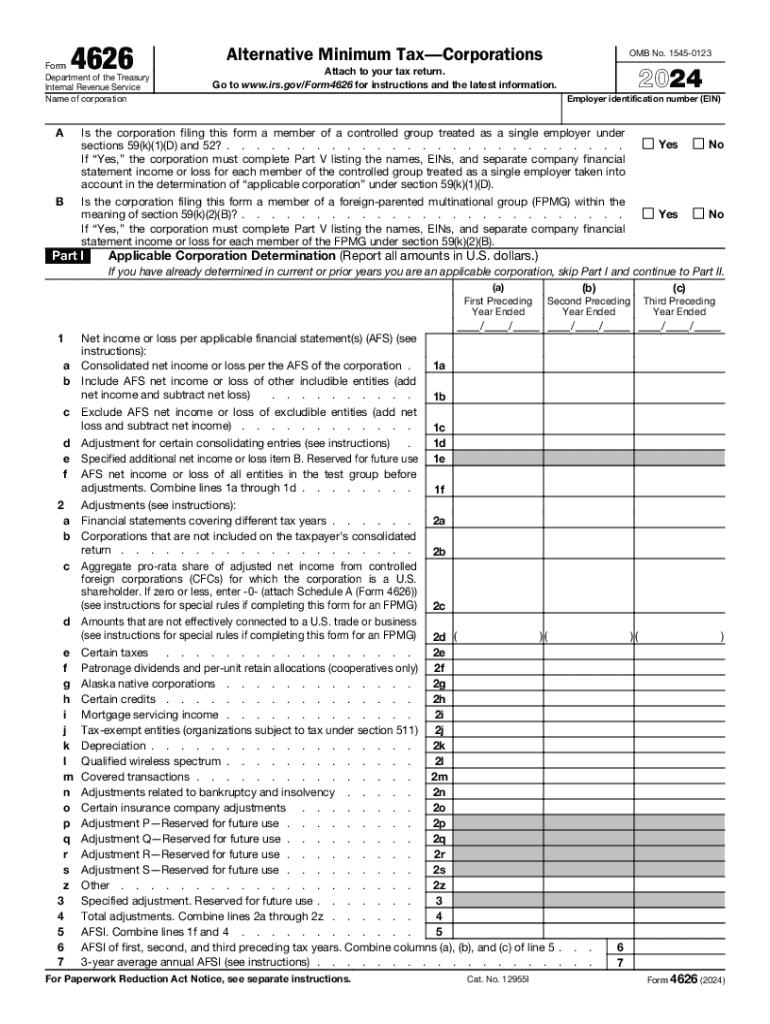

Form 4626 Alternative Minimum TaxCorporations

What is the Form 4626 Alternative Minimum Tax for Corporations

The Form 4626 is a tax form used by corporations to calculate their Alternative Minimum Tax (AMT). The AMT is designed to ensure that corporations pay a minimum amount of tax, regardless of deductions or credits. This form is essential for corporations that may have significant tax benefits that could reduce their tax liability to zero under the regular tax system. By using the 4626 form, businesses can determine their AMT liability, which is calculated based on adjusted current earnings and specific AMT depreciation tables provided by the IRS.

How to Use the Form 4626 Alternative Minimum Tax for Corporations

To effectively use Form 4626, corporations must first gather their financial data, including taxable income and any applicable deductions. The form requires the completion of various sections that detail income adjustments, preferences, and tax credits. Corporations should carefully follow the instructions provided with the form to ensure accurate calculations. After completing the form, it is crucial to review all entries for accuracy before submission, as mistakes can lead to penalties or delays in processing.

Steps to Complete the Form 4626 Alternative Minimum Tax for Corporations

Completing Form 4626 involves several key steps:

- Gather necessary financial documents, including income statements and tax records.

- Calculate your taxable income and identify any adjustments required for AMT purposes.

- Fill out the form by following the provided instructions, ensuring all entries are accurate.

- Review the completed form for errors or omissions.

- Submit the form by the appropriate deadline, either electronically or by mail.

Key Elements of the Form 4626 Alternative Minimum Tax for Corporations

Key elements of Form 4626 include:

- Adjusted Current Earnings: This figure is crucial for calculating AMT liability and includes various income adjustments.

- AMT Depreciation Tables: These tables provide specific guidelines for depreciation calculations under the AMT system.

- Tax Credits: Certain credits may be applicable, which can reduce the overall AMT liability.

- Filing Instructions: Detailed instructions accompany the form, guiding corporations on how to complete and file it correctly.

Filing Deadlines / Important Dates for Form 4626

Corporations must adhere to specific filing deadlines for Form 4626 to avoid penalties. Typically, the form is due on the same date as the corporation's federal income tax return. For most corporations, this means the form must be filed by the fifteenth day of the third month following the end of the tax year. However, corporations should verify the exact deadlines each year, as they may vary based on specific circumstances or changes in tax law.

IRS Guidelines for Form 4626

The IRS provides comprehensive guidelines for completing Form 4626. These guidelines outline eligibility criteria, necessary documentation, and detailed instructions for each section of the form. Corporations are encouraged to review these guidelines thoroughly to ensure compliance with federal tax regulations. Additionally, the IRS updates these guidelines periodically, so staying informed about any changes is essential for accurate filing.

Handy tips for filling out Form 4626 Alternative Minimum TaxCorporations online

Quick steps to complete and e-sign Form 4626 Alternative Minimum TaxCorporations online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Get access to a GDPR and HIPAA compliant solution for optimum simpleness. Use signNow to e-sign and share Form 4626 Alternative Minimum TaxCorporations for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4626 alternative minimum taxcorporations 771141477

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 4626 and how can airSlate SignNow help with it?

Form 4626 is a tax form used for calculating the alternative minimum tax for corporations. airSlate SignNow simplifies the process of completing and eSigning form 4626 by providing an intuitive platform that allows users to fill out, sign, and send documents securely and efficiently.

-

Is there a cost associated with using airSlate SignNow for form 4626?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that streamline the completion and eSigning of form 4626, ensuring that you get the best value for your investment.

-

What features does airSlate SignNow offer for managing form 4626?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure cloud storage, all of which enhance the management of form 4626. These tools help users efficiently prepare and track their documents, ensuring compliance and accuracy.

-

Can I integrate airSlate SignNow with other software for form 4626?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including CRM and accounting software. This integration allows users to easily import data into form 4626, reducing manual entry and minimizing errors.

-

What are the benefits of using airSlate SignNow for form 4626?

Using airSlate SignNow for form 4626 offers numerous benefits, including time savings, enhanced security, and improved collaboration. The platform's user-friendly interface ensures that even those unfamiliar with tax forms can navigate the process with ease.

-

How secure is airSlate SignNow when handling form 4626?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive information related to form 4626. Users can trust that their documents are safe and secure throughout the eSigning process.

-

Is there customer support available for questions about form 4626?

Yes, airSlate SignNow provides dedicated customer support to assist users with any questions regarding form 4626. Whether you need help with features or troubleshooting, our support team is ready to help you navigate the platform.

Get more for Form 4626 Alternative Minimum TaxCorporations

- Employment form 100096541

- Silver eagle checklist form

- Documentation of supervised counseling experience nj form

- Creb residential tenancy agreement form

- Drivers license renewal form illinois

- Ontrack reprocessing in servicecompetency for oer pro form

- Bautismonational shrine of our lady of guadalupe form

- Retention system provider training instructions and form

Find out other Form 4626 Alternative Minimum TaxCorporations

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now