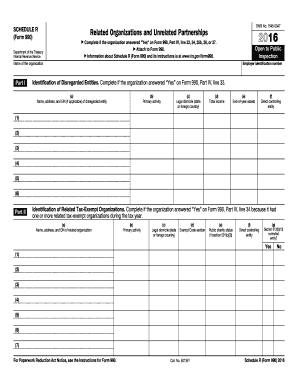

Schedule R Form 2016

What is the Schedule R Form

The Schedule R Form is a tax document used by individuals and businesses to claim a credit for certain retirement savings contributions. This form is particularly relevant for those who qualify for the Retirement Savings Contributions Credit, often referred to as the Saver’s Credit. The Schedule R Form helps taxpayers report their contributions to eligible retirement plans, ensuring they receive the appropriate tax benefits. Understanding this form is essential for maximizing potential credits and managing tax obligations effectively.

How to use the Schedule R Form

Using the Schedule R Form involves several steps to ensure accurate completion and submission. Taxpayers must first determine their eligibility based on income and filing status. Once eligibility is confirmed, the next step is to gather necessary documentation, such as proof of retirement contributions. The form requires detailed information about contributions made to qualified plans, which must be accurately reported. After filling out the form, it should be attached to the main tax return before submission to the IRS.

Steps to complete the Schedule R Form

Completing the Schedule R Form involves a systematic approach to ensure all required information is accurately captured. Follow these steps:

- Gather all relevant documents, including W-2 forms and records of retirement contributions.

- Determine your eligibility based on income limits and filing status.

- Fill out personal information, including your name, address, and Social Security number.

- Report contributions made to eligible retirement accounts in the designated sections.

- Calculate the credit amount based on the instructions provided on the form.

- Review the completed form for accuracy before attaching it to your tax return.

Legal use of the Schedule R Form

The legal use of the Schedule R Form is governed by IRS regulations regarding tax credits for retirement contributions. To ensure compliance, taxpayers must adhere to the eligibility criteria and accurately report their contributions. The form must be submitted with the annual tax return, and any inaccuracies may lead to penalties or denial of the credit. Utilizing digital tools, such as e-signature solutions, can facilitate the completion and submission process while maintaining compliance with legal standards.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule R Form align with the general tax return deadlines set by the IRS. Typically, individual tax returns are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any state-specific deadlines that may apply. It is crucial to submit the Schedule R Form by the deadline to ensure eligibility for the Saver’s Credit and avoid potential penalties.

Examples of using the Schedule R Form

Examples of using the Schedule R Form can illustrate its practical application. For instance, a taxpayer who contributes to a 401(k) plan and meets the income requirements can use the form to claim a Saver’s Credit on their tax return. Another example includes an individual making contributions to an IRA. By accurately reporting these contributions on the Schedule R Form, they can benefit from a reduced tax liability. These examples highlight the importance of understanding the form's application in various financial scenarios.

Quick guide on how to complete 2016 schedule r form

Complete Schedule R Form effortlessly on any gadget

Online document management has gained immense popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documentation, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources you require to create, modify, and electronically sign your documents swiftly without delays. Handle Schedule R Form on any platform using airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to modify and eSign Schedule R Form effortlessly

- Locate Schedule R Form and then click Get Form to commence.

- Utilize the tools we offer to finalize your form.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to send your form—via email, SMS, invite link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your preference. Modify and eSign Schedule R Form and ensure exceptional communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 schedule r form

Create this form in 5 minutes!

How to create an eSignature for the 2016 schedule r form

How to make an electronic signature for the 2016 Schedule R Form online

How to generate an electronic signature for the 2016 Schedule R Form in Chrome

How to make an electronic signature for putting it on the 2016 Schedule R Form in Gmail

How to generate an electronic signature for the 2016 Schedule R Form from your smartphone

How to generate an electronic signature for the 2016 Schedule R Form on iOS

How to make an electronic signature for the 2016 Schedule R Form on Android devices

People also ask

-

What is the Schedule R Form used for in airSlate SignNow?

The Schedule R Form is essential for taxpayers who want to calculate and report their credit for tax dependents. With airSlate SignNow, you can easily eSign and manage your Schedule R Form electronically, ensuring that your submissions are efficient and secure.

-

How does airSlate SignNow simplify the completion of the Schedule R Form?

airSlate SignNow streamlines the completion of the Schedule R Form by providing intuitive templates and eSignature features. This allows users to fill out their forms accurately and electronically sign them, reducing the hassle of paper documents.

-

Are there any costs associated with using the Schedule R Form in airSlate SignNow?

While airSlate SignNow offers various pricing plans, many features related to the Schedule R Form are included in the subscription. This cost-effective solution helps businesses manage their documents without hidden fees, making it accessible for all users.

-

Can I integrate airSlate SignNow with other tax software for the Schedule R Form?

Yes, airSlate SignNow integrates seamlessly with various tax software, allowing you to manage your Schedule R Form alongside other financial documents. This integration enhances workflow efficiency and helps ensure all your tax filings are in one place.

-

What are the benefits of using airSlate SignNow for the Schedule R Form?

Using airSlate SignNow for your Schedule R Form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. You can track document status, store forms securely, and access them anytime, making tax season less stressful.

-

Is it easy to share the Schedule R Form with others using airSlate SignNow?

Absolutely! airSlate SignNow allows you to share your Schedule R Form with others easily via email or direct links. This feature enables collaborative efforts in completing forms, ensuring everyone involved can contribute efficiently.

-

How does airSlate SignNow ensure the security of the Schedule R Form?

airSlate SignNow prioritizes the security of your Schedule R Form by utilizing advanced encryption technology and secure cloud storage. This ensures that all your sensitive tax information remains protected and confidential throughout the signing process.

Get more for Schedule R Form

Find out other Schedule R Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation