Publication 6961 a Rev 9 Calendar Year Projections of Information and Withholding Documents for the United States and IRS Campus 2024-2026

Understanding Publication 6961 A Rev 9

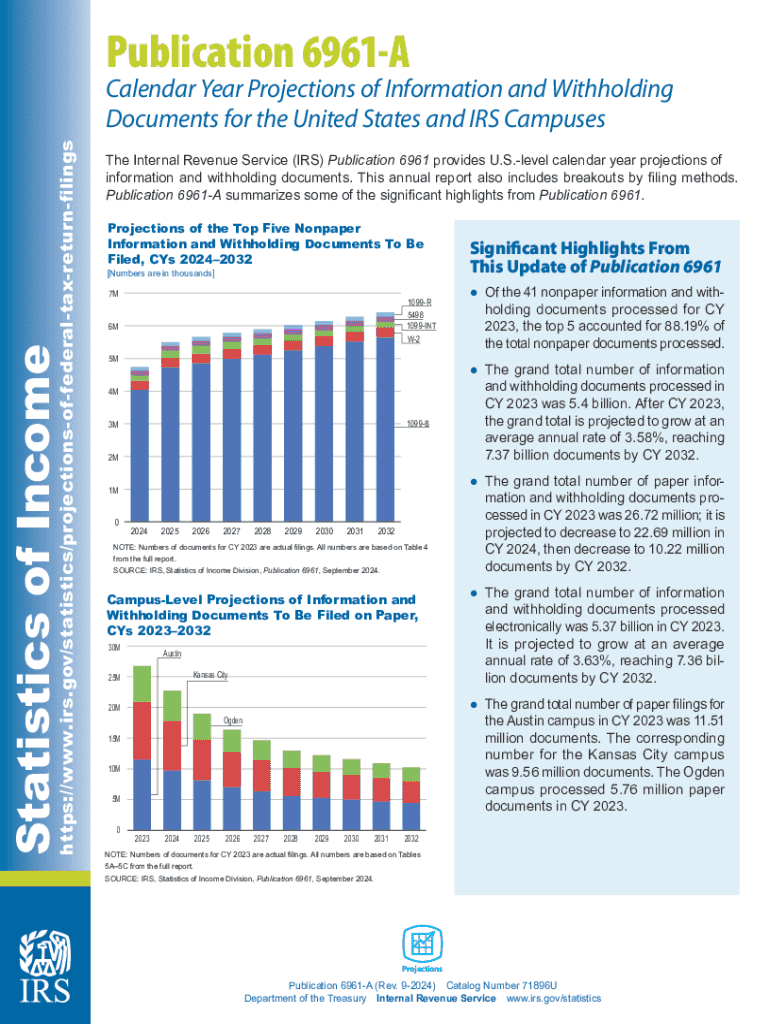

Publication 6961 A Rev 9 provides essential information regarding calendar year projections of information and withholding documents for the United States and IRS campuses. This document is crucial for taxpayers and businesses as it outlines the necessary reporting requirements and deadlines related to various forms of income and withholding. It serves as a guide to help users navigate the complexities of tax compliance and ensure that all necessary documentation is correctly submitted to the IRS.

How to Use Publication 6961 A Rev 9

Using Publication 6961 A Rev 9 involves reviewing the guidelines it provides for the preparation and submission of withholding documents. Taxpayers should carefully read through the publication to understand the specific requirements for their situation. This includes identifying the types of income that must be reported, the appropriate forms to use, and the deadlines for submission. It is advisable to keep a copy of this publication on hand for reference throughout the tax year.

Steps to Complete Publication 6961 A Rev 9

Completing the requirements outlined in Publication 6961 A Rev 9 involves several key steps:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Identify the specific forms required for your income type, as detailed in the publication.

- Fill out the forms accurately, ensuring that all information matches your financial records.

- Review the completed forms for accuracy and completeness before submission.

- Submit the forms by the specified deadlines to avoid penalties.

Key Elements of Publication 6961 A Rev 9

Key elements of Publication 6961 A Rev 9 include:

- Detailed descriptions of various types of income and withholding requirements.

- Specific deadlines for filing and submitting required documents.

- Instructions for reporting income accurately to the IRS.

- Information on penalties for non-compliance with reporting requirements.

IRS Guidelines Related to Publication 6961 A Rev 9

The IRS provides comprehensive guidelines in Publication 6961 A Rev 9 to assist taxpayers in understanding their obligations. These guidelines cover various scenarios, including how to handle different types of income and the respective withholding requirements. Adhering to these guidelines is essential for maintaining compliance and avoiding potential issues with the IRS.

Filing Deadlines and Important Dates

Publication 6961 A Rev 9 outlines critical filing deadlines and important dates that taxpayers must adhere to. These dates are crucial for ensuring that all forms are submitted on time, which helps avoid late fees and penalties. Taxpayers should mark these dates on their calendars and prepare their documents well in advance to ensure timely submission.

Obtaining Publication 6961 A Rev 9

Publication 6961 A Rev 9 can be obtained directly from the IRS website or through various tax preparation resources. It is advisable to ensure you have the most current version, as tax regulations and requirements may change annually. Keeping a digital or printed copy of the publication can assist in future tax preparations and compliance.

Create this form in 5 minutes or less

Find and fill out the correct publication 6961 a rev 9 calendar year projections of information and withholding documents for the united states and irs

Create this form in 5 minutes!

How to create an eSignature for the publication 6961 a rev 9 calendar year projections of information and withholding documents for the united states and irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Publication 6961 A Rev 9 Calendar Year Projections Of Information And Withholding Documents For The United States And IRS Campuses?

Publication 6961 A Rev 9 Calendar Year Projections Of Information And Withholding Documents For The United States And IRS Campuses provides essential guidelines for businesses regarding information reporting and withholding requirements. It outlines the necessary documents and timelines for compliance with IRS regulations, ensuring that organizations can effectively manage their tax obligations.

-

How can airSlate SignNow help with Publication 6961 A Rev 9 Calendar Year Projections?

airSlate SignNow streamlines the process of managing documents related to Publication 6961 A Rev 9 Calendar Year Projections Of Information And Withholding Documents For The United States And IRS Campuses. Our platform allows businesses to easily send, sign, and store necessary documents, ensuring compliance and reducing the risk of errors in reporting.

-

What features does airSlate SignNow offer for handling IRS documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and automated workflows specifically designed for handling IRS documents like Publication 6961 A Rev 9 Calendar Year Projections Of Information And Withholding Documents For The United States And IRS Campuses. These features enhance efficiency and ensure that all necessary documentation is completed accurately and on time.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is a cost-effective solution for small businesses looking to manage their documentation needs, including those related to Publication 6961 A Rev 9 Calendar Year Projections Of Information And Withholding Documents For The United States And IRS Campuses. Our pricing plans are designed to fit various budgets, making it accessible for organizations of all sizes.

-

Can airSlate SignNow integrate with other software for tax management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax management software, enhancing your ability to manage Publication 6961 A Rev 9 Calendar Year Projections Of Information And Withholding Documents For The United States And IRS Campuses. This integration allows for a smoother workflow and ensures that all relevant data is synchronized across platforms.

-

What are the benefits of using airSlate SignNow for IRS compliance?

Using airSlate SignNow for IRS compliance, particularly for Publication 6961 A Rev 9 Calendar Year Projections Of Information And Withholding Documents For The United States And IRS Campuses, offers numerous benefits. These include improved accuracy in document handling, faster processing times, and enhanced security for sensitive information, all of which contribute to a more efficient compliance process.

-

How does airSlate SignNow ensure the security of sensitive documents?

airSlate SignNow prioritizes the security of sensitive documents, including those related to Publication 6961 A Rev 9 Calendar Year Projections Of Information And Withholding Documents For The United States And IRS Campuses. We utilize advanced encryption methods and secure cloud storage to protect your data, ensuring that only authorized users have access to critical information.

Get more for Publication 6961 A Rev 9 Calendar Year Projections Of Information And Withholding Documents For The United States And IRS Campus

Find out other Publication 6961 A Rev 9 Calendar Year Projections Of Information And Withholding Documents For The United States And IRS Campus

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself