Schedule R Form 990 Rev January 2025 Related Organizations and Unrelated Partnerships 2025-2026

Understanding the Schedule R Form 990 for Related Organizations

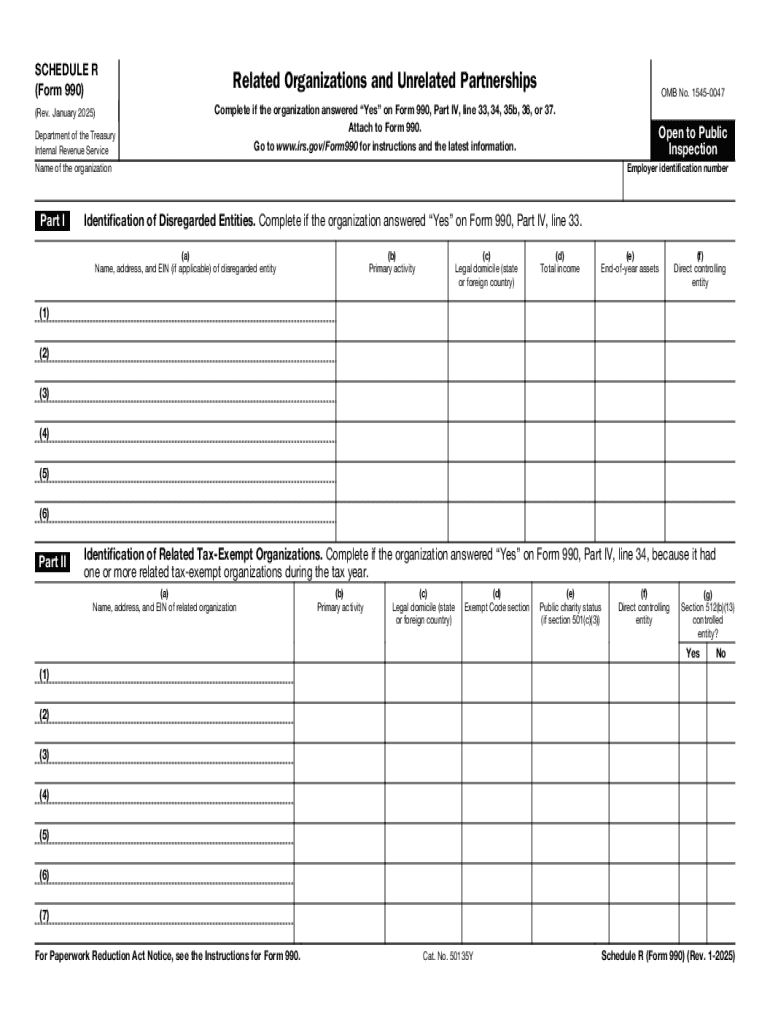

The Schedule R Form 990 is specifically designed for organizations that have related organizations or unrelated partnerships. This form helps to provide detailed information about the relationships between the filing organization and its related entities. It is essential for ensuring compliance with IRS regulations and for maintaining transparency in financial reporting. The form is particularly important for tax-exempt organizations, as it outlines how these relationships can affect their tax status and reporting obligations.

How to Complete the Schedule R Form 990

Completing the Schedule R Form 990 involves several key steps. First, gather all necessary information about the related organizations and partnerships. This includes names, addresses, and the nature of the relationships. Next, complete each section of the form accurately, ensuring that all details are consistent with your main Form 990. Pay special attention to the sections that require disclosures about financial transactions and governance structures. Finally, review the completed form for any errors or omissions before submission.

Obtaining the Schedule R Form 990

The Schedule R Form 990 can be obtained directly from the IRS website or through tax preparation software that supports IRS forms. It is important to ensure that you are using the most current version of the form, as revisions may occur annually. If you are unsure about which version to use, consult the IRS guidelines or a tax professional for assistance.

Filing Deadlines for the Schedule R Form 990

Filing deadlines for the Schedule R Form 990 align with the deadlines for the main Form 990. Typically, organizations must file their Form 990 by the fifteenth day of the fifth month after the end of their fiscal year. For organizations operating on a calendar year, this means the due date is May fifteenth. It is crucial to be aware of these deadlines to avoid penalties and ensure compliance with IRS regulations.

Key Elements of the Schedule R Form 990

Key elements of the Schedule R Form 990 include details about related organizations, the nature of the relationships, and any financial transactions that occurred between the entities. The form also requires information about governance, such as board members and officers of the related organizations. Providing complete and accurate information in these sections is vital for maintaining compliance and transparency.

Legal Use of the Schedule R Form 990

The Schedule R Form 990 serves a legal purpose by documenting the relationships between organizations and ensuring compliance with IRS regulations. Accurate completion of this form helps organizations avoid legal issues related to tax-exempt status and provides a clear record of financial transactions and governance structures. Organizations must understand the legal implications of the information reported on this form to protect their interests.

Examples of Using the Schedule R Form 990

Examples of when to use the Schedule R Form 990 include situations where a nonprofit organization collaborates with other nonprofits or has partnerships with for-profit entities. For instance, if a charitable organization receives funding from a related organization, it must disclose this relationship on the Schedule R. Another example is when an organization has shared board members with another entity, which also needs to be reported. These examples illustrate the importance of accurately reflecting relationships on the form to maintain compliance and transparency.

Create this form in 5 minutes or less

Find and fill out the correct schedule r form 990 rev january 2025 related organizations and unrelated partnerships

Create this form in 5 minutes!

How to create an eSignature for the schedule r form 990 rev january 2025 related organizations and unrelated partnerships

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 990 related form and why is it important?

A 990 related form is a tax document that nonprofit organizations must file with the IRS to provide information about their financial status. It is crucial for maintaining transparency and compliance with federal regulations. Understanding how to properly complete a 990 related form can help organizations avoid penalties and ensure continued tax-exempt status.

-

How can airSlate SignNow help with the 990 related form?

airSlate SignNow offers a streamlined solution for electronically signing and sending the 990 related form. With our user-friendly interface, you can easily gather signatures from board members and ensure that your documents are securely stored. This simplifies the filing process and helps you stay organized.

-

What features does airSlate SignNow provide for managing 990 related forms?

airSlate SignNow includes features such as customizable templates, automated reminders, and secure cloud storage specifically designed for managing 990 related forms. These tools enhance efficiency and reduce the risk of errors during the filing process. Additionally, our platform allows for easy collaboration among team members.

-

Is airSlate SignNow cost-effective for handling 990 related forms?

Yes, airSlate SignNow is a cost-effective solution for managing 990 related forms. Our pricing plans are designed to fit various budgets, making it accessible for nonprofits of all sizes. By reducing the time spent on paperwork, you can allocate more resources to your organization's mission.

-

Can I integrate airSlate SignNow with other software for 990 related forms?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and document management software, enhancing your workflow for 990 related forms. This integration allows for easy data transfer and ensures that all your documents are in one place, simplifying the filing process.

-

What are the benefits of using airSlate SignNow for 990 related forms?

Using airSlate SignNow for 990 related forms offers numerous benefits, including increased efficiency, enhanced security, and improved compliance. Our platform ensures that your documents are signed and stored securely, reducing the risk of data bsignNowes. Additionally, the ease of use allows your team to focus on more critical tasks.

-

How secure is airSlate SignNow when handling 990 related forms?

airSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect your 990 related forms. Our platform complies with industry standards to ensure that your sensitive information remains confidential. You can trust that your documents are safe with us.

Get more for Schedule R Form 990 Rev January 2025 Related Organizations And Unrelated Partnerships

- Diabetes placemat pdf form

- Greyhound baggage tracking form

- Laptop damage evaluation form marist college emerald

- Confidential statement of finances bucknell university bucknell form

- Form 2 revised nomination and declaration

- Adventure academy program online application form

- Hardware as a service agreement template form

- Hardware reseller agreement template form

Find out other Schedule R Form 990 Rev January 2025 Related Organizations And Unrelated Partnerships

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now