Form 945 Annual Return of Withheld Federal Income Tax 2024-2026

Understanding Form 945: Annual Return of Withheld Federal Income Tax

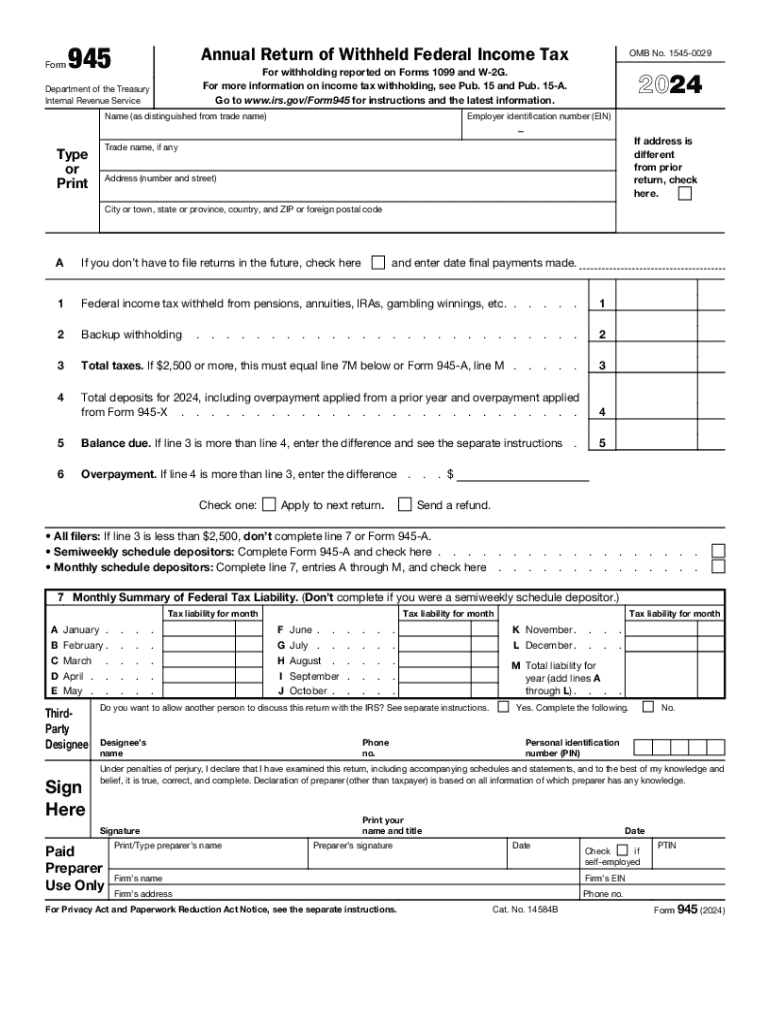

The Form 945 is a crucial document used by businesses to report federal income tax withheld from non-payroll payments. This includes payments made to independent contractors, freelancers, and other non-employees. It serves as an annual return that summarizes the total amount of federal income tax withheld throughout the year. Understanding the purpose and requirements of Form 945 is essential for compliance with IRS regulations.

Steps to Complete Form 945

Completing Form 945 involves several key steps to ensure accuracy and compliance:

- Gather necessary information, including the total amount of federal income tax withheld for the year.

- Fill out the identifying information, such as your business name, address, and Employer Identification Number (EIN).

- Report the total amount withheld in the appropriate section of the form.

- Review the form for any errors before submission.

It is advisable to keep copies of the completed form for your records, as well as any supporting documentation related to the amounts reported.

Filing Deadlines for Form 945

Form 945 must be filed annually, and the deadline typically falls on January 31 of the year following the reporting year. If January 31 falls on a weekend or holiday, the deadline is extended to the next business day. Timely filing is crucial to avoid penalties and ensure compliance with IRS regulations.

Obtaining Form 945

Form 945 can be easily obtained from the IRS website or through various tax preparation software. It is available in a printable format, allowing businesses to fill it out manually if preferred. Additionally, many tax professionals can assist in obtaining and completing the form correctly.

Legal Use of Form 945

The legal use of Form 945 is to report federal income tax withheld from payments made to non-employees. Businesses are required to file this form to comply with federal tax laws. Failure to file or inaccuracies in reporting can result in penalties, making it essential for businesses to understand their obligations regarding this form.

Key Elements of Form 945

Form 945 includes several key elements that need to be accurately reported:

- Business identification information, including the EIN.

- Total federal income tax withheld during the year.

- Signature and date of the person authorized to file the form.

Ensuring that all information is complete and accurate is vital for a successful filing process.

Create this form in 5 minutes or less

Find and fill out the correct form 945 annual return of withheld federal income tax

Create this form in 5 minutes!

How to create an eSignature for the form 945 annual return of withheld federal income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 945 and why is it important?

Form 945 is an IRS form used to report withheld federal income tax from nonpayroll payments. Understanding form 945 is crucial for businesses to ensure compliance with tax regulations and avoid penalties. Using airSlate SignNow, you can easily manage and eSign documents related to form 945, streamlining your tax reporting process.

-

How can airSlate SignNow help with form 945 submissions?

airSlate SignNow simplifies the process of preparing and submitting form 945 by allowing users to create, edit, and eSign documents securely. With its user-friendly interface, businesses can ensure that their form 945 is completed accurately and submitted on time. This efficiency helps reduce the risk of errors and enhances compliance.

-

What features does airSlate SignNow offer for managing form 945?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for form 945. These tools help businesses streamline their workflow and maintain accurate records. Additionally, the platform allows for easy collaboration among team members when preparing form 945.

-

Is airSlate SignNow cost-effective for handling form 945?

Yes, airSlate SignNow provides a cost-effective solution for managing form 945 and other documents. With various pricing plans, businesses can choose an option that fits their budget while still accessing essential features. This affordability makes it an attractive choice for companies of all sizes.

-

Can I integrate airSlate SignNow with other software for form 945 management?

Absolutely! airSlate SignNow offers integrations with popular software solutions, enhancing your ability to manage form 945 efficiently. By connecting with tools like CRM systems and accounting software, you can streamline your document workflows and ensure that all necessary information is readily available.

-

What are the benefits of using airSlate SignNow for form 945?

Using airSlate SignNow for form 945 provides numerous benefits, including increased efficiency, improved accuracy, and enhanced security. The platform allows for quick eSigning and document sharing, which saves time and reduces the likelihood of errors. Additionally, your sensitive information is protected with advanced security measures.

-

How does airSlate SignNow ensure the security of my form 945 documents?

airSlate SignNow prioritizes the security of your form 945 documents by employing industry-standard encryption and secure cloud storage. This ensures that your sensitive information remains confidential and protected from unauthorized access. Regular security audits further enhance the platform's reliability.

Get more for Form 945 Annual Return Of Withheld Federal Income Tax

Find out other Form 945 Annual Return Of Withheld Federal Income Tax

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors