Form ST 809 New York State and Local Sales and Use Tax Return for Part Quarterly Monthly Filers Revised 1223 2023

Understanding the NY ST 809 Form

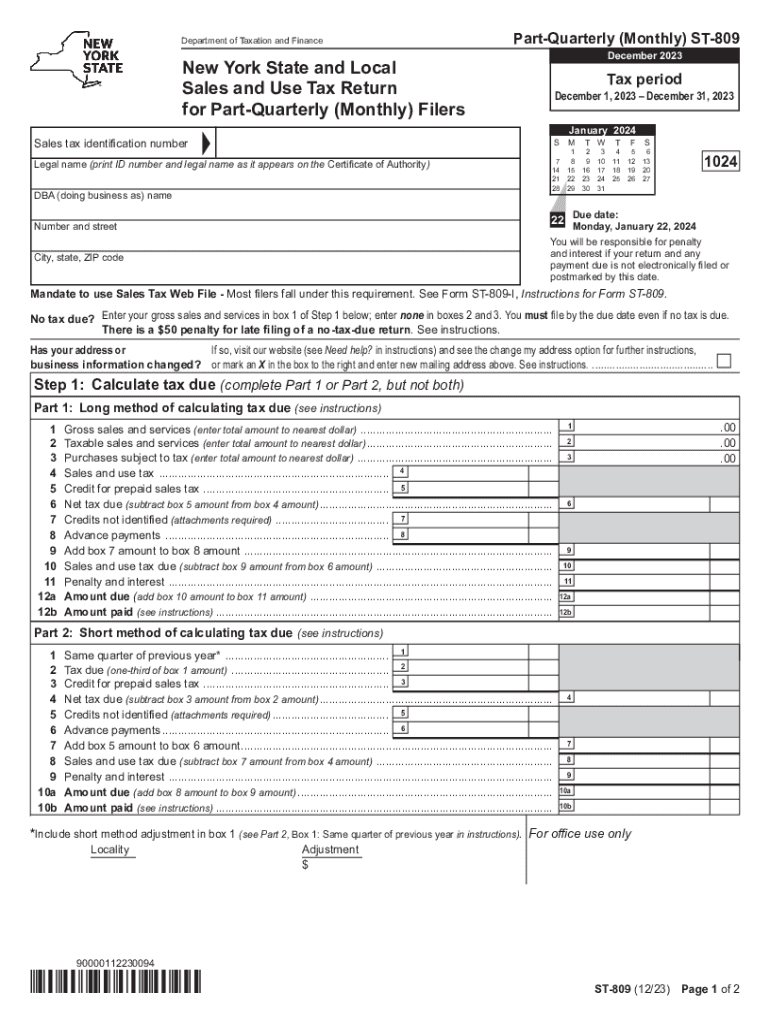

The NY ST 809 form, officially known as the New York State and Local Sales and Use Tax Return for Part Quarterly Monthly Filers, is a crucial document for businesses operating in New York. This form is specifically designed for those who must report sales and use tax collected during a specified period. It is essential for compliance with state tax regulations, ensuring that businesses accurately report their tax liabilities to the New York State Department of Taxation and Finance.

Steps to Complete the NY ST 809 Form

Completing the NY ST 809 form involves several key steps. First, gather all necessary financial records, including sales receipts and purchase invoices. Next, accurately calculate the total sales and use tax due for the reporting period. Ensure that all amounts are clearly documented on the form. After filling out the form, review it for accuracy before submitting it to avoid potential penalties. It is advisable to keep a copy of the completed form for your records.

Key Elements of the NY ST 809 Form

The NY ST 809 form includes several important sections that businesses must complete. These sections typically cover the following:

- Business Information: This includes the business name, address, and identification number.

- Sales and Use Tax Calculations: Details regarding total sales, exempt sales, and the total tax due.

- Payment Information: Instructions for submitting payment for the tax owed.

Each section must be filled out accurately to ensure compliance with state tax laws.

Filing Deadlines and Important Dates

Timely filing of the NY ST 809 form is critical to avoid penalties. The deadlines for submitting the form vary depending on whether a business is a monthly or quarterly filer. Generally, monthly filers must submit the form by the 20th of the following month, while quarterly filers have a deadline of the 20th of the month following the end of the quarter. It is essential to mark these dates on your calendar to ensure compliance.

Legal Use of the NY ST 809 Form

The NY ST 809 form is legally required for businesses that collect sales tax in New York. Failure to file this form can result in significant penalties, including fines and interest on unpaid tax amounts. It is important for business owners to understand their legal obligations regarding sales tax collection and reporting to avoid any legal issues with the state.

Obtaining the NY ST 809 Form

Businesses can obtain the NY ST 809 form through the New York State Department of Taxation and Finance website. The form is available for download in PDF format, allowing users to print and fill it out manually or complete it digitally. Additionally, businesses may contact the department directly for assistance in obtaining the form or for any questions related to its completion.

Quick guide on how to complete form st 809 new york state and local sales and use tax return for part quarterly monthly filers revised 1223

Effortlessly Prepare Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1223 on Any Device

The use of online document management has surged among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to swiftly create, modify, and electronically sign your documents without delays. Manage Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1223 on any device with the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

How to Modify and eSign Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1223 with Ease

- Locate Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1223 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important sections of your documents or conceal sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to finalize your changes.

- Decide how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors necessitating the reprinting of new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1223 while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form st 809 new york state and local sales and use tax return for part quarterly monthly filers revised 1223

Create this form in 5 minutes!

How to create an eSignature for the form st 809 new york state and local sales and use tax return for part quarterly monthly filers revised 1223

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NY ST 809 form, and why is it important?

The NY ST 809 form is a crucial document used for various tax-related transactions in New York State. It serves as a certificate for vendors to establish tax-exempt status for their purchases. Understanding its significance helps businesses manage their tax obligations efficiently.

-

How can airSlate SignNow assist with filling out the NY ST 809 form?

airSlate SignNow offers an easy-to-use platform that streamlines the process of filling out the NY ST 809 form. With our electronic signature capabilities, you can fill out and send the form quickly, ensuring your documents are both compliant and secure. This simplifies the filing process and saves time.

-

Is there a cost associated with using airSlate SignNow for the NY ST 809 form?

Yes, airSlate SignNow provides various pricing plans that cater to businesses of all sizes. These plans include features that facilitate the completion and electronic signing of the NY ST 809 form, making the solution both cost-effective and efficient. You can choose a plan that fits your needs.

-

What features does airSlate SignNow offer for handling the NY ST 809 form?

airSlate SignNow provides features such as templates, cloud storage, and secure e-signatures for handling the NY ST 809 form. These tools allow for quick edits and collaborations, helping you manage your documents seamlessly. Our user-friendly interface ensures that you can complete forms effortlessly.

-

Can I integrate airSlate SignNow with other applications for the NY ST 809 form?

Absolutely! airSlate SignNow supports a range of integrations with popular applications, making it easy to link your workflow with tools you already use. This capability enhances your productivity when working with the NY ST 809 form and other documents.

-

What are the benefits of using airSlate SignNow for the NY ST 809 form?

Utilizing airSlate SignNow for the NY ST 809 form offers numerous benefits, including efficiency, cost-effectiveness, and secure document handling. By automating the signing and submission process, you reduce the likelihood of errors and delays. This ultimately leads to better compliance and faster processing.

-

Is customer support available if I have questions about the NY ST 809 form?

Yes, airSlate SignNow provides comprehensive customer support to assist you with any questions regarding the NY ST 809 form. Our team is available to help you navigate the platform and resolve any issues that may arise during the signing process. We are committed to your success.

Get more for Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1223

- State of illinois department of human services 3 dhs state il form

- Dfss intake form bright star community outreach

- Child amp adolescent intake form

- Imfrf application form 3 dated 1 dec 14 state active duty onlydocx

- Illinois food service permit form

- Michel malek form

- Case closure form 16832159

- Efs new jersey loan program credit application energy finance form

Find out other Form ST 809 New York State And Local Sales And Use Tax Return For Part Quarterly Monthly Filers Revised 1223

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast