Form 945 Annual Return of Withheld Federal Income Tax 2014

What is the Form 945 Annual Return Of Withheld Federal Income Tax

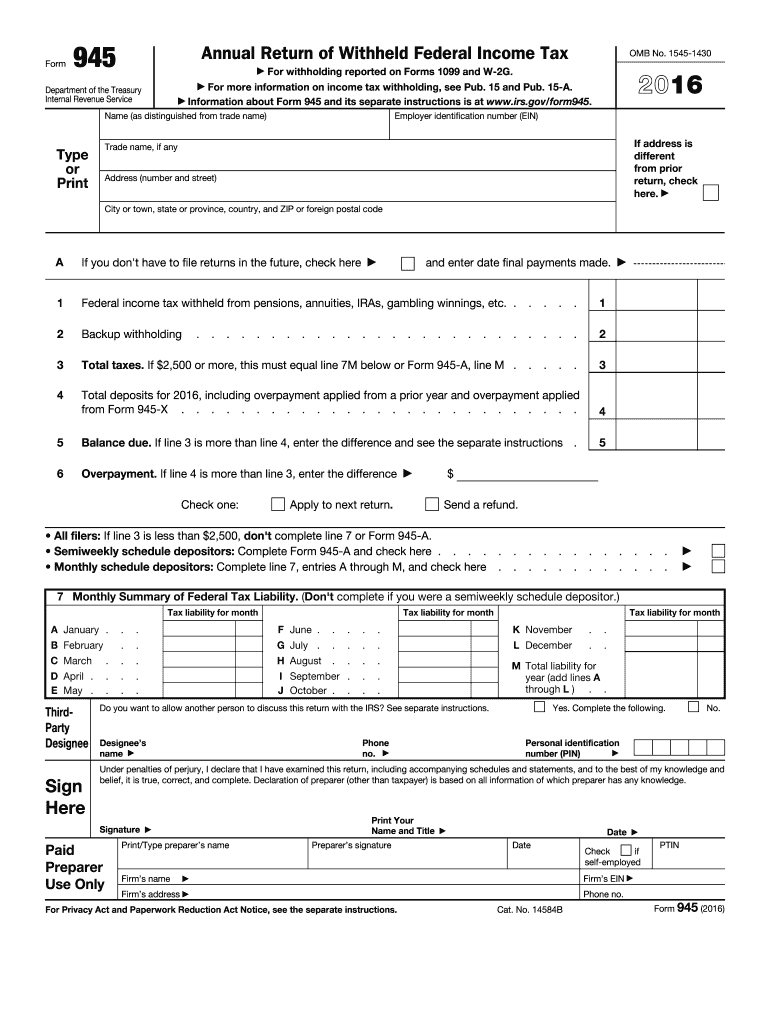

The Form 945 Annual Return of Withheld Federal Income Tax is a tax form used by employers and businesses to report federal income tax withheld from nonpayroll payments. This includes payments made to independent contractors, freelancers, and other non-employees. The form is essential for ensuring compliance with federal tax regulations and is typically submitted annually to the Internal Revenue Service (IRS).

Steps to complete the Form 945 Annual Return Of Withheld Federal Income Tax

Completing the Form 945 involves several key steps:

- Gather necessary information: Collect details such as the total amount of federal income tax withheld, your Employer Identification Number (EIN), and any relevant payment records.

- Fill out the form: Input the required information in the designated fields, ensuring accuracy to avoid penalties.

- Review the form: Double-check all entries for completeness and correctness.

- Submit the form: Choose your preferred submission method, whether electronically or via mail, and ensure it is sent by the deadline.

Filing Deadlines / Important Dates

It is crucial to adhere to the filing deadlines for the Form 945 to avoid penalties. The form is generally due on January thirty-first of the year following the tax year being reported. If January thirty-first falls on a weekend or holiday, the deadline is extended to the next business day. Employers should also be aware of any changes in deadlines announced by the IRS.

Legal use of the Form 945 Annual Return Of Withheld Federal Income Tax

The legal use of the Form 945 requires compliance with IRS regulations. Employers must accurately report the amount of federal income tax withheld to ensure proper tax collection. Failure to file or inaccuracies in reporting can lead to penalties and interest charges. It is important for businesses to understand their obligations under federal tax law and maintain accurate records to support their filings.

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting the Form 945. The form can be filed electronically through the IRS e-file system, which is often the quickest method. Alternatively, it can be mailed to the appropriate IRS address based on the employer's location. In-person submission is generally not available for this form. It is advisable to confirm the latest submission methods and requirements on the IRS website.

Key elements of the Form 945 Annual Return Of Withheld Federal Income Tax

The Form 945 includes several key elements that must be completed accurately:

- Employer Identification Number (EIN): This unique number identifies the business entity filing the form.

- Total withheld amount: The total federal income tax withheld from nonpayroll payments during the tax year.

- Signature: An authorized person must sign the form to validate the information provided.

- Contact information: Include the name and phone number of a contact person for any questions regarding the form.

How to obtain the Form 945 Annual Return Of Withheld Federal Income Tax

The Form 945 can be obtained directly from the IRS website, where it is available for download in PDF format. Additionally, businesses can request a physical copy by contacting the IRS or visiting a local IRS office. It is recommended to ensure you are using the most current version of the form to comply with IRS regulations.

Quick guide on how to complete 2016 form 945 annual return of withheld federal income tax

Accomplish Form 945 Annual Return Of Withheld Federal Income Tax effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed papers, enabling you to obtain the correct form and securely store it online. airSlate SignNow supplies all the resources you require to create, modify, and eSign your documents promptly without hold-ups. Manage Form 945 Annual Return Of Withheld Federal Income Tax on any gadget with airSlate SignNow Android or iOS applications and simplify any document-based task today.

The easiest way to modify and eSign Form 945 Annual Return Of Withheld Federal Income Tax without straining

- Find Form 945 Annual Return Of Withheld Federal Income Tax and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature with the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your updates.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 945 Annual Return Of Withheld Federal Income Tax and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 945 annual return of withheld federal income tax

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 945 annual return of withheld federal income tax

The way to make an electronic signature for a PDF document in the online mode

The way to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your mobile device

The way to generate an eSignature for a PDF document on iOS devices

How to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is Form 945 Annual Return Of Withheld Federal Income Tax?

Form 945 Annual Return Of Withheld Federal Income Tax is a tax form used by employers to report and pay federal income tax withheld from non-payroll payments, such as pensions, annuities, and gambling winnings. Understanding this form is essential for compliance with IRS regulations and ensuring accurate tax reporting.

-

Why should I use airSlate SignNow to manage Form 945 Annual Return Of Withheld Federal Income Tax?

airSlate SignNow simplifies the process of managing Form 945 Annual Return Of Withheld Federal Income Tax with its user-friendly interface and features designed for efficiency. Our platform allows you to eSign and share documents securely, ensuring that your tax submissions are accurate and delivered on time.

-

Is there a cost associated with using airSlate SignNow for Form 945 Annual Return Of Withheld Federal Income Tax?

Yes, airSlate SignNow offers several pricing plans to accommodate different business needs and budgets. Each plan provides access to features that streamline the handling of Form 945 Annual Return Of Withheld Federal Income Tax, making compliance easier while maintaining a cost-effective solution.

-

Can I integrate airSlate SignNow with other accounting software for managing Form 945 Annual Return Of Withheld Federal Income Tax?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and bookkeeping software, enhancing your ability to manage Form 945 Annual Return Of Withheld Federal Income Tax effectively. These integrations ensure that your financial data is synchronized, reducing the chances of errors and simplifying your tax processes.

-

How does airSlate SignNow ensure the security of my Form 945 Annual Return Of Withheld Federal Income Tax documents?

airSlate SignNow prioritizes security by employing advanced encryption technologies and secure server protocols. When you handle Form 945 Annual Return Of Withheld Federal Income Tax documents through our platform, you can trust that your sensitive information is protected from unauthorized access.

-

What features does airSlate SignNow offer for completing Form 945 Annual Return Of Withheld Federal Income Tax?

airSlate SignNow offers features such as customizable templates, easy eSigning, and automated workflows to streamline the completion of Form 945 Annual Return Of Withheld Federal Income Tax. These tools help enhance productivity, ensuring that you can complete your tax forms quickly and effectively.

-

Are there any resources available to help me understand Form 945 Annual Return Of Withheld Federal Income Tax better?

Yes, airSlate SignNow provides a wealth of resources, including guides, FAQs, and customer support dedicated to helping you understand Form 945 Annual Return Of Withheld Federal Income Tax. Our knowledgeable team is here to assist you as you navigate your tax obligations.

Get more for Form 945 Annual Return Of Withheld Federal Income Tax

Find out other Form 945 Annual Return Of Withheld Federal Income Tax

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement