Fillable Online Form 39NR Idaho Supplemental Schedule 2021

What is the Idaho Tax Form 39NR?

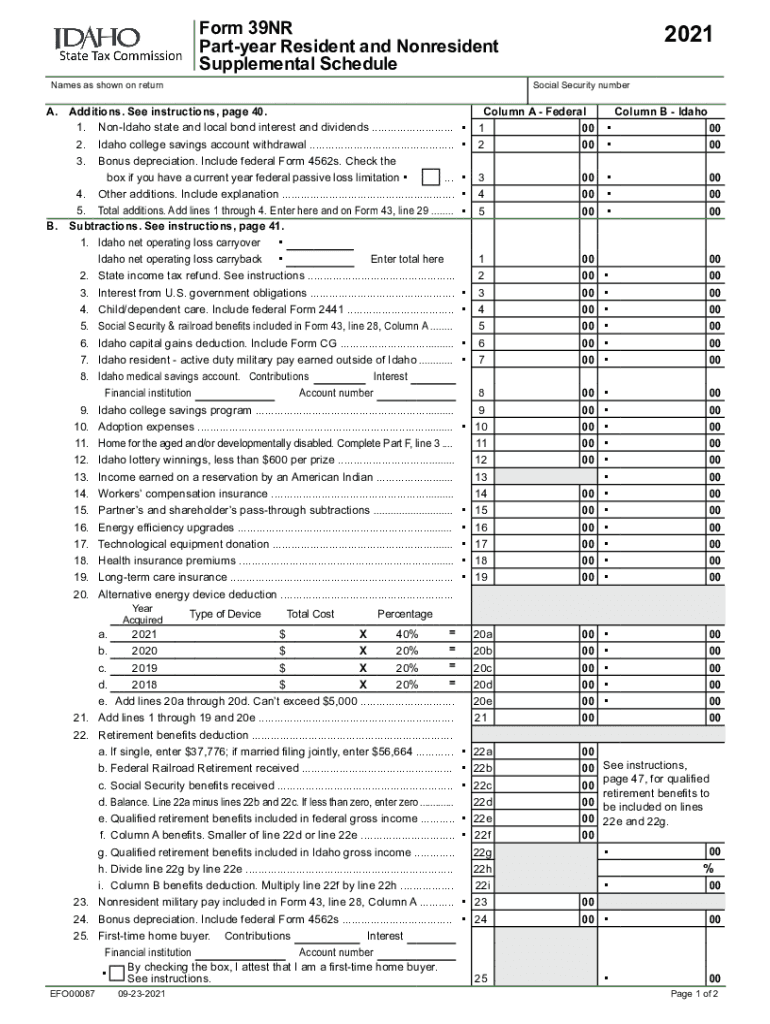

The Idaho tax form 39NR is a supplemental schedule specifically designed for nonresidents who earn income in Idaho. This form is essential for individuals who do not reside in Idaho but have taxable income sourced from the state. By accurately completing the 39NR, nonresidents can report their Idaho income and calculate the appropriate tax owed. Understanding this form is crucial for compliance with Idaho tax regulations and ensuring that nonresidents fulfill their tax obligations correctly.

Steps to Complete the Idaho Tax Form 39NR

Completing the Idaho 39NR form involves several key steps to ensure accuracy and compliance. Begin by gathering all relevant income documents, including W-2s and 1099s that report income earned in Idaho. Next, fill out personal identification information, including your name, address, and Social Security number. Then, report your Idaho-sourced income, which may include wages, rental income, or business earnings. After calculating your total income, apply any applicable deductions and credits. Finally, review the form for completeness and accuracy before submission.

Legal Use of the Idaho Tax Form 39NR

The Idaho tax form 39NR is legally recognized for reporting income by nonresidents. To ensure its validity, the form must be completed accurately and submitted by the designated filing deadlines. Compliance with state tax laws is essential, as failure to file or inaccuracies can lead to penalties. The form must be signed and dated, affirming that the information provided is true and complete. Utilizing a reliable eSignature platform can enhance the legal standing of the completed form, ensuring it meets all necessary requirements.

Filing Deadlines for the Idaho Tax Form 39NR

Timely filing of the Idaho 39NR is crucial to avoid penalties. The standard deadline for submitting the form is typically April 15 of the year following the tax year being reported. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Nonresidents should also be aware of any specific extensions that may apply, particularly if they are awaiting additional documentation or have unique circumstances affecting their filing timeline.

Required Documents for the Idaho Tax Form 39NR

To complete the Idaho tax form 39NR, several documents are necessary. Primarily, gather all forms of income documentation, such as W-2s and 1099s, that detail earnings sourced from Idaho. Additionally, any records of deductions or credits that may apply to your situation should be included. If applicable, documentation supporting residency status in another state may also be required. Ensuring that all necessary documents are at hand will facilitate a smoother completion process.

Form Submission Methods for the Idaho Tax Form 39NR

The Idaho tax form 39NR can be submitted through various methods. Nonresidents have the option to file the form electronically using approved e-filing services, which can expedite processing times. Alternatively, the form can be printed and mailed to the Idaho State Tax Commission. In-person submissions may also be possible at designated tax offices. Regardless of the method chosen, it is important to retain copies of the submitted form and any supporting documents for personal records.

Quick guide on how to complete fillable online form 39nr idaho supplemental schedule

Effortlessly Prepare Fillable Online Form 39NR Idaho Supplemental Schedule on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally-friendly substitute to conventional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage Fillable Online Form 39NR Idaho Supplemental Schedule on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Modify and Electronically Sign Fillable Online Form 39NR Idaho Supplemental Schedule with Ease

- Obtain Fillable Online Form 39NR Idaho Supplemental Schedule and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of the documents or conceal sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method of sharing your form—via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, the hassle of searching for forms, and mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in a few clicks from any device you choose. Modify and electronically sign Fillable Online Form 39NR Idaho Supplemental Schedule while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online form 39nr idaho supplemental schedule

Create this form in 5 minutes!

How to create an eSignature for the fillable online form 39nr idaho supplemental schedule

How to generate an e-signature for a PDF file online

How to generate an e-signature for a PDF file in Google Chrome

How to create an electronic signature for signing PDFs in Gmail

The way to make an e-signature right from your mobile device

The best way to create an e-signature for a PDF file on iOS

The way to make an e-signature for a PDF on Android devices

People also ask

-

What is the Idaho tax form 39nr and who needs to file it?

The Idaho tax form 39nr is a non-resident income tax return that individuals must file if they earned income in Idaho but reside elsewhere. Anyone who has income sourced from Idaho and meets the eligibility requirements must fill out this form to report their Idaho-sourced income accurately. Using the Idaho tax form 39nr ensures compliance with state tax regulations.

-

How can airSlate SignNow help me with the Idaho tax form 39nr?

airSlate SignNow simplifies the process of signing and submitting your Idaho tax form 39nr by providing a user-friendly interface for electronic signatures. You can easily send, sign, and securely store your tax documents online, reducing the hassle of paperwork. This makes it an ideal solution for managing your Idaho tax form 39nr efficiently.

-

Is airSlate SignNow a cost-effective solution for handling the Idaho tax form 39nr?

Yes, airSlate SignNow offers competitive pricing that makes it cost-effective for individuals and businesses filing the Idaho tax form 39nr. With various subscription plans, you can choose one that fits your budget while ensuring access to essential features like document tracking and audit trails. This affordability can save you both time and money during tax season.

-

What features does airSlate SignNow offer for eSigning the Idaho tax form 39nr?

airSlate SignNow provides features such as customizable workflows, real-time collaboration, and secure eSigning for the Idaho tax form 39nr. These tools enhance your experience by enabling multiple parties to sign documents seamlessly and track their status. This ensures you never miss a deadline while filing your Idaho tax form 39nr.

-

Can I integrate airSlate SignNow with other software to manage my Idaho tax form 39nr?

Absolutely! airSlate SignNow integrates smoothly with various software solutions, including accounting and tax software, to streamline the process of managing your Idaho tax form 39nr. Integrating these tools can automate data input and ensure your tax information is accurate and up-to-date. This makes filing your Idaho tax form 39nr even easier.

-

How does airSlate SignNow ensure the security of my Idaho tax form 39nr documents?

Security is a top priority for airSlate SignNow, which employs industry-standard encryption and secure servers to protect your Idaho tax form 39nr documents. You can feel confident that your sensitive information remains confidential and secure throughout the signing process. This commitment to security adds an extra layer of trust when handling your Idaho tax form 39nr.

-

What if I have questions while filling out the Idaho tax form 39nr using airSlate SignNow?

If you have questions while using airSlate SignNow to fill out your Idaho tax form 39nr, our comprehensive customer support is available to assist you. You can access our extensive knowledge base, FAQs, and contact customer service for personalized assistance. We're dedicated to ensuring you have a smooth experience with your Idaho tax form 39nr.

Get more for Fillable Online Form 39NR Idaho Supplemental Schedule

- Missouri drainage 497313456 form

- Tax free exchange package missouri form

- Landlord tenant sublease package missouri form

- Mo buy form

- Option to purchase package missouri form

- Amendment of lease package missouri form

- Annual financial checkup package missouri form

- Bill of sale for camper in missouri form

Find out other Fillable Online Form 39NR Idaho Supplemental Schedule

- Sign Utah Living Will Fast

- Sign Wyoming Living Will Easy

- How Can I Sign Georgia Pet Care Agreement

- Can I Sign Kansas Moving Checklist

- How Do I Sign Rhode Island Pet Care Agreement

- How Can I Sign Virginia Moving Checklist

- Sign Illinois Affidavit of Domicile Online

- How Do I Sign Iowa Affidavit of Domicile

- Sign Arkansas Codicil to Will Free

- Sign Colorado Codicil to Will Now

- Can I Sign Texas Affidavit of Domicile

- How Can I Sign Utah Affidavit of Domicile

- How To Sign Massachusetts Codicil to Will

- How To Sign Arkansas Collateral Agreement

- Sign New York Codicil to Will Now

- Sign Oregon Codicil to Will Later

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit