Printable Idaho FORM 39NR NONRESIDENTPART YEAR RESIDENT Idaho Supplemental Schedule 2020

Understanding the Idaho Form 39NR Nonresident Part-Year Resident Idaho Supplemental Schedule

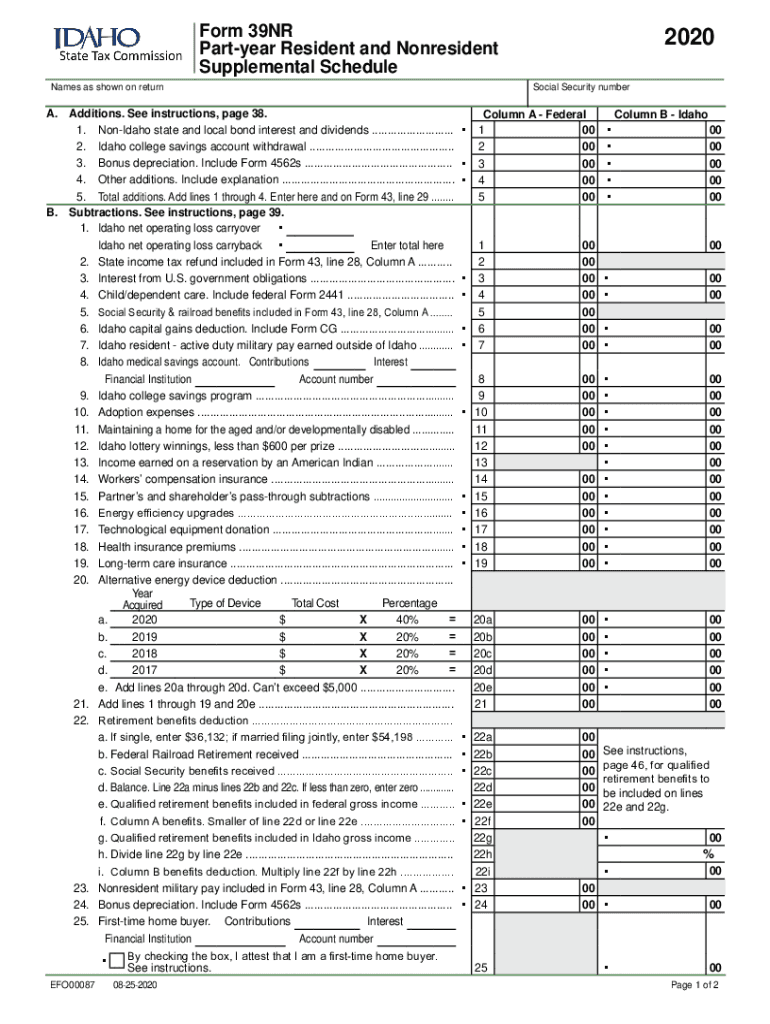

The Idaho Form 39NR is specifically designed for nonresident and part-year resident taxpayers who need to report their income earned within the state of Idaho. This supplemental schedule is essential for accurately calculating Idaho taxable income and ensuring compliance with state tax regulations. It is particularly important for individuals who have income from Idaho sources but do not reside in the state for the entire year. Understanding this form is crucial for proper tax filing and to avoid potential penalties.

Steps to Complete the Idaho Form 39NR

Completing the Idaho Form 39NR involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and any other income statements that reflect earnings from Idaho sources.

- Fill in personal information: Provide your name, address, and Social Security number at the top of the form.

- Report Idaho income: Accurately report all income earned from Idaho sources. This may include wages, rental income, or business income.

- Calculate deductions: Identify any deductions you are eligible for, which may reduce your taxable income.

- Review and sign: Ensure all information is accurate, then sign and date the form before submission.

Legal Use of the Idaho Form 39NR

The Idaho Form 39NR is legally binding when completed and signed correctly. It must comply with state laws governing tax filings. The form serves as an official document for reporting income and calculating taxes owed to the state. Failure to file this form, or inaccuracies within it, can lead to penalties, including fines or interest on unpaid taxes. Utilizing a reliable eSignature solution can help ensure that the form is executed properly and securely.

Obtaining the Idaho Form 39NR

The Idaho Form 39NR can be obtained from the Idaho State Tax Commission's official website or through various tax preparation software. It is also available at local tax offices and libraries. Ensuring you have the most current version of the form is essential, as tax laws and forms can change annually. Always check for updates before starting your filing process.

State-Specific Rules for the Idaho Form 39NR

Idaho has specific rules regarding the filing of the Form 39NR. Nonresident and part-year resident taxpayers must be aware of the following:

- Income sourcing: Only income earned from Idaho sources should be reported on this form.

- Filing status: Taxpayers must select the correct filing status that reflects their residency status during the tax year.

- Deadlines: The form must be submitted by the state’s tax filing deadline to avoid penalties.

Filing Deadlines for the Idaho Form 39NR

It is crucial to adhere to the filing deadlines associated with the Idaho Form 39NR. Typically, the deadline aligns with the federal tax filing deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should verify the specific deadline each year to ensure timely submission and avoid late fees.

Quick guide on how to complete printable 2020 idaho form 39nr nonresidentpart year resident idaho supplemental schedule

Effortlessly Prepare Printable Idaho FORM 39NR NONRESIDENTPART YEAR RESIDENT Idaho Supplemental Schedule on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers a perfect eco-friendly alternative to conventional printed and signed documents, enabling you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without delays. Handle Printable Idaho FORM 39NR NONRESIDENTPART YEAR RESIDENT Idaho Supplemental Schedule on any device using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

How to Modify and eSign Printable Idaho FORM 39NR NONRESIDENTPART YEAR RESIDENT Idaho Supplemental Schedule with Ease

- Locate Printable Idaho FORM 39NR NONRESIDENTPART YEAR RESIDENT Idaho Supplemental Schedule and click on Get Form to begin.

- Use the tools at your disposal to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information using the tools specifically provided by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes just seconds and holds the same legal significance as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, frustrating form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Modify and eSign Printable Idaho FORM 39NR NONRESIDENTPART YEAR RESIDENT Idaho Supplemental Schedule to ensure seamless communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 idaho form 39nr nonresidentpart year resident idaho supplemental schedule

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 idaho form 39nr nonresidentpart year resident idaho supplemental schedule

The best way to generate an electronic signature for a PDF file in the online mode

The best way to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF on Android

People also ask

-

What is form 39nr and how can it be used with airSlate SignNow?

Form 39nr is a specific document used for non-resident taxpayers to report income from U.S. sources. With airSlate SignNow, you can easily create, send, and electronically sign form 39nr, streamlining the process to ensure compliance and efficiency.

-

How much does it cost to use airSlate SignNow for form 39nr?

airSlate SignNow offers flexible pricing plans suitable for various business needs. Depending on the features you require to manage form 39nr effectively, you can choose from different subscription models that provide great value for your investment.

-

What features does airSlate SignNow offer for managing form 39nr?

AirSlate SignNow provides an intuitive platform for managing form 39nr, including customizable templates, automated workflows, and secure eSignature capabilities. These features help simplify document handling and ensure that your form 39nr is processed efficiently.

-

Can airSlate SignNow integrate with other tools to assist with form 39nr?

Yes, airSlate SignNow seamlessly integrates with various applications and tools, allowing for a smoother workflow when dealing with form 39nr. Popular integrations include CRM systems and cloud storage services, enhancing your document management capabilities.

-

What are the benefits of using airSlate SignNow for form 39nr?

Using airSlate SignNow for form 39nr provides several benefits, including enhanced efficiency, reduced turnaround time, and improved security for your documents. Additionally, electronic signatures ensure that your form 39nr is legally binding and accepted by tax authorities.

-

Is airSlate SignNow secure for handling sensitive form 39nr documents?

Absolutely, airSlate SignNow prioritizes security and compliance. It employs robust encryption and authentication methods to protect your sensitive form 39nr documents, ensuring that your information remains confidential throughout the signing process.

-

How does airSlate SignNow simplify the process of submitting form 39nr?

AirSlate SignNow simplifies the submission of form 39nr by providing an easy-to-navigate interface where you can fill out, sign, and send documents without hassle. This streamlined process saves you time and reduces the chances of errors, making it easier to comply with tax requirements.

Get more for Printable Idaho FORM 39NR NONRESIDENTPART YEAR RESIDENT Idaho Supplemental Schedule

- Evaluation of supervised experience lpc draft doc ok form

- Okc fence permit form

- Sa i 2644 form

- Okc fence permit 541302723 form

- Nominating petition township office ohio secretary of state sos state oh form

- Odjfs 07120 form

- Edchoice scholarship program print form income cincinnatiwaldorfschool

- Ohio department of jobs and family services residential state supplement form

Find out other Printable Idaho FORM 39NR NONRESIDENTPART YEAR RESIDENT Idaho Supplemental Schedule

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe