3 Schedule R 990 Form to Edit, Download & Print 2021

Understanding the 2021 Schedule R Form

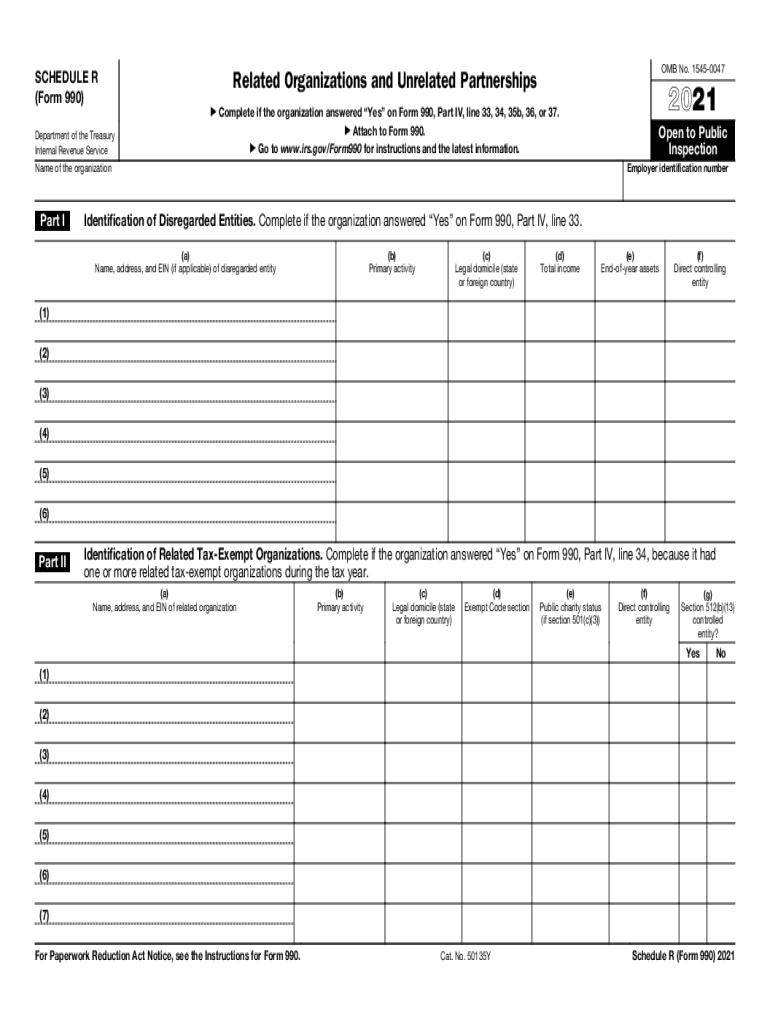

The 2021 Schedule R form is a crucial document for certain tax-exempt organizations that need to report their unrelated business income. This form helps organizations determine the amount of income that is subject to unrelated business income tax (UBIT). It is essential for maintaining compliance with IRS regulations and ensuring accurate tax reporting. Organizations must accurately complete this form to avoid penalties and ensure proper tax treatment.

Steps to Complete the 2021 Schedule R Form

Completing the 2021 Schedule R form involves several key steps:

- Gather necessary financial documents, including income statements and expense records related to unrelated business activities.

- Begin by filling out the organization's identifying information at the top of the form.

- Report the unrelated business income in Part I, ensuring to separate it from other types of income.

- In Part II, calculate the allowable deductions related to the unrelated business income.

- Complete Part III, where you will summarize the tax liability based on the income and deductions reported.

- Review the completed form for accuracy before submission.

Legal Use of the 2021 Schedule R Form

The 2021 Schedule R form is legally binding when properly completed and submitted to the IRS. This form must be filed by organizations that engage in unrelated business activities to ensure compliance with tax laws. Failure to file the form or inaccuracies can lead to penalties, including fines and additional tax liabilities. It is important for organizations to understand the legal implications of the information reported on this form.

Filing Deadlines for the 2021 Schedule R Form

Timely filing of the 2021 Schedule R form is essential to avoid penalties. The form is typically due on the fifteenth day of the fifth month after the end of the organization’s tax year. For organizations operating on a calendar year, this means the form is due by May 15, 2022. If additional time is needed, organizations can file for an extension, but they must ensure that any taxes owed are paid by the original deadline to avoid interest and penalties.

IRS Guidelines for the 2021 Schedule R Form

The IRS provides specific guidelines for completing the 2021 Schedule R form. Organizations must adhere to these guidelines to ensure compliance and accuracy. Key points include:

- Understanding the definitions of unrelated business income and related deductions.

- Following the instructions provided for each part of the form carefully.

- Maintaining accurate records to support the income and deductions reported.

Examples of Using the 2021 Schedule R Form

Organizations may encounter various scenarios that require the use of the 2021 Schedule R form. For instance, a nonprofit that operates a gift shop may need to report income generated from sales as unrelated business income. Additionally, if a charity holds a fundraising event that includes activities unrelated to its mission, it must report the income from that event on the Schedule R form. These examples illustrate the importance of accurately reporting unrelated business activities to maintain compliance with IRS regulations.

Quick guide on how to complete 3 schedule r 990 form free to edit download ampamp print

Complete 3 Schedule R 990 Form To Edit, Download & Print seamlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to access the right form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents quickly and without delays. Handle 3 Schedule R 990 Form To Edit, Download & Print on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and electronically sign 3 Schedule R 990 Form To Edit, Download & Print with ease

- Find 3 Schedule R 990 Form To Edit, Download & Print and then click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you would like to send your form, whether it be via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign 3 Schedule R 990 Form To Edit, Download & Print to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 3 schedule r 990 form free to edit download ampamp print

Create this form in 5 minutes!

How to create an eSignature for the 3 schedule r 990 form free to edit download ampamp print

How to create an electronic signature for your PDF document online

How to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The way to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

The way to create an electronic signature for a PDF on Android OS

People also ask

-

What is the 2021 schedule r, and why is it important for businesses?

The 2021 schedule r is a tax form used by businesses to report specific tax information. Understanding this form is crucial for compliance and optimizing tax strategies. airSlate SignNow simplifies this process by enabling you to easily send, eSign, and manage documents related to your 2021 schedule r.

-

How can airSlate SignNow help with submitting the 2021 schedule r?

AirSlate SignNow streamlines the submission of the 2021 schedule r by providing a secure and efficient way to eSign and send documents. With its user-friendly interface, you can upload and organize your tax forms quickly. This ensures that your 2021 schedule r is submitted accurately and on time.

-

What are the pricing plans for airSlate SignNow regarding the 2021 schedule r?

AirSlate SignNow offers various pricing plans designed to cater to different business needs while managing documents like the 2021 schedule r. The plans vary based on features and the number of users. You can choose a plan that best fits your budget while ensuring you have the necessary tools for handling the 2021 schedule r.

-

What features does airSlate SignNow offer to assist with the 2021 schedule r?

AirSlate SignNow offers robust features that enhance the management of documents tied to the 2021 schedule r. These include automated workflows, template creation, and real-time tracking of document status. These features help ensure that your tax forms are completed accurately and efficiently.

-

Can airSlate SignNow integrate with accounting software for the 2021 schedule r?

Yes, airSlate SignNow integrates seamlessly with popular accounting software to streamline the preparation of the 2021 schedule r. This integration allows for easy data sharing and document management, reducing the time spent on tax preparations. You can focus on growing your business while ensuring compliance with tax regulations.

-

How does eSigning with airSlate SignNow benefit the 2021 schedule r process?

eSigning with airSlate SignNow simplifies the signature collection process for documents related to the 2021 schedule r. It eliminates the need for in-person meetings and physical paperwork, allowing for a faster turnaround. This efficiency is invaluable during the busy tax season.

-

Is airSlate SignNow secure for managing sensitive documents like the 2021 schedule r?

Absolutely, airSlate SignNow employs advanced security measures to protect sensitive documents such as the 2021 schedule r. These include encryption, secure cloud storage, and compliance with data protection regulations. You can trust that your information is safe while using our platform.

Get more for 3 Schedule R 990 Form To Edit, Download & Print

- Warranty deed to separate property of one spouse to both as joint tenants with right of survivorship delaware form

- Fiduciary deed for use by executors trustees trustors administrators and other fiduciaries delaware form

- Warranty deed from individuals limited partnership or llc is the grantor or grantee delaware form

- Warranty deed from individual to three individuals as joint tenants delaware form

- Legal last will and testament form for single person with no children delaware

- Legal last will and testament form for a single person with minor children delaware

- Legal last will and testament form for single person with adult and minor children delaware

- Legal last will and testament form for single person with adult children delaware

Find out other 3 Schedule R 990 Form To Edit, Download & Print

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now