Www Irs Govpubirs Pdf2021 Schedule R Form 990 IRS Tax Forms 2022

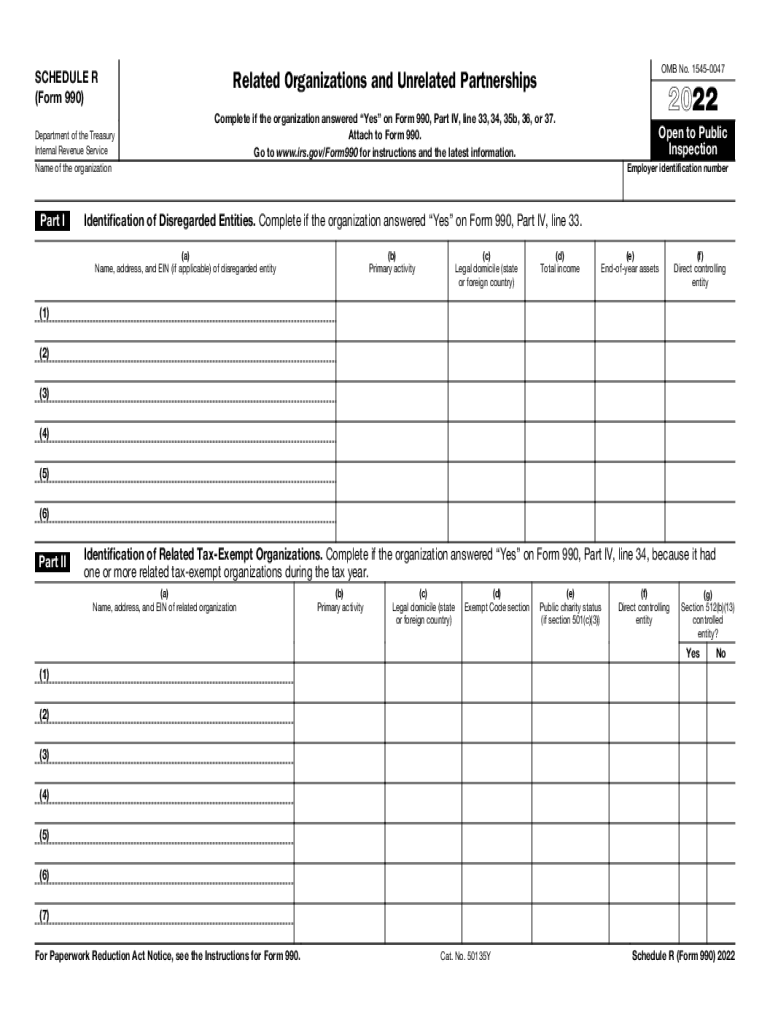

What is the 2017 Schedule R Form?

The 2017 Schedule R is a tax form used by certain organizations to report their activities related to related organizations. It is part of the Form 990 series, which tax-exempt organizations must file with the IRS. This form helps the IRS understand the relationships between organizations and their affiliates, ensuring transparency and compliance with tax regulations. The 2017 Schedule R is specifically designed for organizations that have relationships with other entities, such as subsidiaries, partnerships, or joint ventures.

Steps to Complete the 2017 Schedule R Form

Completing the 2017 Schedule R Form involves several key steps:

- Gather necessary information about related organizations, including names, addresses, and tax identification numbers.

- Determine the nature of the relationships with these organizations, such as ownership percentages or types of transactions.

- Fill out the form accurately, ensuring all required sections are completed, including details of each related organization.

- Review the completed form for accuracy and compliance with IRS guidelines.

- Attach the Schedule R to your Form 990 before submission.

Legal Use of the 2017 Schedule R Form

The 2017 Schedule R Form is legally binding when completed accurately and submitted to the IRS. It must be signed by an authorized representative of the organization, affirming that the information provided is true and correct to the best of their knowledge. Compliance with IRS regulations is crucial, as failure to file or inaccuracies can result in penalties or loss of tax-exempt status.

Filing Deadlines for the 2017 Schedule R Form

The filing deadline for the 2017 Schedule R Form aligns with the due date for Form 990, which is typically the fifteenth day of the fifth month after the end of the organization’s fiscal year. For organizations operating on a calendar year, this means the form is due on May 15. Extensions may be requested, but it is important to ensure that all forms are filed timely to avoid penalties.

Required Documents for the 2017 Schedule R Form

To complete the 2017 Schedule R Form, organizations should prepare the following documents:

- Financial statements from the organization and related entities.

- Records of transactions with related organizations, including contracts and agreements.

- Previous years’ Form 990 filings, if applicable, for reference.

- Any additional documentation that supports the relationships and transactions reported on the form.

IRS Guidelines for the 2017 Schedule R Form

The IRS provides specific guidelines for completing the 2017 Schedule R Form, emphasizing accuracy and transparency. Organizations must ensure that all related organizations are reported, and any transactions between them are disclosed. The IRS may audit these forms, so maintaining thorough records and documentation is essential for compliance and to support the information reported on the form.

Quick guide on how to complete wwwirsgovpubirs pdf2021 schedule r form 990 irs tax forms

Effortlessly Complete Www irs govpubirs pdf2021 Schedule R Form 990 IRS Tax Forms on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Www irs govpubirs pdf2021 Schedule R Form 990 IRS Tax Forms on any device using airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to Modify and Electronically Sign Www irs govpubirs pdf2021 Schedule R Form 990 IRS Tax Forms with Ease

- Find Www irs govpubirs pdf2021 Schedule R Form 990 IRS Tax Forms and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional handwritten signature.

- Review all information and click the Done button to save your changes.

- Decide how you want to share your form—via email, SMS, invitation link, or download it to your PC.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from your preferred device. Edit and electronically sign Www irs govpubirs pdf2021 Schedule R Form 990 IRS Tax Forms to ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwirsgovpubirs pdf2021 schedule r form 990 irs tax forms

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow's pricing for the 2017 r plan?

The pricing for the 2017 r plan of airSlate SignNow is competitive and designed to suit various business needs. It offers flexible subscription options that provide value for businesses of all sizes. Additionally, you can explore discounted annual plans that further reduce costs, ensuring you get an efficient eSigning solution without breaking the bank.

-

What features are included in the airSlate SignNow 2017 r package?

The 2017 r package includes essential features such as document templates, customizable workflows, and audit trails for enhanced security. Users can also enjoy advanced features like in-person signing and integrations with popular applications. This comprehensive functionality allows businesses to streamline their document signing processes effectively.

-

How does airSlate SignNow enhance document security for the 2017 r solution?

AirSlate SignNow prioritizes document security within the 2017 r solution by implementing robust encryption and authentication measures. This includes secure access controls and the ability to track document status throughout the signing process. With these features, businesses can confidently manage sensitive documents without the risk of unauthorized access.

-

Can I integrate airSlate SignNow with other applications in the 2017 r plan?

Yes, the 2017 r plan of airSlate SignNow offers seamless integrations with a variety of applications such as Google Drive, Dropbox, and Salesforce. These integrations enable users to streamline their workflows and improve collaboration across different platforms. This flexibility makes it easier for teams to manage their documents efficiently.

-

What benefits does the 2017 r version of airSlate SignNow provide to businesses?

The 2017 r version of airSlate SignNow offers several benefits, including increased productivity and signNow time savings. By enabling businesses to send and eSign documents quickly and efficiently, it helps reduce paper usage and streamline processes. This ultimately leads to enhanced customer satisfaction and faster turnaround times.

-

Is there a mobile app for the 2017 r version of airSlate SignNow?

Absolutely! The 2017 r version of airSlate SignNow includes a mobile app that allows users to manage document signing on-the-go. This flexibility ensures that you can send, sign, and track documents anytime and anywhere, making it a convenient solution for busy professionals and teams.

-

How does airSlate SignNow's customer support function for the 2017 r users?

For 2017 r users, airSlate SignNow provides comprehensive customer support through various channels, including email, chat, and phone assistance. This dedicated support team is available to help resolve any issues or queries you may have promptly. Additionally, you'll find a wealth of resources in the help center to help you maximize the value of the platform.

Get more for Www irs govpubirs pdf2021 Schedule R Form 990 IRS Tax Forms

- Letter from landlord to tenant returning security deposit less deductions new mexico form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return new mexico form

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return new mexico form

- Letter from tenant to landlord containing request for permission to sublease new mexico form

- New mexico landlord tenant form

- Nm landlord 497319996 form

- Nm tenant form

- Letter from landlord to tenant with 30 day notice of expiration of lease and nonrenewal by landlord vacate by expiration new 497319998 form

Find out other Www irs govpubirs pdf2021 Schedule R Form 990 IRS Tax Forms

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document