Instructions for Form 945 Internal Revenue Service 2022

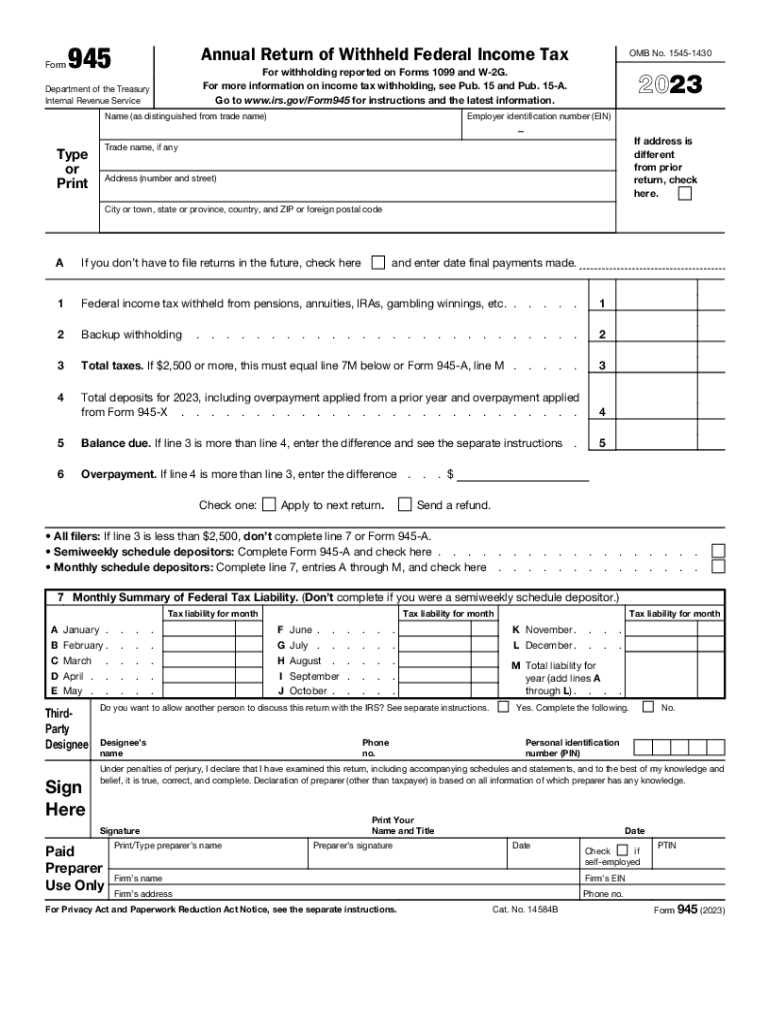

What is IRS Form 945?

IRS Form 945 is an annual return used to report withheld federal income tax from nonpayroll payments, such as those made to independent contractors or certain types of payments to corporations. This form is essential for businesses and organizations that have withheld federal income tax from payments made to individuals or entities throughout the year. Understanding the purpose of Form 945 is crucial for compliance with federal tax regulations.

Key Elements of IRS Form 945

Form 945 includes several important sections that must be completed accurately. Key elements of the form include:

- Identification Information: This section requires the name, address, and Employer Identification Number (EIN) of the entity filing the form.

- Withholding Amounts: Taxpayers must report the total amount of federal income tax withheld during the year.

- Payment Information: This section details how the withheld taxes were paid to the IRS, including any adjustments or corrections made during the year.

Steps to Complete IRS Form 945

Completing IRS Form 945 involves several steps to ensure accuracy and compliance. Here’s a simplified process:

- Gather necessary information, including your EIN and details of payments made throughout the year.

- Fill out the identification section with your business name and address.

- Report the total federal income tax withheld in the appropriate section.

- Review the form for accuracy and completeness before submission.

- Submit the form to the IRS by the specified deadline.

Filing Deadlines for IRS Form 945

The deadline for filing IRS Form 945 is typically January 31 of the year following the tax year being reported. If January 31 falls on a weekend or holiday, the deadline is extended to the next business day. It is important to adhere to these deadlines to avoid penalties and interest on unpaid taxes.

Form Submission Methods

IRS Form 945 can be submitted through various methods, providing flexibility for taxpayers. The available submission methods include:

- Online Filing: Taxpayers can file electronically using IRS-approved software.

- Mail: The form can be printed and mailed to the appropriate IRS address based on the taxpayer's location.

- In-Person: Some taxpayers may choose to deliver their forms directly to a local IRS office.

Penalties for Non-Compliance

Failure to file IRS Form 945 on time or inaccuracies in reporting can result in significant penalties. The IRS may impose fines based on the amount of tax owed and the duration of the delay. It is advisable for businesses to stay informed about their filing obligations to avoid unnecessary penalties.

Quick guide on how to complete instructions for form 945 internal revenue service

Complete Instructions For Form 945 Internal Revenue Service effortlessly on any device

Online document management has gained popularity among enterprises and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without issues. Manage Instructions For Form 945 Internal Revenue Service on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to adjust and eSign Instructions For Form 945 Internal Revenue Service with ease

- Find Instructions For Form 945 Internal Revenue Service and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select relevant portions of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to submit your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choosing. Adjust and eSign Instructions For Form 945 Internal Revenue Service and ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 945 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 945 internal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and why is it beneficial for my business?

airSlate SignNow is a powerful eSignature tool that allows businesses to send and sign documents electronically. It streamlines the signing process, making it more efficient and cost-effective, which is crucial for organizations aiming to enhance productivity without breaking the bank. With airSlate SignNow, you can manage contracts and agreements easily, ensuring you never miss an essential document.

-

How does airSlate SignNow pricing work?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. For just $945 per year, you can access features that help simplify your document workflows, making it an economical choice. Additionally, airSlate SignNow provides a free trial so you can experience the capabilities and see if it fits your needs before committing.

-

Can I integrate airSlate SignNow with my existing tools?

Absolutely! airSlate SignNow provides seamless integrations with popular CRM and business applications, such as Salesforce, Google Drive, and Dropbox. This flexibility allows you to incorporate the eSigning process into your existing workflows, making document management more streamlined than ever for just $945.

-

What features does airSlate SignNow offer?

airSlate SignNow includes a wealth of features such as customizable templates, tracking options, and secure storage for all your signed documents. These features empower businesses to fully utilize the tool for efficient document management, all while maintaining compliance and security — ensuring you get the most out of your $945 investment.

-

Is airSlate SignNow secure for sensitive documents?

Yes, airSlate SignNow ensures that your documents are handled with the highest security standards. All data is encrypted and stored securely, providing peace of mind when dealing with sensitive material. For businesses looking to protect their information while managing documents, this security is a key benefit of the $945 annual plan.

-

How long does it take to get started with airSlate SignNow?

Getting started with airSlate SignNow is quick and straightforward. After signing up for an account, you can start sending your first document for signatures within minutes. The user-friendly interface allows you to become familiar with the platform rapidly, making your investment of $945 worthwhile right from the start.

-

What customer support options are available for airSlate SignNow users?

airSlate SignNow provides robust customer support, including live chat, email assistance, and an extensive help center filled with resources. Whether you have questions about setting up your account or need help troubleshooting, support is readily available. Knowing that help is just a message away makes the $945 investment even more valuable.

Get more for Instructions For Form 945 Internal Revenue Service

- Bgsu schedule change form

- Request for exemption form doc

- Affidavit of financial support international students prescott erau form

- Renewal application university of north georgia form

- Www facilitiesservices ufl edudepartmentsutilitiesutilities and energy services ufuniversity of florida form

- Ag bio worksheet pdf nameteacherdateactivity 6 1 form

- Irsc edustudentsstudent recordsstudent records indian river state college form

- New york memorial hospital form

Find out other Instructions For Form 945 Internal Revenue Service

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy