W 107 Form WT 7, Employers Annual Reconciliation of Wisconsin Income Tax Withheld Fillable

What is the WT-7 Form?

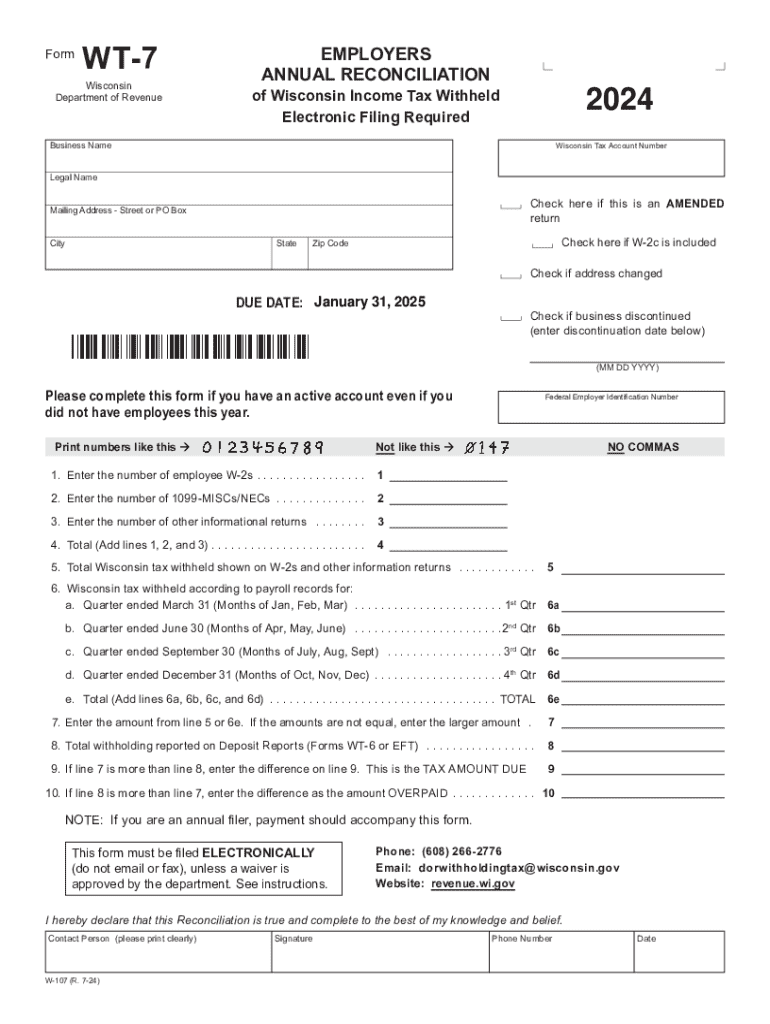

The WT-7 form, officially known as the Employers Annual Reconciliation of Wisconsin Income Tax Withheld, is a crucial document for employers in Wisconsin. This form is used to report the total amount of state income tax withheld from employees' wages throughout the year. It serves as a summary of the employer's withholding tax obligations and is necessary for compliance with state tax regulations.

Employers must fill out the WT-7 form accurately to ensure that they meet their tax responsibilities and avoid potential penalties. This form is particularly important for businesses that have withheld Wisconsin income tax from their employees, as it consolidates all withholding information for the year into a single report.

Steps to Complete the WT-7 Form

Completing the WT-7 form involves several key steps to ensure accuracy and compliance. Here is a straightforward guide:

- Gather Information: Collect all necessary payroll records for the year, including total wages paid and the amount of state tax withheld.

- Fill Out the Form: Enter the total amounts in the appropriate fields on the WT-7 form. Ensure that all figures are accurate and match your payroll records.

- Review for Errors: Double-check all entries for accuracy. Common errors include incorrect amounts or missing information.

- Submit the Form: File the completed WT-7 form with the Wisconsin Department of Revenue by the specified deadline.

Legal Use of the WT-7 Form

The WT-7 form is legally required for employers in Wisconsin who withhold state income tax from their employees' wages. Filing this form is essential to comply with Wisconsin tax laws and regulations. Failure to submit the WT-7 can result in penalties, including fines and interest on unpaid taxes.

Employers must ensure that they complete and file the WT-7 form accurately and on time to avoid legal repercussions. It is advisable to keep copies of submitted forms and any supporting documentation for record-keeping purposes.

Filing Deadlines for the WT-7 Form

Employers must be aware of the filing deadlines associated with the WT-7 form to remain compliant. The WT-7 is typically due on January 31 of the year following the tax year being reported. For example, the WT-7 for the 2023 tax year must be filed by January 31, 2024.

It is important to mark this date on your calendar and ensure that the form is submitted on time to avoid late fees or penalties. Employers should also be aware of any changes to deadlines that may occur due to state regulations or special circumstances.

How to Obtain the WT-7 Form

The WT-7 form can be easily obtained through the Wisconsin Department of Revenue's official website. Employers can download a fillable PDF version of the form, which can be completed electronically or printed for manual entry.

Additionally, employers may also contact the Department of Revenue directly to request a physical copy of the form if needed. It is essential to ensure that you are using the most current version of the WT-7 form to comply with any updates in tax regulations.

Key Elements of the WT-7 Form

Understanding the key elements of the WT-7 form is vital for accurate completion. The form typically includes:

- Employer Information: Name, address, and identification number of the employer.

- Employee Information: Summary of total wages paid and taxes withheld for each employee.

- Total Amounts: Total state income tax withheld for the year, along with any adjustments.

- Signature: A declaration that the information provided is true and accurate, signed by an authorized representative of the employer.

Each of these elements must be completed accurately to ensure the form is valid and accepted by the Wisconsin Department of Revenue.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w 107 form wt 7 employers annual reconciliation of wisconsin income tax withheld fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the wt 7 feature in airSlate SignNow?

The wt 7 feature in airSlate SignNow allows users to streamline their document signing process. It provides an intuitive interface for sending and eSigning documents, making it easier for businesses to manage their workflows efficiently.

-

How does airSlate SignNow's wt 7 pricing compare to other eSignature solutions?

airSlate SignNow offers competitive pricing for its wt 7 feature, making it a cost-effective solution for businesses of all sizes. With flexible plans, users can choose the option that best fits their needs without compromising on quality or functionality.

-

What are the key benefits of using wt 7 in airSlate SignNow?

Using the wt 7 feature in airSlate SignNow provides numerous benefits, including enhanced productivity and reduced turnaround times for document signing. It also ensures compliance and security, giving businesses peace of mind while managing their important documents.

-

Can I integrate wt 7 with other applications?

Yes, airSlate SignNow's wt 7 feature supports integrations with various applications, enhancing its functionality. Users can connect it with popular tools like Google Drive, Salesforce, and more, allowing for seamless document management across platforms.

-

Is the wt 7 feature user-friendly for non-technical users?

Absolutely! The wt 7 feature in airSlate SignNow is designed with user-friendliness in mind. Its intuitive interface allows even non-technical users to easily navigate and utilize the eSigning capabilities without extensive training.

-

What types of documents can I send using wt 7?

With the wt 7 feature in airSlate SignNow, you can send a wide variety of documents for eSigning, including contracts, agreements, and forms. This versatility makes it suitable for different industries and business needs.

-

How secure is the wt 7 feature in airSlate SignNow?

The wt 7 feature prioritizes security, employing advanced encryption and authentication methods to protect your documents. airSlate SignNow complies with industry standards, ensuring that your sensitive information remains safe throughout the signing process.

Get more for W 107 Form WT 7, Employers Annual Reconciliation Of Wisconsin Income Tax Withheld fillable

Find out other W 107 Form WT 7, Employers Annual Reconciliation Of Wisconsin Income Tax Withheld fillable

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now