maintain the integrity of your documents.

Get more for Form 39NR, Part year Resident And Nonresident Supplemental Schedule And Instructions

- Request autopsy report tn form

- Mmmp application packet state of michigan michigan form

- Sedgwick claims management direct deposit 2015 2019 form

- Schedule g form t239 2015 2019

- Fcc form 397 eeo mid term reports apps fcc

- Cash drawer check out sheet foodservicewarehousecom form

- Fin517 application for licensee exemption or extension tdi texas form

- Joint motion shc 1310 alaska court records state of alaska courts alaska form

Find out other Form 39NR, Part year Resident And Nonresident Supplemental Schedule And Instructions

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe