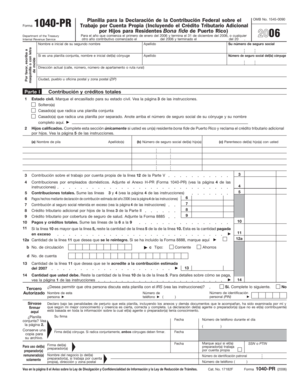

Form 1040 PR IRS Irs

What is the Form 1040 PR?

The Form 1040 PR is a tax return form specifically designed for residents of Puerto Rico. It allows individuals to report their income and calculate their tax liability to the Internal Revenue Service (IRS). Unlike the standard Form 1040 used on the mainland, the Form 1040 PR accommodates the unique tax laws and regulations applicable to Puerto Rico. This form is essential for residents who earn income and need to fulfill their tax obligations while taking advantage of any available deductions and credits specific to the territory.

How to use the Form 1040 PR

Using the Form 1040 PR involves several steps to ensure accurate reporting of income and tax calculations. Begin by gathering all necessary financial documents, such as W-2s, 1099s, and other income statements. Next, fill out the form by entering your personal information, including your name, address, and Social Security number. Report your income from various sources and claim any applicable deductions and credits. Finally, calculate your total tax liability and determine if you owe money or are due a refund. It is advisable to review the completed form for accuracy before submission.

Steps to complete the Form 1040 PR

Completing the Form 1040 PR requires careful attention to detail. Follow these steps:

- Gather all relevant income documents, including W-2s and 1099s.

- Fill in your personal information at the top of the form.

- Report your total income in the designated sections.

- Claim deductions and credits available to you as a resident of Puerto Rico.

- Calculate your total tax liability based on the information provided.

- Review the form for any errors or omissions.

- Sign and date the form before submission.

Legal use of the Form 1040 PR

The Form 1040 PR serves a legal purpose in tax compliance for residents of Puerto Rico. It is recognized by the IRS as an official document for reporting income and calculating taxes. To ensure that the form is legally binding, it must be filled out accurately and submitted by the appropriate deadlines. Additionally, electronic signatures may be used if the form is submitted online, provided that the e-signature complies with the relevant laws governing electronic documents.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 PR generally align with the federal tax calendar. The typical deadline for submission is April 15 of each year. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. Taxpayers should also be aware of any extensions available for filing, which may provide additional time to complete the form without incurring penalties. It is crucial to stay informed about any changes to deadlines that the IRS may announce.

Required Documents

To complete the Form 1040 PR accurately, several documents are required. These include:

- W-2 forms from employers detailing wages earned.

- 1099 forms for other income sources, such as freelance work or interest.

- Documentation for any deductions or credits claimed, such as receipts for medical expenses or education costs.

- Previous year’s tax return for reference.

Having these documents ready will streamline the process of filling out the form and ensure that all income is reported correctly.

Quick guide on how to complete form 1040pr

Effortlessly prepare form 1040pr on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute to conventional printed and signed documents, as you can obtain the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any hold-ups. Handle form 1040pr on any platform with the airSlate SignNow apps available for Android or iOS and simplify your document-related procedures today.

Edit and electronically sign form 1040pr with ease

- Obtain form 1040pr and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools particularly designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your desktop.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign form 1040pr and guarantee exceptional communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to form 1040pr

Create this form in 5 minutes!

How to create an eSignature for the form 1040pr

How to make an electronic signature for your 2006 Form 1040 Pr Irs Irs online

How to generate an electronic signature for your 2006 Form 1040 Pr Irs Irs in Chrome

How to create an electronic signature for putting it on the 2006 Form 1040 Pr Irs Irs in Gmail

How to create an electronic signature for the 2006 Form 1040 Pr Irs Irs straight from your smart phone

How to create an electronic signature for the 2006 Form 1040 Pr Irs Irs on iOS devices

How to create an electronic signature for the 2006 Form 1040 Pr Irs Irs on Android

People also ask form 1040pr

-

What is form 1040pr and why is it important?

Form 1040PR is the Puerto Rican version of the federal income tax return that residents must file. It is crucial for compliance with tax regulations and ensures that taxpayers receive any eligible refunds or credits. Understanding form 1040PR is essential for accurate income reporting and tax planning.

-

How can airSlate SignNow help me with form 1040pr?

AirSlate SignNow provides a seamless platform for electronically signing and sending documents, including form 1040PR. With user-friendly features and security measures, you can ensure that your tax documents are signed quickly and safely. This streamlines the filing process, making it easier to meet deadlines.

-

What are the pricing options for using airSlate SignNow with form 1040pr?

AirSlate SignNow offers various pricing plans to cater to different business needs, starting from a basic plan to more advanced tiers. Each plan includes features that facilitate document management and e-signing for forms like 1040PR. You can choose a plan that fits your requirements and budget.

-

Are there any specific features for managing form 1040pr on airSlate SignNow?

Yes, airSlate SignNow includes features such as customizable templates, document tracking, and reminders that enhance the experience of managing form 1040PR. These tools ensure that you can prepare, sign, and send your tax documents efficiently. This feature set allows users to maintain organization and compliance.

-

Can I integrate airSlate SignNow with other software for filing form 1040pr?

Absolutely! AirSlate SignNow supports integrations with various accounting and tax software that facilitate filing form 1040PR. This allows you to streamline your workflows and ensure that your documents are managed appropriately across platforms, enhancing your overall productivity.

-

What are the benefits of using airSlate SignNow for form 1040pr?

Using airSlate SignNow for form 1040PR provides numerous benefits, including time savings, enhanced security, and increased efficiency. The platform's intuitive interface allows users to navigate document signing effortlessly, which is particularly beneficial during tax season. Additionally, you can ensure compliance with e-signature laws, thus protecting your business.

-

Is airSlate SignNow compliant with e-signature laws for form 1040pr?

Yes, airSlate SignNow complies with all relevant e-signature laws, making it a suitable choice for signing form 1040PR. The platform adheres to standards set by the ESIGN Act and UETA, ensuring that your electronically signed documents are legally valid and enforceable. This compliance gives users peace of mind when preparing their tax returns.

Get more for form 1040pr

- Kentucky personal property tax form fill out and sign

- General instructions use this form to request an extension

- Form st 809 new york state and local sales and use tax return for part quarterly monthly filers revised 1223

- Personal property tax forms and instructions excel

- Louisiana sales tax form

- Kentucky resale print form

- R1029i 823sales tax return general instructions form

- Kentucky education and labor cabinet welcome form

Find out other form 1040pr

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy