Form 945 2016

What is the Form 945

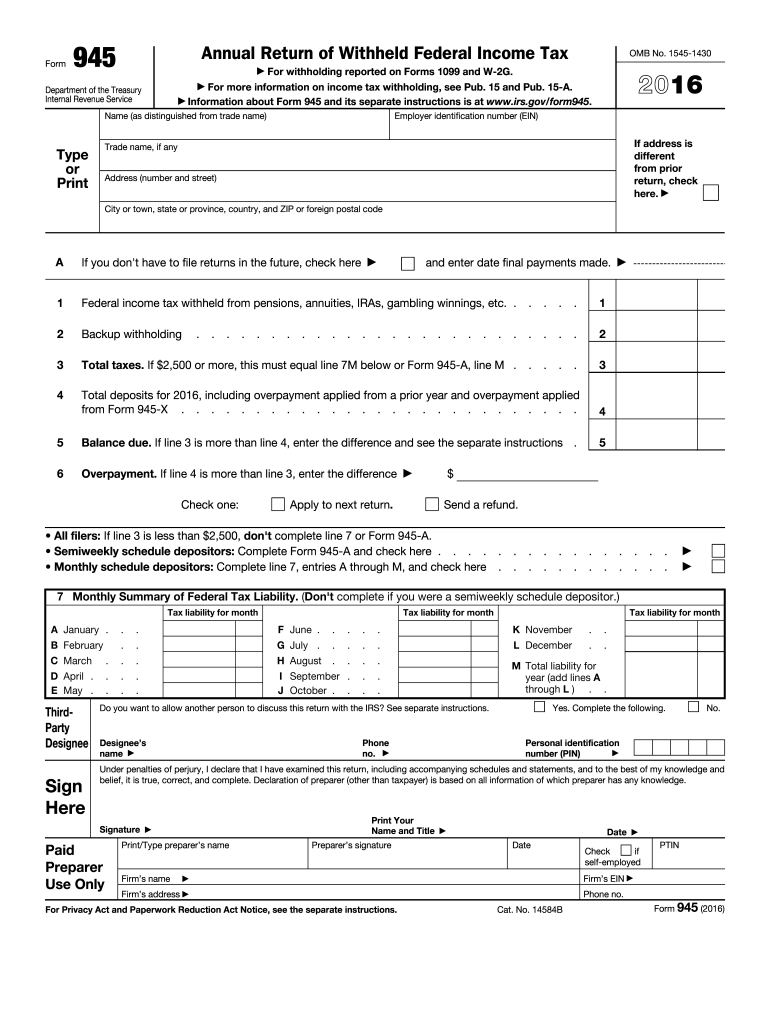

The Form 945 is a tax document used by employers to report withheld federal income tax from nonpayroll payments. This includes payments made to independent contractors, freelancers, and other non-employees. The form is essential for businesses to comply with IRS regulations and ensure that the correct amount of taxes is reported and remitted to the federal government.

How to use the Form 945

To use the Form 945 effectively, businesses must first determine if they need to file it based on their payment activities. Employers should gather all relevant information regarding nonpayroll payments made during the tax year. Once the necessary data is collected, the form can be filled out accurately, ensuring that all amounts reported reflect the actual taxes withheld. After completion, the form must be submitted to the IRS by the specified deadline to avoid penalties.

Steps to complete the Form 945

Completing the Form 945 involves several key steps:

- Gather all necessary information regarding nonpayroll payments made during the year.

- Fill out the form with accurate data, including your business name, address, and Employer Identification Number (EIN).

- Report the total amount of federal income tax withheld from nonpayroll payments.

- Double-check all entries for accuracy to prevent errors.

- Submit the completed form to the IRS by the due date.

Legal use of the Form 945

The legal use of the Form 945 is crucial for businesses to maintain compliance with federal tax laws. It serves as an official record of the federal income tax withheld from nonpayroll payments. Failure to use the form correctly can result in penalties, including fines and interest on unpaid taxes. Therefore, it is essential for employers to understand their obligations and ensure that the form is completed and submitted accurately.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines associated with the Form 945. The form is typically due on January 31 of the year following the tax year being reported. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Timely submission is critical to avoid penalties, so businesses should mark their calendars and prepare in advance.

Form Submission Methods (Online / Mail / In-Person)

The Form 945 can be submitted to the IRS through various methods. Employers may choose to file electronically using IRS e-file systems, which is often faster and more efficient. Alternatively, the form can be mailed to the appropriate IRS address based on the business's location. In-person submission is generally not an option, as the IRS encourages electronic filing for quicker processing.

Penalties for Non-Compliance

Non-compliance with Form 945 filing requirements can lead to significant penalties. These may include fines for late submissions, failure to file, or inaccuracies on the form. The IRS may also assess interest on any unpaid taxes. To avoid these consequences, it is essential for employers to understand their responsibilities and ensure timely and accurate filing of the form.

Quick guide on how to complete 2016 form 945

Manage Form 945 effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly and seamlessly. Manage Form 945 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

The easiest method to modify and eSign Form 945 with minimal effort

- Locate Form 945 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and click on the Done button to save your edits.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Form 945 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 945

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 945

How to create an eSignature for the 2016 Form 945 in the online mode

How to create an electronic signature for your 2016 Form 945 in Chrome

How to make an electronic signature for signing the 2016 Form 945 in Gmail

How to generate an electronic signature for the 2016 Form 945 from your smart phone

How to create an eSignature for the 2016 Form 945 on iOS devices

How to create an electronic signature for the 2016 Form 945 on Android OS

People also ask

-

What is Form 945 and why is it important for businesses?

Form 945 is a crucial IRS form used for reporting withheld federal income tax from non-payroll payments. Businesses that make these payments need to file Form 945 annually. Understanding how to correctly fill out and submit Form 945 can save businesses from potential penalties and ensure compliance with tax regulations.

-

How does airSlate SignNow simplify the completion of Form 945?

airSlate SignNow streamlines the process of completing Form 945 by providing easy-to-use templates that you can fill out and eSign quickly. With our platform, businesses can ensure that all required fields are correctly completed and signed, reducing the time and effort spent on paperwork. This helps in maintaining compliance and accuracy when submitting Form 945.

-

Can I track the status of my Form 945 submissions with airSlate SignNow?

Yes, airSlate SignNow offers tracking features that allow you to monitor the status of your Form 945 submissions. You can see when the form is sent, viewed, and signed, providing you with peace of mind that your tax documents are being handled properly. This transparency helps businesses stay organized and on top of their filing requirements.

-

What are the pricing options for using airSlate SignNow to manage Form 945?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Whether you need basic features or advanced functionalities, our pricing is designed to provide cost-effective solutions for managing documents like Form 945. You can choose a plan that fits your budget and needs while ensuring compliance with tax regulations.

-

Does airSlate SignNow integrate with other software for managing Form 945?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and payroll software, making it easier to manage Form 945 alongside your other financial documents. These integrations help streamline your workflow and ensure that your tax reporting is accurate and efficient.

-

How secure is my information when using airSlate SignNow for Form 945?

Security is a top priority at airSlate SignNow. When handling Form 945 and other sensitive documents, we utilize advanced encryption and security protocols to protect your information. This ensures that your data remains confidential and secure throughout the signing and submission process.

-

Can I customize Form 945 templates in airSlate SignNow?

Yes, airSlate SignNow allows you to customize Form 945 templates according to your specific business needs. You can add your branding, modify fields, and include instructions to make the form more user-friendly for your team. This customization makes it easier to ensure all necessary information is collected accurately.

Get more for Form 945

Find out other Form 945

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple