Form 945 X Instructions for Adjusted Annual Return of 2021

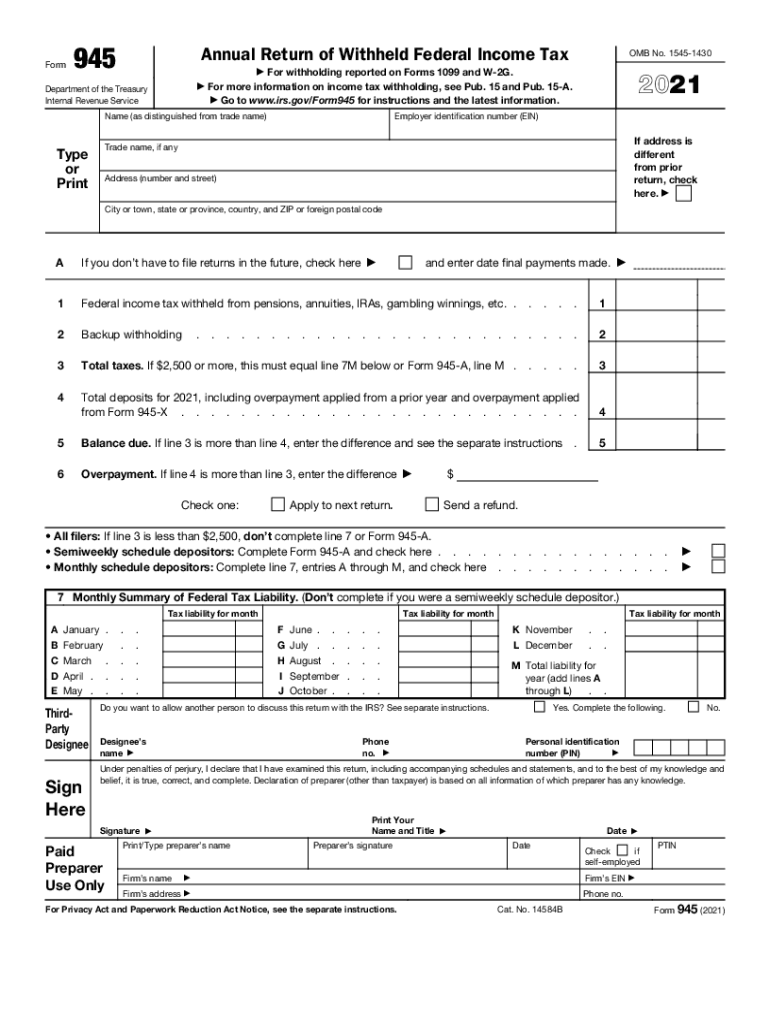

What is the Form 945 X?

The Form 945 X is used for filing an adjusted annual return of withheld federal income tax. This form is essential for businesses that need to correct errors made on the original Form 945. It allows taxpayers to accurately report any discrepancies in the amounts withheld and submitted to the IRS. Understanding the purpose of this form is crucial for maintaining compliance with federal tax regulations.

Steps to Complete the Form 945 X

Completing the Form 945 X involves several key steps to ensure accuracy and compliance. First, gather all relevant information, including the original Form 945 and any supporting documents. Next, clearly indicate the specific errors being corrected in the designated sections of the form. Provide the correct amounts and ensure that all entries are legible. Finally, review the completed form for any additional errors before submission. This careful attention to detail helps avoid further complications with the IRS.

IRS Guidelines for Form 945 X

The IRS provides specific guidelines for the completion and submission of Form 945 X. It is important to follow these guidelines closely to avoid penalties. The form must be filed within three years of the original due date of the Form 945. Additionally, any corrections should be made using the most current version of the form. Taxpayers should also ensure that they keep copies of all submitted documents for their records.

Filing Deadlines for Form 945 X

Filing deadlines for Form 945 X are critical for compliance. Generally, the form must be filed within three years from the original due date of the Form 945. This timeframe allows taxpayers to correct any errors without facing penalties. It is advisable to mark your calendar for these important dates to ensure timely submission and avoid complications with the IRS.

Penalties for Non-Compliance with Form 945 X

Failing to comply with the requirements for Form 945 X can result in significant penalties. The IRS may impose fines for late filing or for inaccuracies in the reported information. It is essential to ensure that all corrections are made in a timely manner to avoid these penalties. Understanding the implications of non-compliance can help businesses maintain their standing with the IRS and avoid unnecessary financial burdens.

Required Documents for Form 945 X

To complete the Form 945 X, certain documents are necessary. These include the original Form 945, any relevant payroll records, and documentation supporting the corrections being made. Having these documents readily available facilitates a smoother filing process and ensures that all necessary information is accurately reported to the IRS.

Quick guide on how to complete form 945 x instructions for adjusted annual return of

Manage Form 945 X Instructions For Adjusted Annual Return Of effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and physically signed documents, allowing you to easily locate the necessary form and store it securely online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Form 945 X Instructions For Adjusted Annual Return Of on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and eSign Form 945 X Instructions For Adjusted Annual Return Of with minimal effort

- Locate Form 945 X Instructions For Adjusted Annual Return Of and click Get Form to begin.

- Use the tools available to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate reprinting new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Modify and eSign Form 945 X Instructions For Adjusted Annual Return Of and guarantee effective communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 945 x instructions for adjusted annual return of

Create this form in 5 minutes!

How to create an eSignature for the form 945 x instructions for adjusted annual return of

How to generate an electronic signature for a PDF file in the online mode

How to generate an electronic signature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your smartphone

How to make an e-signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF on Android

People also ask

-

What is the michigan 5081 2021 form used for?

The michigan 5081 2021 form is utilized for specific document filings within the Michigan state. It typically pertains to tax purposes and compliance needs. Understanding this form is crucial for businesses dealing with state regulations and ensuring they meet all legal requirements.

-

How does airSlate SignNow facilitate the michigan 5081 2021 filing process?

airSlate SignNow provides a streamlined way to prepare, sign, and send the michigan 5081 2021 form electronically. With its user-friendly platform, you can quickly fill out and eSign documents, saving time and reducing paperwork. This automation helps businesses maintain compliance while improving efficiency.

-

What features does airSlate SignNow offer for michigan 5081 2021 documentation?

airSlate SignNow offers various features such as customizable templates, in-person signing, and advanced security to ensure your michigan 5081 2021 documents are handled safely. The platform supports multiple file formats and provides easy access to document history. These features enhance both user experience and regulatory compliance.

-

Is the pricing for airSlate SignNow competitive for michigan 5081 2021 users?

Yes, the pricing for airSlate SignNow is designed to be cost-effective for businesses needing to manage michigan 5081 2021 forms. With various subscription plans available, users can choose the option that best fits their volume of documents and budget. This affordability makes it accessible for small to large businesses alike.

-

Can I integrate airSlate SignNow with other software for michigan 5081 2021 processing?

Absolutely, airSlate SignNow offers integration capabilities with various applications, making it easy to incorporate the michigan 5081 2021 into your existing workflow. This integration ensures seamless document management, enhancing productivity. Common integrations include CRM systems, cloud storage, and project management tools.

-

What are the benefits of using airSlate SignNow for michigan 5081 2021?

Using airSlate SignNow for michigan 5081 2021 filing provides numerous benefits, including faster processing times and reduced errors. The eSignature feature allows for quick approvals while maintaining a legally binding status. Plus, the platform's extensive tracking capabilities keep you informed throughout the submission process.

-

Is airSlate SignNow secure for handling michigan 5081 2021 forms?

Yes, airSlate SignNow places a high priority on security, ensuring that your michigan 5081 2021 forms are protected with advanced encryption and security protocols. This commitment to safety means you can confidently manage sensitive documents without fear of data bsignNowes or unauthorized access.

Get more for Form 945 X Instructions For Adjusted Annual Return Of

Find out other Form 945 X Instructions For Adjusted Annual Return Of

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself