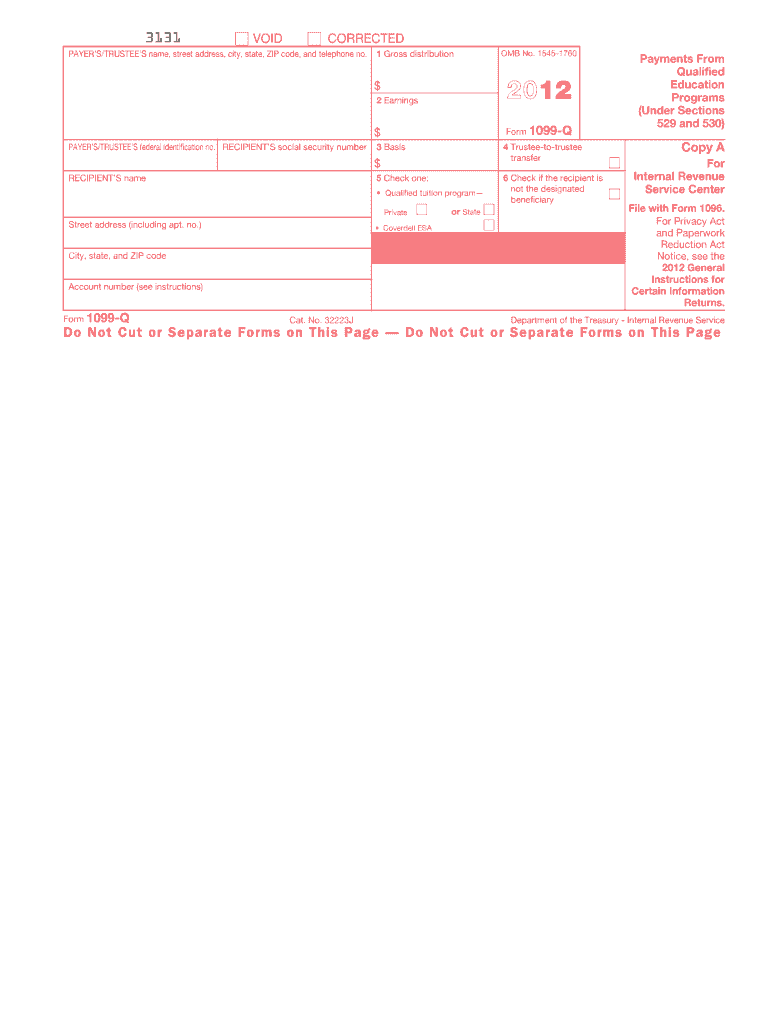

1099 Q Form 2012

What is the 1099 Q Form

The 1099 Q Form, officially known as the "Qualified Tuition Program (QTP) Distribution" form, is used to report distributions from qualified tuition programs, commonly referred to as 529 plans. These plans are tax-advantaged savings accounts designed to encourage saving for future education costs. The 1099 Q Form provides essential information regarding the amount of money withdrawn from the account, which can be used for qualified educational expenses such as tuition, fees, and room and board.

How to use the 1099 Q Form

Using the 1099 Q Form involves several steps. First, recipients must review the information provided on the form, including the total distribution amount and the portion that is taxable. This form is typically sent by the financial institution managing the 529 plan to both the account holder and the IRS. When preparing tax returns, individuals must report the distribution amounts on their federal income tax forms, ensuring they accurately reflect any taxable portions. It is crucial to maintain records of how the funds were used to substantiate any tax-free withdrawals.

Steps to complete the 1099 Q Form

Completing the 1099 Q Form requires careful attention to detail. Follow these steps:

- Gather relevant information, including the total distribution amount and the purpose of the withdrawal.

- Fill out the form with accurate details such as the recipient's name, Social Security number, and the amount distributed.

- Indicate the portion of the distribution that is taxable, if applicable.

- Submit the completed form to the IRS along with your tax return, ensuring you keep a copy for your records.

Legal use of the 1099 Q Form

The legal use of the 1099 Q Form is primarily tied to tax reporting requirements. The IRS mandates that any distributions from a qualified tuition program be reported, ensuring compliance with tax laws. Failure to report this income can lead to penalties or additional taxes owed. It is important for recipients to understand the tax implications of their distributions, particularly regarding qualified versus non-qualified expenses, as this can affect their tax liability.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 Q Form align with the general tax filing schedule. Typically, the form must be sent to recipients by January 31 of the year following the distribution. Additionally, the IRS requires that the form be filed by the end of February if submitting by paper, or by March 31 if filing electronically. Keeping track of these dates is essential to avoid late filing penalties.

Who Issues the Form

The 1099 Q Form is issued by the financial institution or entity that manages the qualified tuition program. This could be a state agency, a bank, or another financial services provider. It is the responsibility of these institutions to provide accurate information regarding distributions made from the 529 plans to both the account holder and the IRS.

Quick guide on how to complete 2012 1099 q form

Effortlessly prepare 1099 Q Form on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents quickly and without delays. Manage 1099 Q Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to edit and electronically sign 1099 Q Form with ease

- Locate 1099 Q Form and click Get Form to commence.

- Make use of the tools we offer to submit your document.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that require creating new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you prefer. Edit and electronically sign 1099 Q Form to ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 1099 q form

Create this form in 5 minutes!

How to create an eSignature for the 2012 1099 q form

The best way to make an eSignature for a PDF document in the online mode

The best way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is the 1099 Q Form and why do I need it?

The 1099 Q Form is essential for reporting distributions from qualified education programs, including Coverdell ESAs and 529 plans. If you received any distributions for educational expenses, this form ensures you can accurately report this income during tax season.

-

How can airSlate SignNow help with the 1099 Q Form?

airSlate SignNow simplifies the process of sending and signing your 1099 Q Form electronically. This easy-to-use platform allows you to securely manage your documents, ensuring that your 1099 Q Form signNowes the necessary parties quickly and efficiently.

-

Is airSlate SignNow a cost-effective solution for handling 1099 Q Forms?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business needs, making it a cost-effective solution for managing 1099 Q Forms. You can save time and reduce costs associated with traditional paper processing while enjoying a seamless digital experience.

-

What features does airSlate SignNow offer for managing the 1099 Q Form?

airSlate SignNow provides several features for managing the 1099 Q Form, including electronic signatures, document tracking, and customizable templates. These features streamline the process, ensuring that you can efficiently prepare and send your forms without any hassle.

-

Are there integrations available for using the 1099 Q Form with airSlate SignNow?

Yes, airSlate SignNow offers integrations with various accounting and finance tools that can assist in managing the 1099 Q Form. This integration ensures that you can easily sync your financial data and streamline your tax reporting process.

-

Can I store my 1099 Q Form securely with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security and offers a secure cloud storage option for your 1099 Q Form. Your documents are protected with encryption and can only be accessed by authorized individuals, ensuring your sensitive information remains confidential.

-

What are the benefits of using airSlate SignNow for the 1099 Q Form?

Using airSlate SignNow for the 1099 Q Form offers multiple benefits, including reduced turnaround time for document processing and enhanced collaboration features. You'll find it easier to manage your documents, track their status, and retain compliance during tax season.

Get more for 1099 Q Form

Find out other 1099 Q Form

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF